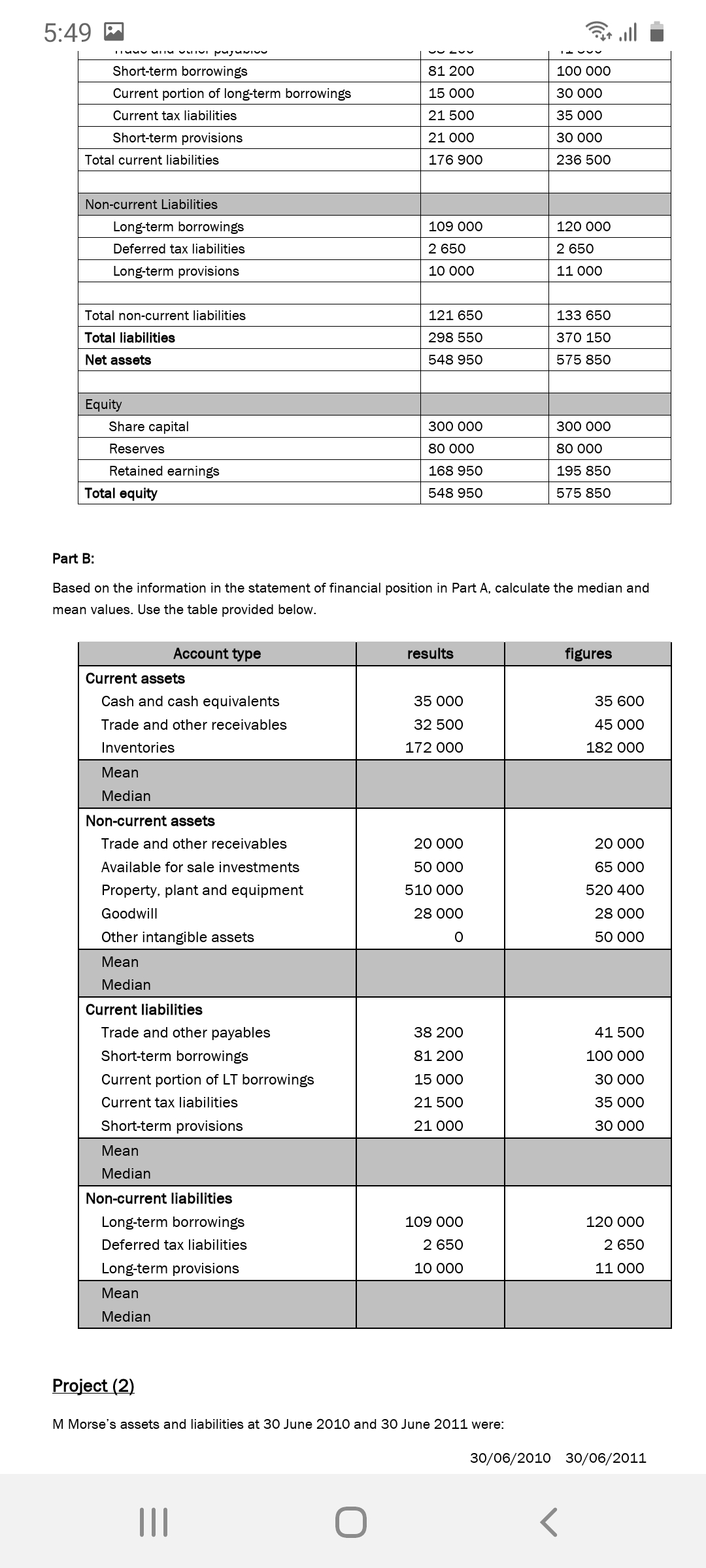

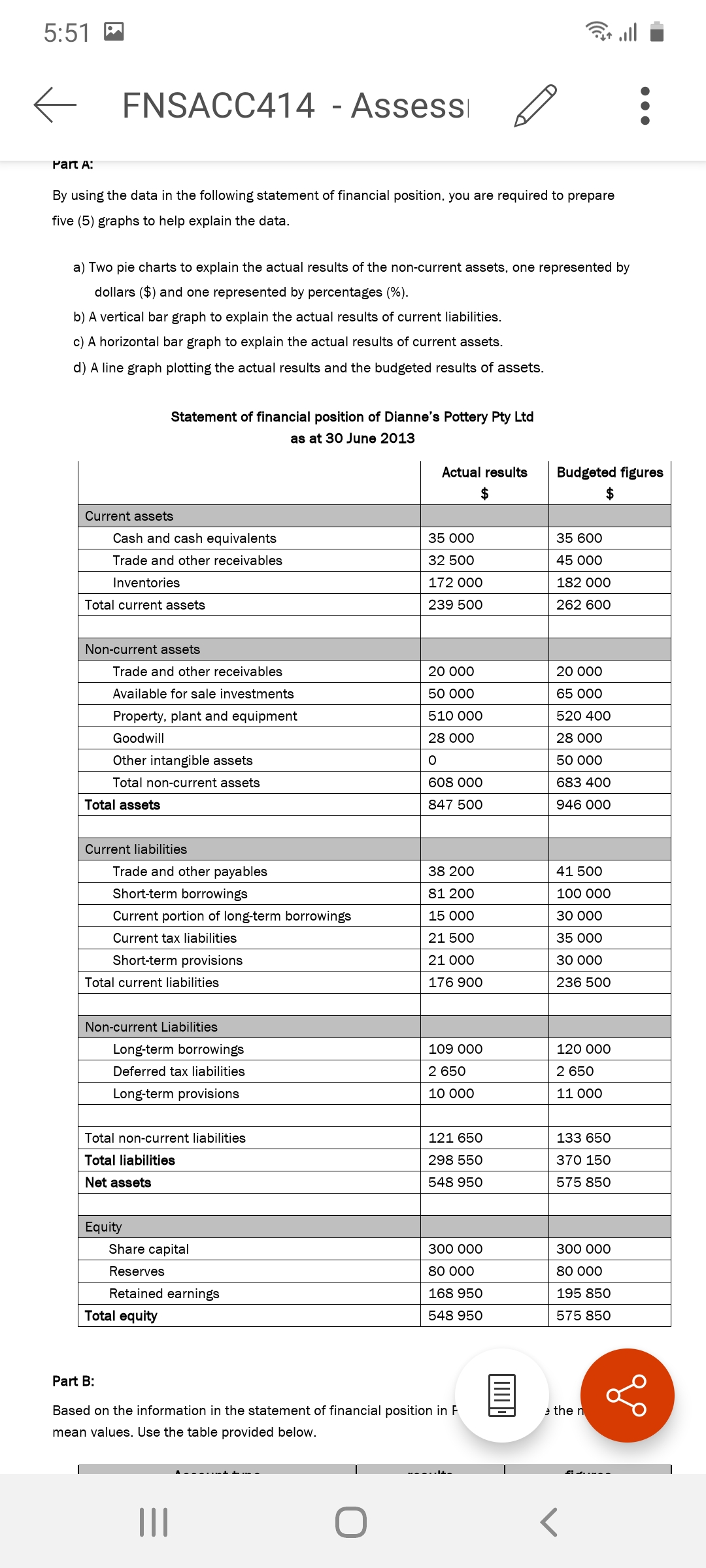

5:49 P Short-term borrowings 81 200 100 000 Current portion of long-term borrowings 15 000 30 000 Current tax liabilities 21 500 35 000 Short-term provisions 21 000 30 000 Total current liabilities 176 900 236 500 Non-current Liabilities Long-term borrowings 109 000 120 000 Deferred tax liabilities 2 650 2 650 Long-term provisions 10 000 11 000 Total non-current liabilities 121 650 133 650 Total liabilities 298 550 370 150 Net assets 548 950 575 850 Equity Share capital 300 000 300 000 Reserves 80 000 80 000 Retained earnings 168 950 195 850 Total equity 548 950 575 850 Part B: Based on the information in the statement of financial position in Part A, calculate the median and mean values. Use the table provided below. Account type results figures Current assets Cash and cash equivalents 35 000 35 600 Trade and other receivables 32 500 45 000 Inventories 172 000 182 000 Mean Median Non-current assets Trade and other receivables 20 000 20 000 Available for sale investments 50 000 65 000 Property, plant and equipment 510 000 520 400 Goodwill 28 000 28 000 Other intangible assets 0 50 000 Mean Median Current liabilities Trade and other payables 38 200 41 500 Short-term borrowings 81 200 100 000 Current portion of LT borrowings 15 000 30 000 Current tax liabilities 21 500 35 000 Short-term provisions 21 000 30 000 Mean Median Non-current liabilities Long-term borrowings 109 000 120 000 Deferred tax liabilities 2 650 2 650 Long-term provisions 10 000 11 000 Mean Median Project (2) M Morse's assets and liabilities at 30 June 2010 and 30 June 2011 were: 30/06/2010 30/06/2011 O) 5: 51 IS a. ..II I O 6 FNSACC414 - AsseSSI . 0 Part A: By using the data in the following statement of financial position. you are required to prepare five (5) graphs to help explain the data. a) Two pie charts to explain the actual results of the non-current assets. one represented by dollars (5) and one represented by percentages ('36). b) A vertical bar graph to explain the actual results of current liabilities. c) A horizontal bar graph to explain the actual results of current assets. d) A line graph plotting the actual results and the budgeted results of assets. Statement of nancial poeltlon of DIanne'e Pottery Pty Ltd as at 30 June 2013 Actual results Budgeted figures (-3- 9} Cash and cash equivalents 35 000 35 600 Trade and other receivables 32 500 45 000 Inventories 172 000 182 000 Total current assets 239 500 262 600 Trade and other receivables 20 000 20 000 Available for sale investments 50 000 65 000 Property, plant and equipment 510 000 520 400 Goodwill 28 000 28 000 Other intangible assets 0 50 000 Total non-current assets 608 000 683 400 Total aaaeta 847 500 946 000 Trade and other payables 38 200 41 500 Short-term borrowings 81 200 100 000 Current portion of long-term borrowings 15 000 30 000 Current tax liabilities 21 500 35 000 Short-term provisions 21 000 30 000 Total current liabilities 176 900 236 500 Long-term borrowings 109 000 120 000 Deferred tax liabilities 2 650 2 650 Longterm provisions 10 000 11 000 Total non-current liabilities 121 650 133 650 Total Ilabllltlaa 298 550 370 150 Nd! aaaah 548 950 575 850 Share capital 300 000 300 000 Reserves 80 000 80 000 Retained earnings 168 950 195 850 Total equity 548 950 575 850 Part B: Based on the information in the statement of financial position in F =- 3 the mean values. Use the table provided below. \\_/' Ill 0 <