Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5:42 Day 11 - Assignmnet #... QS 17-15 Solvency ratios L04 The following information relates to three companies that operate similar businesses: 4 Company

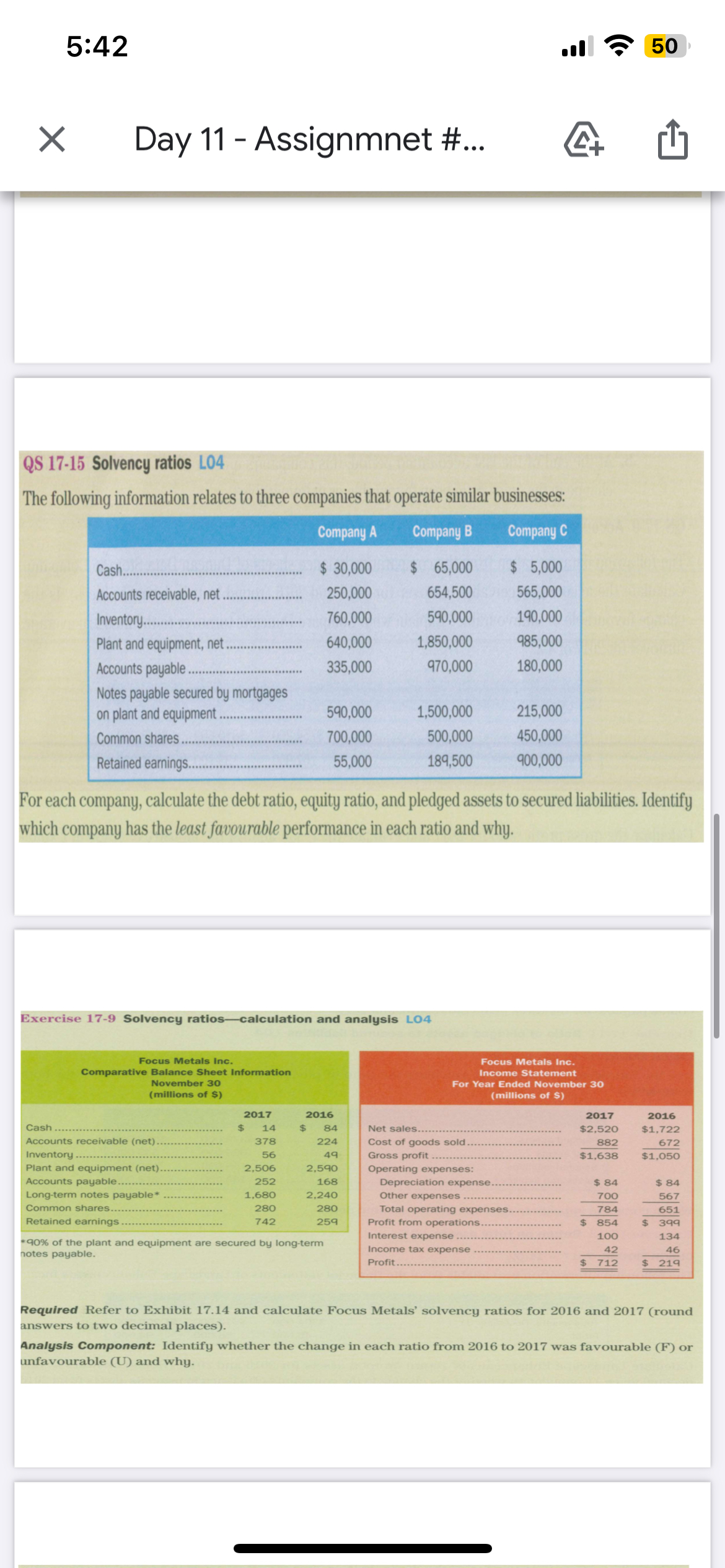

5:42 Day 11 - Assignmnet #... QS 17-15 Solvency ratios L04 The following information relates to three companies that operate similar businesses: 4 Company A Company B Company C Cash.. $ 30,000 $ 65,000 $ 5,000 Accounts receivable, net. 250,000 654,500 565,000 Inventory... 760,000 590,000 190,000 Plant and equipment, net. 640,000 1,850,000 985,000 Accounts payable. 335,000 970,000 180,000 Notes payable secured by mortgages on plant and equipment. 590,000 1,500,000 215,000 Common shares. 700,000 500,000 450,000 Retained earnings... 55,000 189,500 900,000 50 For each company, calculate the debt ratio, equity ratio, and pledged assets to secured liabilities. Identify which company has the least favourable performance in each ratio and why. Exercise 17-9 Solvency ratios-calculation and analysis LO4 Focus Metals Inc. Comparative Balance Sheet Information November 30 (millions of $) Focus Metals Inc. Income Statement For Year Ended November 30 (millions of $) 2017 2016 Cash $ Accounts receivable (net). Inventory Plant and equipment (net). Accounts payable.. Long-term notes payable* Common shares.. Retained earnings. 14 378 56 2,506 252 1,680 280 742 $ 84 Net sales... 224 49 2,590 Cost of goods sold. Gross profit Operating expenses: 2017 $2,520 882 $1,638 2016 $1,722 672 $1,050 168 2,240 Depreciation expense. $ 84 $ 84 Other expenses 700 567 280 Total operating expenses. 784 651 259 Profit from operations. $ 854 $ 399 Interest expense *90% of the plant and equipment are secured by long-term notes payable. Income tax expense Profit.... 100 42 134 46 $ 712 $ 219 Required Refer to Exhibit 17.14 and calculate Focus Metals' solvency ratios for 2016 and 2017 (round answers to two decimal places). Analysis Component: Identify whether the change in each ratio from 2016 to 2017 was favourable (F) or unfavourable (U) and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started