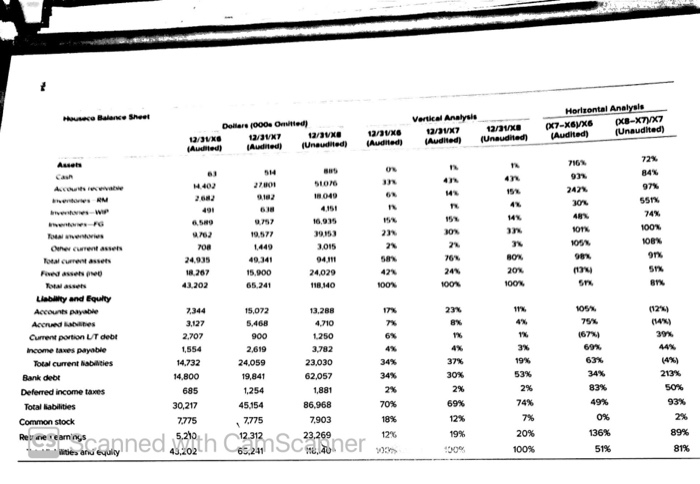

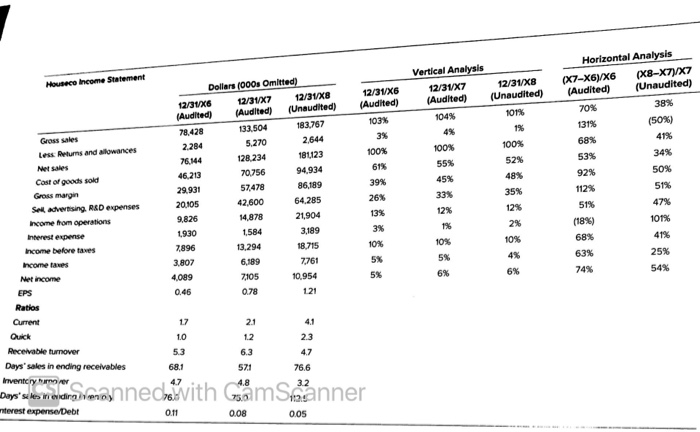

5-57. Houseco, an audit client of Jones, CPA, for the past five years, is a manufacturer of various household products. Approximately four years ago, Houseco developed a better toaster than had been available and sales took off, especially during the most recent two years, 20X7 and 20X8. Currently, the company controls approximately 25 percent of the toaster market in the United States. In addition, the company manufactures other products, including vacuum cleaners, floor polishers, and electric fondue pots. Much of the increased sales performance is due to Donald Skaldon, who became the chief executive officer in 20X4. Donald and several other officers were able to accomplish a lever- aged stock buyout in 20X6. This seems to have worked out very well because Donald sug- gests that his net worth grew from less than $300,000 to well over $5 million due to increases in the value of the common stock he holds in the company. He is also excited because the company's unaudited results show earnings per share of $1.21, one cent more than the most optimistic analysts had projected. He points out to Jones that sales are up over 38 percent compared to the previous year and net income has increased by 54 percent. All is well. Jones is beginning the risk assessment analytical procedures for the 20X8 audit to obtain information to help plan the nature, timing, and extent of other audit procedures. More specifi- cally, he wants to identify areas that may represent specific risks relevant to this year's audit. Use the following Houseco balance sheet and income statement to identify accounts that may represent specific risks relevant to this year's audit. For each area, briefly note why you Grink it represents a risk. CamScanner Musea Balance Sheet Dollar 1000. Omitted 1a/VG X 12/3VO Audited) Audited (Unaudited) Horizontal Analysis (X7-X6X6 (XB-XTYX7 (Audited) (Unaudited) Vertical Analysis ta/vx7 12/31KB (Audited) (Unaudited) VG (Audited) Assets 76 5106 18040 6 2471 300 491 72 84% 97% 551% 74% 100N NOBN 9n 51% 16,915 077 19.577 155 on 23 21 NOT 109 her case Total current assets Pows Asses 702 700 24.935 18.267 43.202 3.015 941 24,029 118.140 15.900 65.241 42 NOON 24 1000 BOX 200 100% 23 B% 1 Liability and Equity Accounts payable Acties Current portion LT debt Income taxes payable Total current abilities Bank debe Deferred income taxes Total abilities Common stock Reve ties and Equity 7,344 3,127 2.707 1,554 14.732 14,800 685 30,217 7775 5.210 43.202 15.072 5.468 900 2,619 24.059 19,841 1.254 45,154 7.775 12.312 65.241 13.288 4.710 1250 3.782 23.030 62,057 1,881 86.968 7.903 23.269 40 1054 75% 1674) 69% 63% 34% 83% 34% 2% 70% 18% 3% 19 53% 2% 74% 7% 20% 37% 30% 2% 69% (12) (14) 399 44% (4%) 213% 50% 93% 2% 89% 81% 12% 19% 1296 0% 136% 51% 100% Houteco Income Statement Vertical Analysis 12/31X7 12/31/X8 (Audited) (Unaudited) 104% 101% 92% Dollars (000s Omitted) 12/31X6 12/31X7 12/31X8 (Audited) (Audited) (Unaudited) 78,428 133.504 183.767 2284 5.270 2,644 76.44 120.234 180123 46.213 70756 94.934 29,931 57478 86,189 20105 42,600 64.285 9.826 14,878 21.904 1930 1,584 3,189 7.896 13.294 18,715 3.807 6,189 7.761 4,089 7105 10,954 0.46 0.78 121 12/31X6 (Audited) 103% 3% 100% 61% 39% 26% 13% 3% 10% 5% 5% 100% 55% 45% 33% 12% Horizontal Analysis (X7-X6\/X6 (X8-X7)/X7 (Audited) (Unaudited) 70% 38% 131% (50%) 68% 41% 53% 34% 50% 112% 51% 51% 47% (18%) 101% 68% 41% 63% 25% 74% 54% 100% 52% 48% 35% 12% 2% 10% Gross sales Less Returns and allowances Net Sales Cost of goods sold Gross margin Sel advertising R&D expenses Income from operations Interest experise Income before taxes Income taxes Net income EPS Ratios Current OUCH Receivable turnover Days' sales in ending receivables Inventcry humorer Days' sie in eiding nterest expense Debt 10% 5% 6% 6% 17 1.0 5.3 68.1 2.1 1.2 6.3 571 2.3 4.7 76.6 cameramanne chevith Om Smanner 0.11 0.08 0.05 5-57. Houseco, an audit client of Jones, CPA, for the past five years, is a manufacturer of various household products. Approximately four years ago, Houseco developed a better toaster than had been available and sales took off, especially during the most recent two years, 20X7 and 20X8. Currently, the company controls approximately 25 percent of the toaster market in the United States. In addition, the company manufactures other products, including vacuum cleaners, floor polishers, and electric fondue pots. Much of the increased sales performance is due to Donald Skaldon, who became the chief executive officer in 20X4. Donald and several other officers were able to accomplish a lever- aged stock buyout in 20X6. This seems to have worked out very well because Donald sug- gests that his net worth grew from less than $300,000 to well over $5 million due to increases in the value of the common stock he holds in the company. He is also excited because the company's unaudited results show earnings per share of $1.21, one cent more than the most optimistic analysts had projected. He points out to Jones that sales are up over 38 percent compared to the previous year and net income has increased by 54 percent. All is well. Jones is beginning the risk assessment analytical procedures for the 20X8 audit to obtain information to help plan the nature, timing, and extent of other audit procedures. More specifi- cally, he wants to identify areas that may represent specific risks relevant to this year's audit. Use the following Houseco balance sheet and income statement to identify accounts that may represent specific risks relevant to this year's audit. For each area, briefly note why you Grink it represents a risk. CamScanner Musea Balance Sheet Dollar 1000. Omitted 1a/VG X 12/3VO Audited) Audited (Unaudited) Horizontal Analysis (X7-X6X6 (XB-XTYX7 (Audited) (Unaudited) Vertical Analysis ta/vx7 12/31KB (Audited) (Unaudited) VG (Audited) Assets 76 5106 18040 6 2471 300 491 72 84% 97% 551% 74% 100N NOBN 9n 51% 16,915 077 19.577 155 on 23 21 NOT 109 her case Total current assets Pows Asses 702 700 24.935 18.267 43.202 3.015 941 24,029 118.140 15.900 65.241 42 NOON 24 1000 BOX 200 100% 23 B% 1 Liability and Equity Accounts payable Acties Current portion LT debt Income taxes payable Total current abilities Bank debe Deferred income taxes Total abilities Common stock Reve ties and Equity 7,344 3,127 2.707 1,554 14.732 14,800 685 30,217 7775 5.210 43.202 15.072 5.468 900 2,619 24.059 19,841 1.254 45,154 7.775 12.312 65.241 13.288 4.710 1250 3.782 23.030 62,057 1,881 86.968 7.903 23.269 40 1054 75% 1674) 69% 63% 34% 83% 34% 2% 70% 18% 3% 19 53% 2% 74% 7% 20% 37% 30% 2% 69% (12) (14) 399 44% (4%) 213% 50% 93% 2% 89% 81% 12% 19% 1296 0% 136% 51% 100% Houteco Income Statement Vertical Analysis 12/31X7 12/31/X8 (Audited) (Unaudited) 104% 101% 92% Dollars (000s Omitted) 12/31X6 12/31X7 12/31X8 (Audited) (Audited) (Unaudited) 78,428 133.504 183.767 2284 5.270 2,644 76.44 120.234 180123 46.213 70756 94.934 29,931 57478 86,189 20105 42,600 64.285 9.826 14,878 21.904 1930 1,584 3,189 7.896 13.294 18,715 3.807 6,189 7.761 4,089 7105 10,954 0.46 0.78 121 12/31X6 (Audited) 103% 3% 100% 61% 39% 26% 13% 3% 10% 5% 5% 100% 55% 45% 33% 12% Horizontal Analysis (X7-X6\/X6 (X8-X7)/X7 (Audited) (Unaudited) 70% 38% 131% (50%) 68% 41% 53% 34% 50% 112% 51% 51% 47% (18%) 101% 68% 41% 63% 25% 74% 54% 100% 52% 48% 35% 12% 2% 10% Gross sales Less Returns and allowances Net Sales Cost of goods sold Gross margin Sel advertising R&D expenses Income from operations Interest experise Income before taxes Income taxes Net income EPS Ratios Current OUCH Receivable turnover Days' sales in ending receivables Inventcry humorer Days' sie in eiding nterest expense Debt 10% 5% 6% 6% 17 1.0 5.3 68.1 2.1 1.2 6.3 571 2.3 4.7 76.6 cameramanne chevith Om Smanner 0.11 0.08 0.05