Question: Hannon Home Products Inc. recently issued $2.3 million worth of 6 percent convertible debentures. Each convertible bond has a face value of $1,000. Each

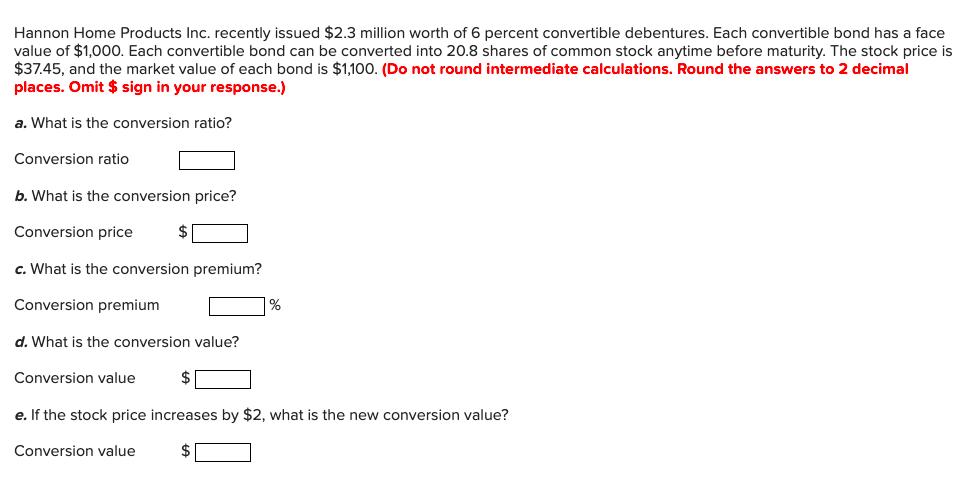

Hannon Home Products Inc. recently issued $2.3 million worth of 6 percent convertible debentures. Each convertible bond has a face value of $1,000. Each convertible bond can be converted into 20.8 shares of common stock anytime before maturity. The stock price is $37.45, and the market value of each bond is $1,100. (Do not round intermediate calculations. Round the answers to 2 decimal places. Omit $ sign in your response.) a. What is the conversion ratio? Conversion ratio b. What is the conversion price? Conversion price c. What is the conversion premium? Conversion premium d. What is the conversion value? Conversion value $ % e. If the stock price increases by $2, what is the new conversion value? Conversion value

Step by Step Solution

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts