Answered step by step

Verified Expert Solution

Question

1 Approved Answer

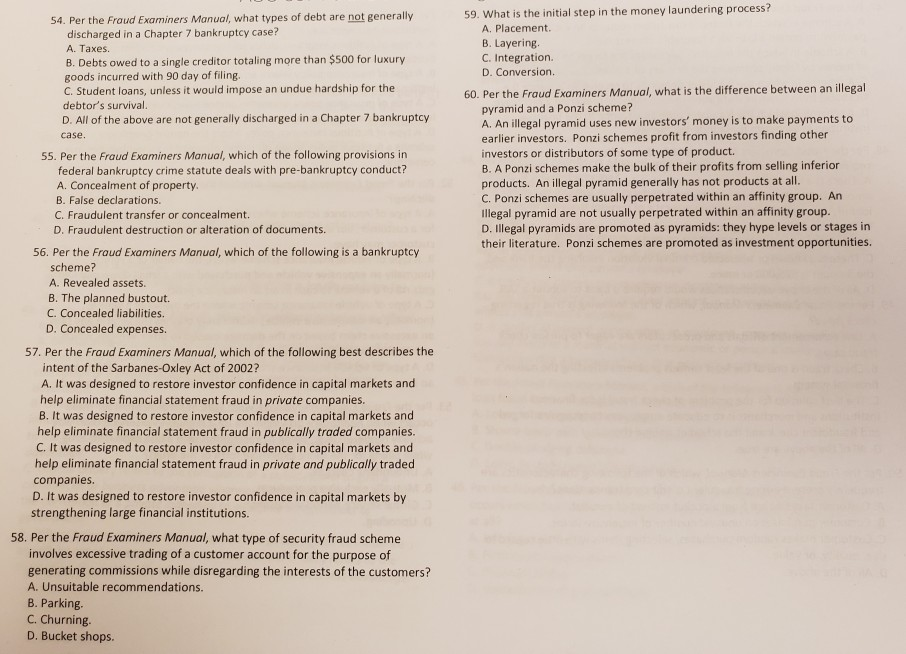

54. Per the Fraud Examiners Manual, what types of debt are not generally 59. What is the initial step in the money laundering process? A.

54. Per the Fraud Examiners Manual, what types of debt are not generally 59. What is the initial step in the money laundering process? A. Placement B. Layering C. Integration. D. Conversion. discharged in a Chapter 7 bankruptcy case? A. Taxes. B. Debts owed to a single creditor totaling more than $500 for luxury goods incurred with 90 day of filing. C. Student loans, unless it would impose an undue hardship for the debtor's survival D. All of the above are not generally discharged in a Chapter 7 bankruptcy case 60. Per the Fraud Examiners Manual, what is the difference between an illegal pyramid and a Ponzi scheme? A. An illegal pyramid uses new investors' money is to make payments to earlier investors. Ponzi schemes profit from investors finding other investors or distributors of some type of product. B. A Ponzi schemes make the bulk of their profits from selling inferior products. An illegal pyramid generally has not products at all C. Ponzi schemes are usually perpetrated within an affinity group. An Illegal pyramid are not usually perpetrated within an affinity group D. Illegal pyramids are promoted as pyramids: they hype levels or stages in their literature. Ponzi schemes are promoted as investment opportunities 55. Per the Fraud Examiners Manual, which of the following provisions in federal bankruptcy crime statute deals with pre-bankruptcy conduct? A. Concealment of property B. False declarations C. Fraudulent transfer or concealment. D. Fraudulent destruction or alteration of documents. 56. Per the Fraud Examiners Manual, which of the following is a bankruptcy scheme? A. Revealed assets. B. The planned bustout. C. Concealed liabilities. D. Concealed expenses. 57. Per the Fraud Examiners Manual, which of the following best describes the intent of the Sarbanes-Oxley Act of 2002? A. It was designed to restore investor confidence in capital markets and help eliminate financial statement fraud in private companies B. It was designed to restore investor confidence in capital markets and help eliminate financial statement fraud in publically traded companies C. It was designed to restore investor confidence in capital markets and help eliminate financial statement fraud in private and publically traded companies. D. It was designed to restore investor confidence in capital markets by strengthening large financial institutions. 58. Per the Fraud Examiners Manual, what type of security fraud scheme involves excessive trading of a customer account for the purpose of generating commissions while disregarding the interests of the customers? A. Unsuitable recommendations. B. Parking. C. Churning. D. Bucket shops

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started