Answered step by step

Verified Expert Solution

Question

1 Approved Answer

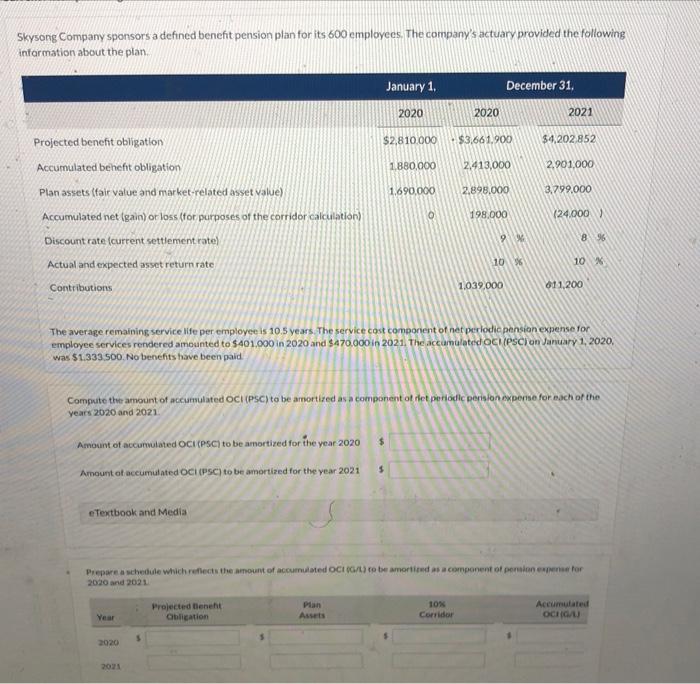

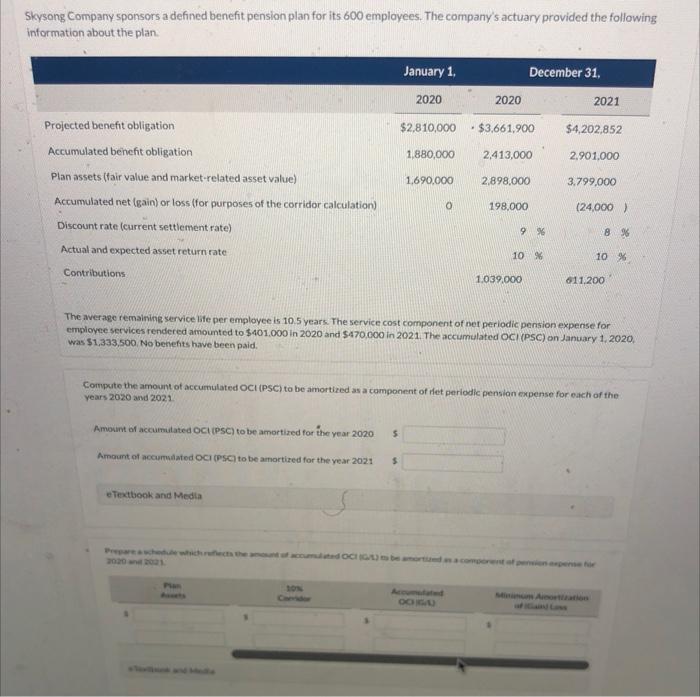

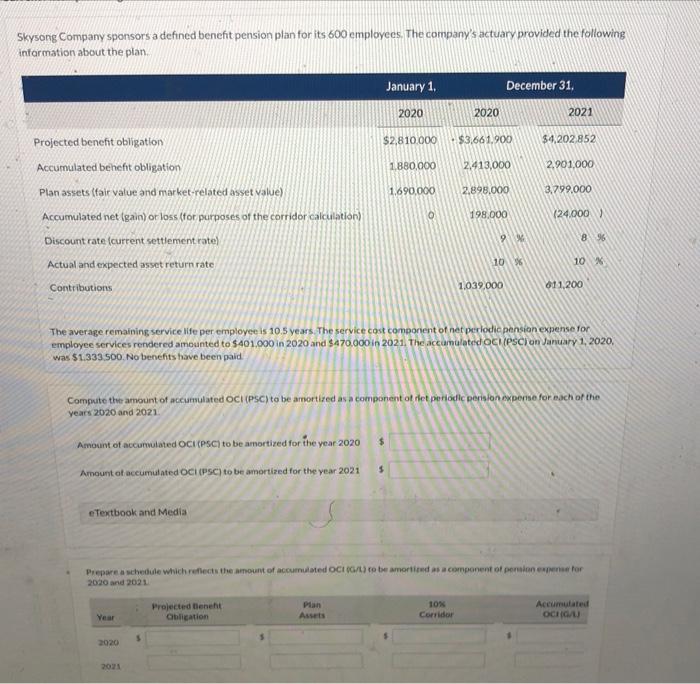

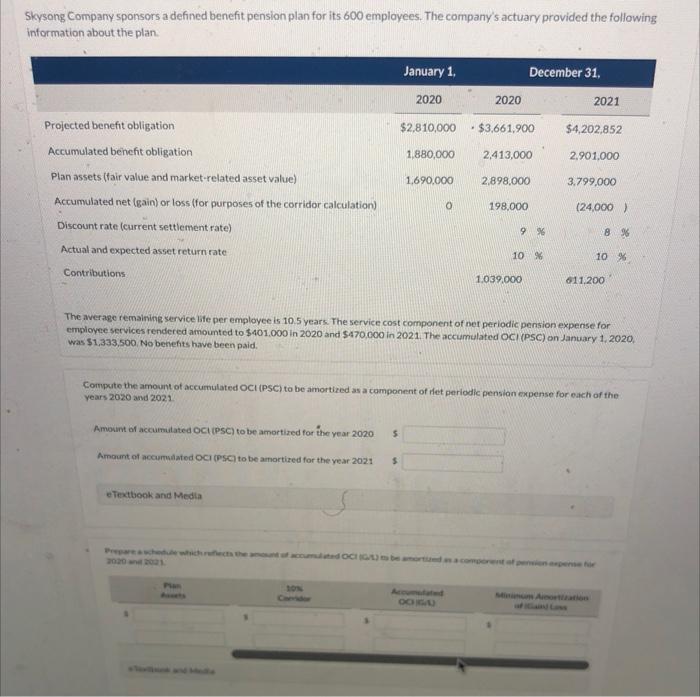

5-4 Skysong Company sponsors a defined benefit pension plan for its 600 employecs. The company's actuary provided the following information about the plan. The average

5-4

Skysong Company sponsors a defined benefit pension plan for its 600 employecs. The company's actuary provided the following information about the plan. The average remaining service life per employee is 10.5 years. The service cost component of net periodic pensian expense for employee services rendered amounted to 4401,000 in 2020 and 5470.000 in 2021 , The accumulated oCl (pSC) on January 1,2020. was $1.333.500. No benefits have been paid Compute the amount of accumulated OCl (PSC) to be amortized as a component of rlet periodic peris ion expense for esch of the years 2020 and 2021 Amount of accumulated OCI (PSC) to be amortized for the year 2020 Amount of accumulated OCi (PSC) to be amortized for the year 2021 3 2020 and 2021 Skysong Company sponsors a defined benefit pension plan for its 600 employees. The company's actuary provided the following information about the plan. The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $401,000 in 2020 and $470,000 in 2021. The accumulated OC) (PSC) on January 1,2020. was $1,333,500, No behefits have been paid. Compute the amount of accumulated OCl (PSC) to be amortized as a component of plet periodic pensian expense for each of the years 2020 and 2021 Amount of accumulated OCI (PSC) to be amortized for the year 2020 Amount of accumbiated oci (Psel) to be amortized for the year 2021 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started