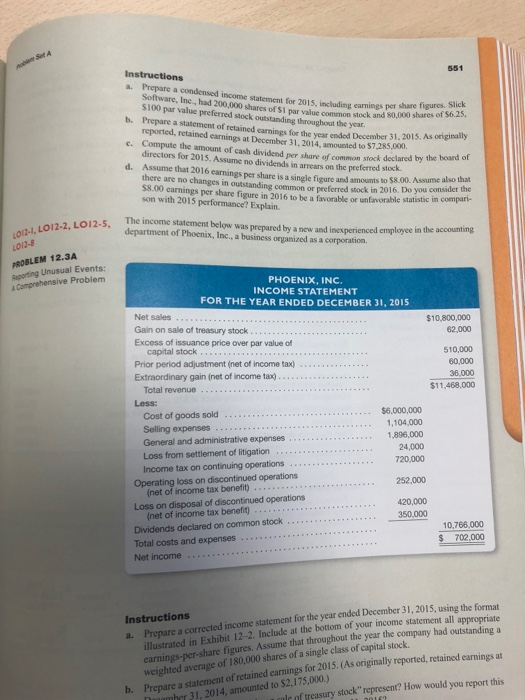

$ 551 Instructions a. Prepare a condensed income statement for 2015, including earnings per share b. Prepare a statement of retained carnings fo e. Compute the amount of cash dividend per share of common stock declared by the Software, Inc, had 200,000 shares of S1 par value common stock and $100 par value preferred stock outstanding throughout the year $0,000 shares of $625, r the year ended December 31, 2015. As originally the board of 6 earnings per share is a single figure and amounts to $8.00. Assume also that reported, retained earnings at December 31,2014, amounted to $7,285,000. directors for 2015. Assume no dividends in arrears on the preferred stox Assume that 201 there are no changes in outstanding common or peeferred stock in 2016. Do you $8.00 earnings per share figure in 2016 to be a favorable or unfavorable statistic in compar- son with 2015 performance? Explain. d. The income statement below was prepared by a new and inesperienced employee in the department of Phoenix, Inc., a business organized as a corporation PROBLEM 12.3A Raporting Unusual Events: A Comprehensive Problem PHOENIX, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2015 Net sales Gain on sale of treasury stock Excess of issuance price over par value of $10,800,000 62,000 capital stock Prior period adjustment (net of income tax) Extraordinary gain (net of income tax). 510,000 60,000 36,000 $11,468,000 Total revenue Less $6,000,000 1,104,000 1,896,000 Cost of goods sold . Selling expenses General and administrative expenses Loss from settlement of litigation Income tax on continuing operations 24,000 720,000 252,000 420,000 Operating loss on discontinued operations (net of income tax benefit) Loss on disposal of discontinued operations 350,000 10,766,000 Dividends declared on common stock... Total costs and expenses Net income (net of income tax benefit) 702,000 a. Prepare a corrected income statement for the year ended December 31, 2015, using the format all appropriate earnings at illustrated in Exhibit 12-2. Include at the bottom of your income statement earnings-per-share figures. Assume that throughout the year the company had outstanding a weighted average Prepare a statement of retained ea Instructions of 180,000 shares of a single class of capital stock. a statement of retained earnings for 2015. (As originally reported, retained earn b. 31, 2014, amounted to $2,175,000.) r of treasury stock" represent? How would you report this $ 551 Instructions a. Prepare a condensed income statement for 2015, including earnings per share b. Prepare a statement of retained carnings fo e. Compute the amount of cash dividend per share of common stock declared by the Software, Inc, had 200,000 shares of S1 par value common stock and $100 par value preferred stock outstanding throughout the year $0,000 shares of $625, r the year ended December 31, 2015. As originally the board of 6 earnings per share is a single figure and amounts to $8.00. Assume also that reported, retained earnings at December 31,2014, amounted to $7,285,000. directors for 2015. Assume no dividends in arrears on the preferred stox Assume that 201 there are no changes in outstanding common or peeferred stock in 2016. Do you $8.00 earnings per share figure in 2016 to be a favorable or unfavorable statistic in compar- son with 2015 performance? Explain. d. The income statement below was prepared by a new and inesperienced employee in the department of Phoenix, Inc., a business organized as a corporation PROBLEM 12.3A Raporting Unusual Events: A Comprehensive Problem PHOENIX, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2015 Net sales Gain on sale of treasury stock Excess of issuance price over par value of $10,800,000 62,000 capital stock Prior period adjustment (net of income tax) Extraordinary gain (net of income tax). 510,000 60,000 36,000 $11,468,000 Total revenue Less $6,000,000 1,104,000 1,896,000 Cost of goods sold . Selling expenses General and administrative expenses Loss from settlement of litigation Income tax on continuing operations 24,000 720,000 252,000 420,000 Operating loss on discontinued operations (net of income tax benefit) Loss on disposal of discontinued operations 350,000 10,766,000 Dividends declared on common stock... Total costs and expenses Net income (net of income tax benefit) 702,000 a. Prepare a corrected income statement for the year ended December 31, 2015, using the format all appropriate earnings at illustrated in Exhibit 12-2. Include at the bottom of your income statement earnings-per-share figures. Assume that throughout the year the company had outstanding a weighted average Prepare a statement of retained ea Instructions of 180,000 shares of a single class of capital stock. a statement of retained earnings for 2015. (As originally reported, retained earn b. 31, 2014, amounted to $2,175,000.) r of treasury stock" represent? How would you report this