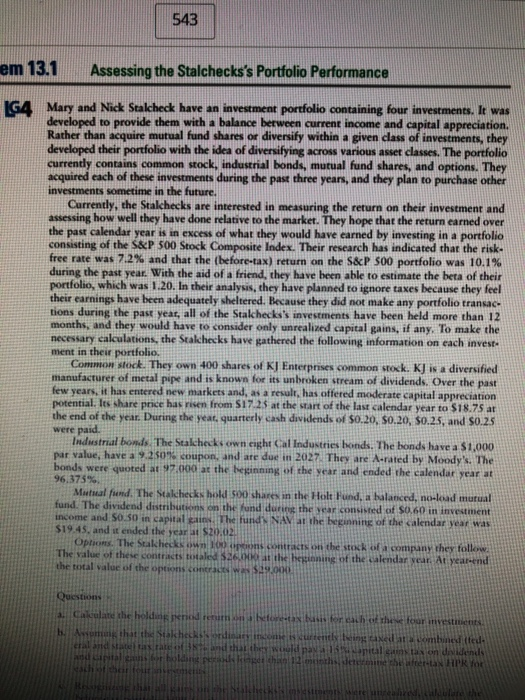

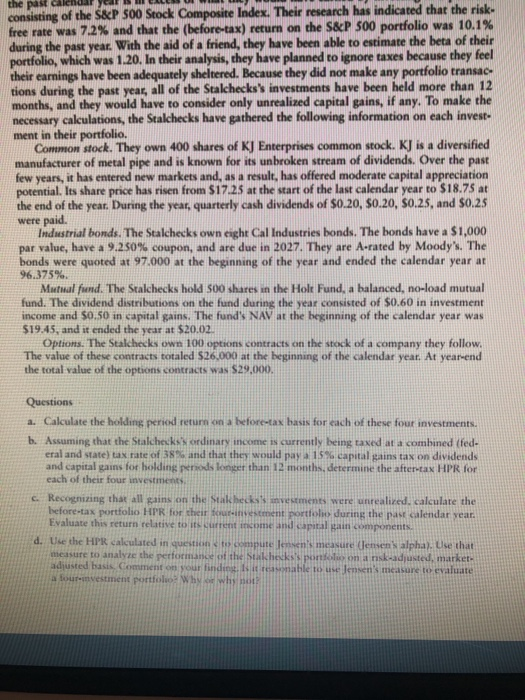

543 em 13.1 Assessing the Stalchecks's Portfolio Performance G4 Mary and Nick Stalcheck have an investment portfolio containing four investments. It was developed to provide them with a balance berween current income and capital appreciation. Rather than acquire mutual fund shares or diversify within a given dass of investments, they developed their portfolio with the idea of diversifying across various asset classes. The portfolio currently contains common stock, industrial bonds, mutual fund shares, and options. They acquired each of these investments during the past three years, and they plan to purcha investments sometime in the future. Currently, the Stalchecks are interested in measuring the return on their investment and assessing how well they have done relative to the market. They hope that the return earned over the past calendar year is in excess of what they would have earned by investing in a portfolio consisting of the S&P 500 Stock Composite Index. Their research has indicated that the risk free rate was 7.2% and that the (before-tax) return on the S&P 500 portfolio was 10.1% during the past year. With the aid of a friend, they have been able to estimate the beta of their portfolio, which was 1.20. In their analysis, they have planned to ignore taxes because they feel their earnings have been adequately sheltered. Because they did not make any portfolio transac tions during the past year, all of the Stakhecks investments have been held more than 12 months, and they would have to consider only unrealized capital gains, if any, To make the necessary calculations, the Stakchecks have gathered the following information on each invest ment in their portfolio. Common stock. They own 400 shares of kJ Enterprises common stock. Kl is a diversified manufacturer of metal pipe and is known for its unbroken stream of dividends. Over the past few years. It has entered new markets and, as a result, has offered moderate capital appreciation potential. Its share price has risen from $17.25 at the start of the last calendar year to $18.75 at the end of the year. During the year, quarterly cash dividends of $0.20 0.20 $0.25, and S0.25 were paid. Industrial bowl The Stalchecks own eight Cal Industries bonds. The bonds have a $1.000 par value, have a 250 coupon, and are due in 2027. They are Aerated by Moody's. The bonds were quoted 97.000 at the beginning of the year and ended the calendar year at 96.375% Mutual fund. The Stakchecks hold 500 shares in the Holt Fund, a balanced, no-load mutual fund. The dividend distribution on the fund during the ver consisted of 0.60 in investitient income and 50.50 in capital . The fund NAV at the beginning of the calendar year was $19.45, and it ended the year at $20.02 Options The Stakhecks on prions contracts on the stock of a company they follow The value of the contracts to the h ing the calendar and the total value of the options W .19000 1. Calculate the hold nedem o Amhat the Stalchecke n eral and sta nd that the s L ola urte for each of the four investments ing o mbine ted p itals on didels det ta HPK for ha K lets the past calendar year I LLLL L LLL consisting of the S&P 500 Stock Composite Index. Their research has indicated that the risk free rate was 7.2% and that the (before-tax) return on the S&P 500 portfolio was 10.1% during the past year. With the aid of a friend, they have been able to estimate the beta of their portfolio, which was 1.20. In their analysis, they have planned to ignore taxes because they feel their earnings have been adequately sheltered. Because they did not make any portfolio transac tions during the past year, all of the Stalchecks's investments have been held more than 12 months, and they would have to consider only unrealized capital gains, if any. To make the necessary calculations, the Stalchecks have gathered the following information on each invest- ment in their portfolio. Common stock. They own 400 shares of Kj Enterprises common stock. KJ is a diversified manufacturer of metal pipe and is known for its unbroken stream of dividends. Over the past few years, it has entered new markets and, as a result, has offered moderate capital appreciation potential. Its share price has risen from $17.25 at the start of the last calendar year to $18.75 at the end of the year. During the year, quarterly cash dividends of $0.20, $0.20, $0.25, and $0.25 were paid. Industrial bonds. The Stalchecks own eight Cal Industries bonds. The bonds have a $1,000 par value, have a 9.2.50% coupon, and are due in 2027. They are A-rated by Moody's. The bonds were quoted at 97.000 at the beginning of the year and ended the calendar year at 96.375%. Mutual fund. The Stalchecks hold 500 shares in the Holt Fund, a balanced, no-load mutual fund. The dividend distributions on the fund during the year consisted of $0.60 in investment income and 50:50 in capital gains. The fund's NAV at the beginning of the calendar year was 519.45, and it ended the year at $20.02. Options. The Stalchecks own 100 options contracts on the stock of a company they follow The value of these contracts totaled 526,000 at the beginning of the calendar year. At year-end the total value of the options contracts was $29.000. Questions a. Calculate the holding period return on a before-tax basis for each of these four investments. b. Assuming that the Stalchecks ordinary income is currently being taxed at a combined (red- eral and state tax rate of and that they would pay capital gains tax on dividends and capital gains for holding longer than 12 months determine the aftertas HPR for each of their four investments c. Recognizing that all gains on the Si m s were realized, calculate the before tax portfolio HPR for their ment sort during the pas calendar year. Evaluate this return relative to its current income and capital gain components. d. Use the HPR calculated in question to con asure (Jensen's alpha). Use that measure to analyze the performance of the S on a nisk-adjusted, market- adjusted basis. Comment on your finding ensen's measure to evaluate a four-nvestment portfolio: Why w