Question

5.6 Westfarmers shares currently trade at $32.55. A funds manager is holding a large number of Westfarmers shares in an investment portfolio and wishes

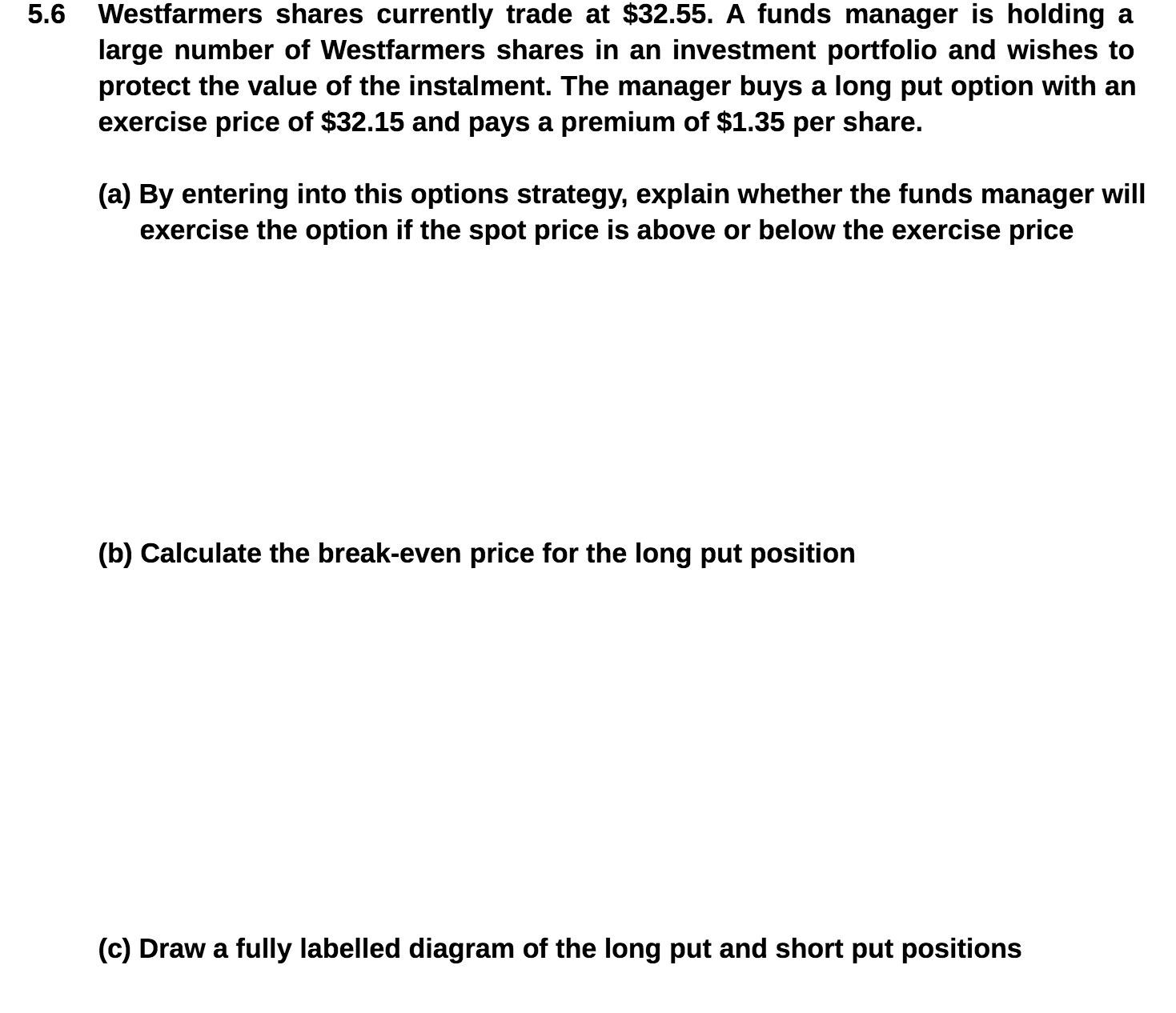

5.6 Westfarmers shares currently trade at $32.55. A funds manager is holding a large number of Westfarmers shares in an investment portfolio and wishes to protect the value of the instalment. The manager buys a long put option with an exercise price of $32.15 and pays a premium of $1.35 per share. (a) By entering into this options strategy, explain whether the funds manager will exercise the option if the spot price is above or below the exercise price (b) Calculate the break-even price for the long put position (c) Draw a fully labelled diagram of the long put and short put positions

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a By entering into this options strategy the funds manager has purchased a long put option This give...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham

Concise 9th Edition

1305635937, 1305635930, 978-1305635937

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App