Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5.5 points Questions Hamad Company signs a lease agreement on January 1, 2020, to lease a machine to Ali Company. The term of the non-cancelable

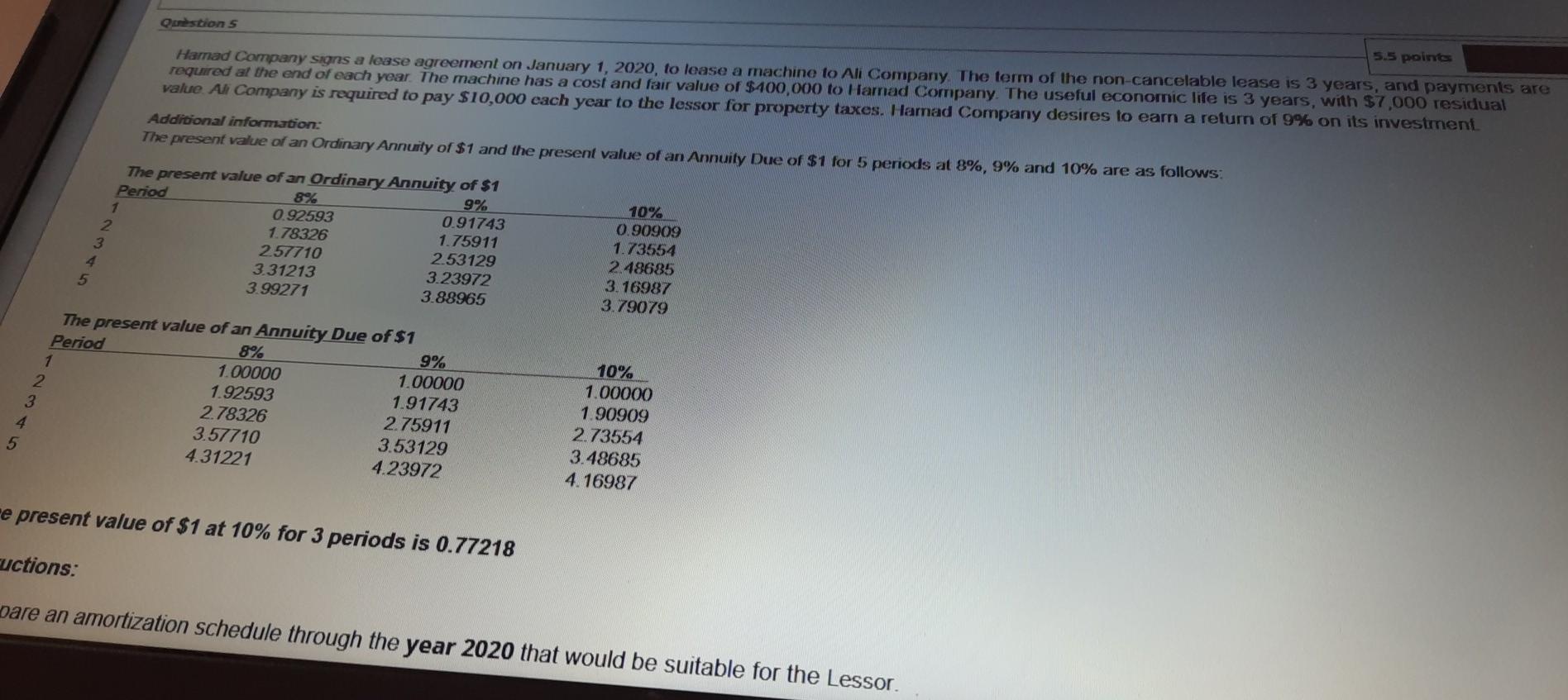

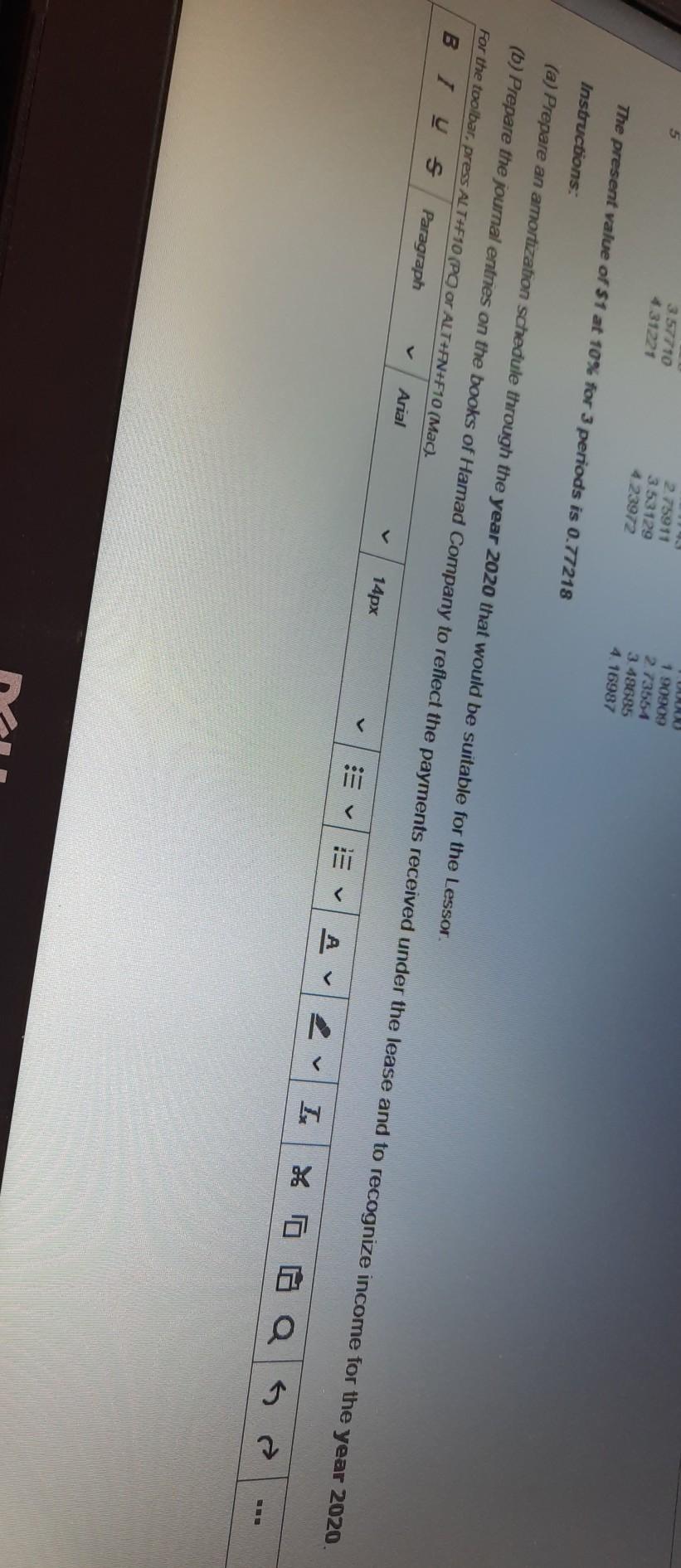

5.5 points Questions Hamad Company signs a lease agreement on January 1, 2020, to lease a machine to Ali Company. The term of the non-cancelable lease is 3 years, and payments are required at the end of each year. The machine has a cost and fair value of $400,000 to Harnad Company. The useful economic life is 3 years, with $7,000 residual value Al Company is required to pay $10,000 each year to the lessor for property taxes. Hamad Company desires to earn a return of 9% on its investment Additional information: The present value of an Ordinary Annuity of $1 and the present value of an Annuity Due of $1 for 5 periods at 8%, 9% and 10% are as follows: The present value of an Ordinary Annuity of $1 Period 8% 10% 0.92593 0.91743 0.90909 1.78326 1.75911 1.73554 2.57710 2.53129 2.48685 3.31213 3.23972 3.16987 3.99271 3.88965 3.79079 1 9% 3 5 1 2 3 The present value of an Annuity Due of $1 Period 8% 9% 1.00000 1.00000 1.92593 1.91743 2.78326 2.75911 3.57710 3.53129 4.31221 4.23972 4 10% 1.00000 1.90909 2.73554 3.48685 4.16987 5 e present value of $1 at 10% for 3 periods is 0.77218 ructions: pare an amortization schedule through the year 2020 that would be suitable for the Lessor. AR 357710 431221 2.75911 353129 4 23972 1 909209 2.73554 3.48685 4.16987 The present value of $1 at 10% for 3 periods is 0.77218 Instructions: (a) Prepare an amortization schedule through the year 2020 that would be suitable for the Lessor (b) Prepare the journal entries on the books of Hamad Company to reflect the payments received under the lease and to recognize income for the year 2020 For the toolbar, press ALT+F10 (PO or ALT+AN+F10 (Mac). / Us Paragraph Arial 14px A v I. % da 5.5 points Questions Hamad Company signs a lease agreement on January 1, 2020, to lease a machine to Ali Company. The term of the non-cancelable lease is 3 years, and payments are required at the end of each year. The machine has a cost and fair value of $400,000 to Harnad Company. The useful economic life is 3 years, with $7,000 residual value Al Company is required to pay $10,000 each year to the lessor for property taxes. Hamad Company desires to earn a return of 9% on its investment Additional information: The present value of an Ordinary Annuity of $1 and the present value of an Annuity Due of $1 for 5 periods at 8%, 9% and 10% are as follows: The present value of an Ordinary Annuity of $1 Period 8% 10% 0.92593 0.91743 0.90909 1.78326 1.75911 1.73554 2.57710 2.53129 2.48685 3.31213 3.23972 3.16987 3.99271 3.88965 3.79079 1 9% 3 5 1 2 3 The present value of an Annuity Due of $1 Period 8% 9% 1.00000 1.00000 1.92593 1.91743 2.78326 2.75911 3.57710 3.53129 4.31221 4.23972 4 10% 1.00000 1.90909 2.73554 3.48685 4.16987 5 e present value of $1 at 10% for 3 periods is 0.77218 ructions: pare an amortization schedule through the year 2020 that would be suitable for the Lessor. AR 357710 431221 2.75911 353129 4 23972 1 909209 2.73554 3.48685 4.16987 The present value of $1 at 10% for 3 periods is 0.77218 Instructions: (a) Prepare an amortization schedule through the year 2020 that would be suitable for the Lessor (b) Prepare the journal entries on the books of Hamad Company to reflect the payments received under the lease and to recognize income for the year 2020 For the toolbar, press ALT+F10 (PO or ALT+AN+F10 (Mac). / Us Paragraph Arial 14px A v I. % da

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started