Answered step by step

Verified Expert Solution

Question

1 Approved Answer

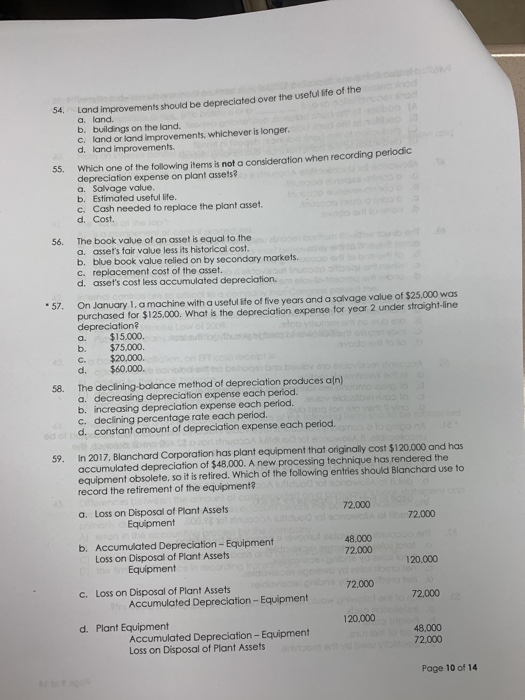

54. 55. 56. *57. 58. Land improvements should be depreciated over the useful life of the a. land. b. buildings on the land. 59.

54. 55. 56. *57. 58. Land improvements should be depreciated over the useful life of the a. land. b. buildings on the land. 59. c. land or land improvements, whichever is longer. d. land improvements. Which one of the following items is not a consideration when recording periodic depreciation expense on plant assets? a. Salvage value. b. Estimated useful life. c. Cash needed to replace the plant asset. d. Cost. The book value of an asset is equal to the a. asset's fair value less its historical cost. booe b. blue book value relied on by secondary markets. c. replacement cost of the asset. d. asset's cost less accumulated depreciation. trapibu On January 1, a machine with a useful life of five years and a salvage value of $25,000 was purchased for $125,000. What is the depreciation expense for year 2 under straight-line depreciation? a. b. C. d. $15,000. $75,000. $20,000. $60,000. odott ho behoges bana The declining-balance method of depreciation produces a[n) a. decreasing depreciation expense each period. b. increasing depreciation expense each period. c. declining percentage rate each period. ed of bd. constant amount of depreciation expense each period. o dappleb o zori strucn uitduod sol nowol, eld In 2017, Blanchard Corporation has plant equipment that originally cost $120,000 and has accumulated depreciation of $48,000. A new processing technique has rendered the equipment obsolete, so it is retired. Which of the following entries should Blanchard use to record the retirement of the equipment? Hiduod tot a. Loss on Disposal of Plant Assets Equipment b. Accumulated Depreciation - Equipment Loss on Disposal of Plant Assets Equipment c. Loss on Disposal of Plant Assets Accumulated Depreciation - Equipment d. Plant Equipment Accumulated Depreciation - Equipment Loss on Disposal of Plant Assets 72,000 (A 48,000 72,000 72,000 120,000 liber 72.000 120,000 72,000 48,000 72,000 Page 10 of 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

54 option d land improvements since land improvements is separate classifi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started