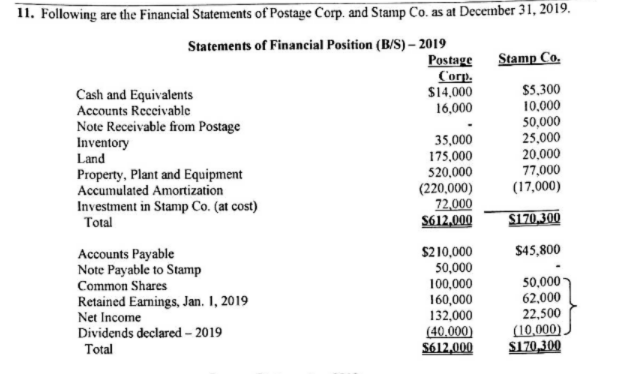

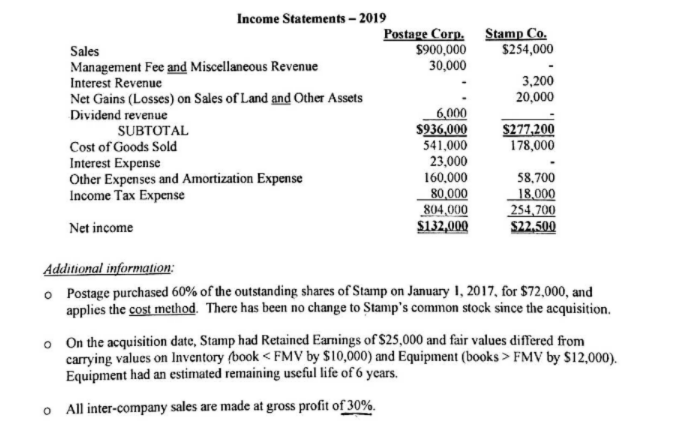

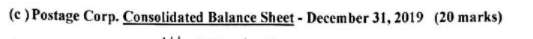

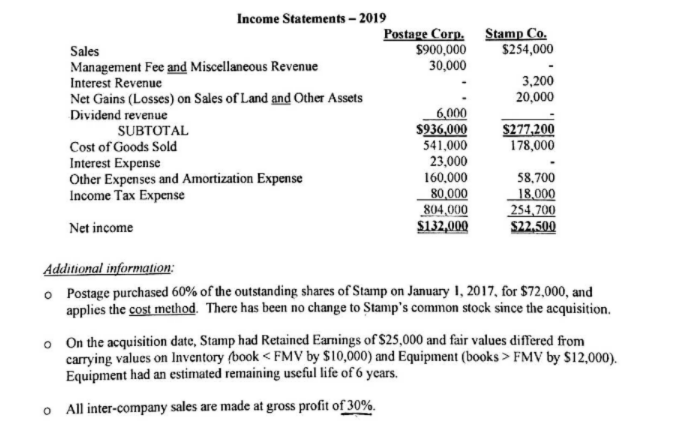

$5,300 11. Following are the Financial Statements of Postage Corp. and Stamp Co. as at December 31, 2019. Statements of Financial Position (B/S) - 2019 Postage Stamp Co. Corp. Cash and Equivalents $14,000 Accounts Receivable 16,000 10.000 Note Receivable from Postage 50,000 Inventory 35,000 25.000 Land 175,000 20.000 Property, Plant and Equipment 520,000 77,000 Accumulated Amortization (220,000) (17,000) Investment in Stamp Co. (at cost) 72,000 Total S612,000 $170,300 $45,800 Accounts Payable Note Payable to Stamp Common Shares Retained Earnings, Jan. 1, 2019 Net Income Dividends declared - 2019 Total $210,000 50,000 100,000 160,000 132,000 (40.000 S612.000 50,000 62,000 22,500 (10,000) S170,300 Income Statements - 2019 Postage Corp. Stamp Co. Sales $900,000 $254,000 Management Fee and Miscellaneous Revenue 30,000 Interest Revenue 3,200 Net Gains (Losses) on Sales of Land and Other Assets 20,000 Dividend revenue 6,000 SUBTOTAL $936,000 $277,200 Cost of Goods Sold 541,000 178,000 Interest Expense 23,000 Other Expenses and Amortization Expense 160.000 58,700 Income Tax Expense 80,000 18,000 804,000 254,700 Net income $132,000 S22,500 Additional information: o Postage purchased 60% of the outstanding shares of Stamp on January 1, 2017, for $72,000, and applies the cost method. There has been no change to Stamp's common stock since the acquisition. On the acquisition date, Stamp had Retained Earnings of $25,000 and fair values differed from carrying values on Inventory book

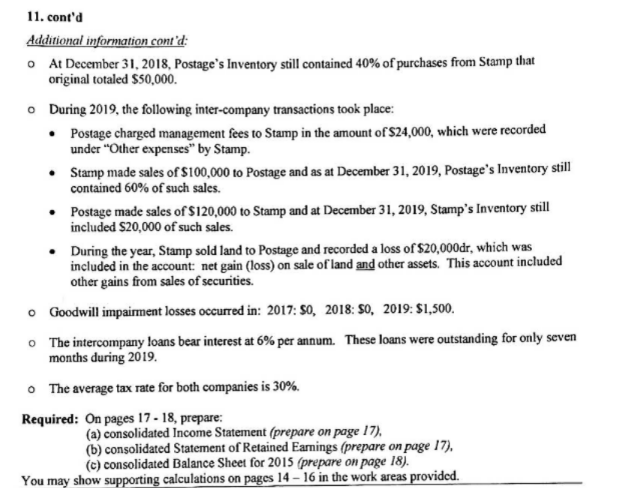

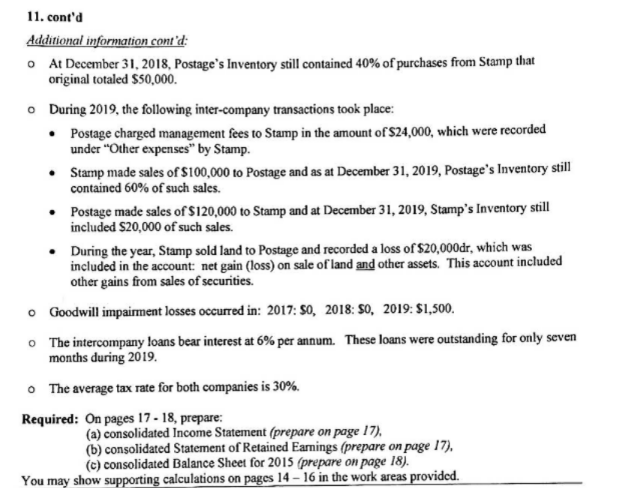

FMV by $12,000). Equipment had an estimated remaining useful life of 6 years. O All inter-company sales are made at gross profit of 30%. o 11. cont'd Additional information contd: At December 31, 2018, Postage's Inventory still contained 40% of purchases from Stamp that original totaled $50,000. o During 2019, the following inter-company transactions took place: Postage charged management fees to Stamp in the amount of $24,000, which were recorded under "Other expenses" by Stamp. Stamp made sales of $100,000 to Postage and as at December 31, 2019, Postage's Inventory still contained 60% of such sales. Postage made sales of $120,000 to Stamp and at December 31, 2019, Stamp's Inventory still included $20,000 of such sales. During the year, Stamp sold land to Postage and recorded a loss of $20,000dr, which was included in the account: net gain (loss) on sale of land and other assets. This account included other gains from sales of securities. o Goodwill impairment losses occurred in: 2017:50, 2018: SO, 2019: $1,500. The intercompany loans bear interest at 6% per annum. These loans were outstanding for only seven months during 2019. The average tax rate for both companies is 30%. Required: On pages 17 - 18, prepare: (a) consolidated Income Statement (prepare on page 17), (b) consolidated Statement of Retained Earnings (prepare on page 17). (c) consolidated Balance Sheet for 2015 (prepare on page 18). You may show supporting calculations on pages 14 - 16 in the work areas provided. (a) Postage Corp. Consolidated Income Statement - Y/E Dec. 31, 2019 (22 marks) (b) Postage Corp. Consolidated Retained Earnings Statement - Y/E Dec 31, 2019 (7 marks) (c) Postage Corp. Consolidated Balance Sheet - December 31, 2019 (20 marks) $5,300 11. Following are the Financial Statements of Postage Corp. and Stamp Co. as at December 31, 2019. Statements of Financial Position (B/S) - 2019 Postage Stamp Co. Corp. Cash and Equivalents $14,000 Accounts Receivable 16,000 10.000 Note Receivable from Postage 50,000 Inventory 35,000 25.000 Land 175,000 20.000 Property, Plant and Equipment 520,000 77,000 Accumulated Amortization (220,000) (17,000) Investment in Stamp Co. (at cost) 72,000 Total S612,000 $170,300 $45,800 Accounts Payable Note Payable to Stamp Common Shares Retained Earnings, Jan. 1, 2019 Net Income Dividends declared - 2019 Total $210,000 50,000 100,000 160,000 132,000 (40.000 S612.000 50,000 62,000 22,500 (10,000) S170,300 Income Statements - 2019 Postage Corp. Stamp Co. Sales $900,000 $254,000 Management Fee and Miscellaneous Revenue 30,000 Interest Revenue 3,200 Net Gains (Losses) on Sales of Land and Other Assets 20,000 Dividend revenue 6,000 SUBTOTAL $936,000 $277,200 Cost of Goods Sold 541,000 178,000 Interest Expense 23,000 Other Expenses and Amortization Expense 160.000 58,700 Income Tax Expense 80,000 18,000 804,000 254,700 Net income $132,000 S22,500 Additional information: o Postage purchased 60% of the outstanding shares of Stamp on January 1, 2017, for $72,000, and applies the cost method. There has been no change to Stamp's common stock since the acquisition. On the acquisition date, Stamp had Retained Earnings of $25,000 and fair values differed from carrying values on Inventory book FMV by $12,000). Equipment had an estimated remaining useful life of 6 years. O All inter-company sales are made at gross profit of 30%. o 11. cont'd Additional information contd: At December 31, 2018, Postage's Inventory still contained 40% of purchases from Stamp that original totaled $50,000. o During 2019, the following inter-company transactions took place: Postage charged management fees to Stamp in the amount of $24,000, which were recorded under "Other expenses" by Stamp. Stamp made sales of $100,000 to Postage and as at December 31, 2019, Postage's Inventory still contained 60% of such sales. Postage made sales of $120,000 to Stamp and at December 31, 2019, Stamp's Inventory still included $20,000 of such sales. During the year, Stamp sold land to Postage and recorded a loss of $20,000dr, which was included in the account: net gain (loss) on sale of land and other assets. This account included other gains from sales of securities. o Goodwill impairment losses occurred in: 2017:50, 2018: SO, 2019: $1,500. The intercompany loans bear interest at 6% per annum. These loans were outstanding for only seven months during 2019. The average tax rate for both companies is 30%. Required: On pages 17 - 18, prepare: (a) consolidated Income Statement (prepare on page 17), (b) consolidated Statement of Retained Earnings (prepare on page 17). (c) consolidated Balance Sheet for 2015 (prepare on page 18). You may show supporting calculations on pages 14 - 16 in the work areas provided. (a) Postage Corp. Consolidated Income Statement - Y/E Dec. 31, 2019 (22 marks) (b) Postage Corp. Consolidated Retained Earnings Statement - Y/E Dec 31, 2019 (7 marks) (c) Postage Corp. Consolidated Balance Sheet - December 31, 2019 (20 marks)