5-7 please. this is all the info provided

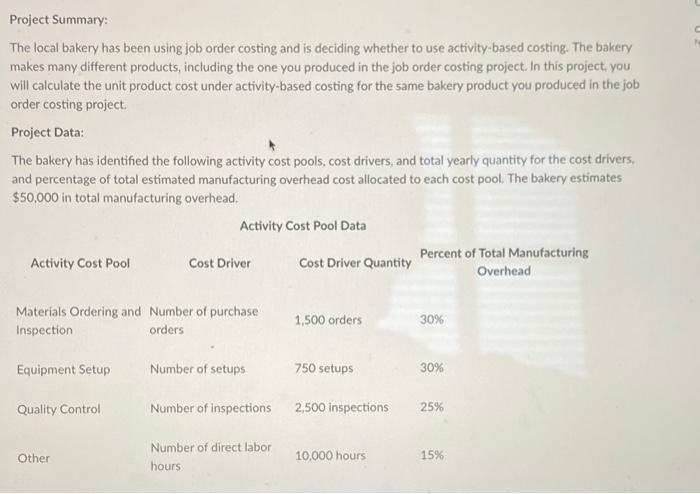

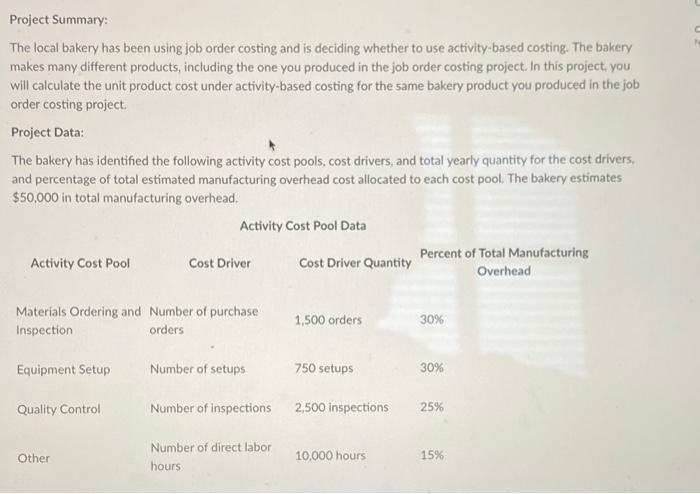

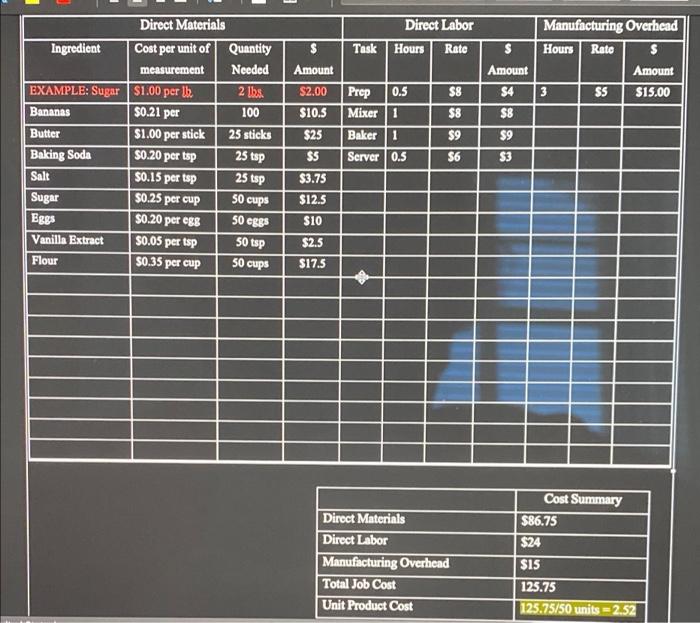

Project Summary: The local bakery has been using Job order costing and is deciding whether to use activity-based costing. The bakery makes many different products, including the one you produced in the job order costing project. In this project, you will calculate the unit product cost under activity-based costing for the same bakery product you produced in the job order costing project Project Data: The bakery has identified the following activity cost pools, cost drivers, and total yearly quantity for the cost drivers, and percentage of total estimated manufacturing overhead cost allocated to each cost pool. The bakery estimates $50,000 in total manufacturing overhead. Activity Cost Pool Data Percent of Total Manufacturing Activity Cost Pool Cost Driver Cost Driver Quantity Overhead Materials Ordering and Number of purchase Inspection orders 1,500 orders 30% Equipment Setup Number of setups 750 setups 30% Quality Control Number of inspections 2,500 inspections 25% Other Number of direct labor hours 10,000 hours 15% 5. Estimate total units produced in the year and calculate manufacturing overhead per unit. 6. Using direct materials per unit and direct labor per unit from the job order costing project, calculate unit product cost. 7. In a few sentences, explain the differences in unit product cost between job order and activity based costing. Direct Labor Task Hours $ Rate $ Manufacturing Overhead Hours Rate $ Amount 3 SS $15.00 Amount Amount $4 2 lbs. $2.00 0.5 $8 Prep Mixer $0.21 per 1 $8 $8 Baker 1 $9 $9 Direct Materials Ingredient Cost per unit of Quantity measurement Needed EXAMPLE: Sugar $1.00 per lb Bananas 100 Butter $1.00 per stick 25 sticks Baking Soda $0.20 per tsp Salt $0.15 per tsp 25 tsp Sugar Eggs $0.20 per egg Vanilla Extract $0.05 per tsp Flour $0.35 per cup 25 tsp Server 0.5 $6 S3 $10.5 $25 $5 $3.75 $12.5 $10 $0.25 per cup 50 cups 50 eggs 50 tsp 50 cups $2.5 $17.5 Direct Materials Direct Labor Manufacturing Overhead Total Job Cost Unit Product Cost Cost Summary $86.75 $24 $15 125.75 125.75/50 units -2.52 Project Summary: The local bakery has been using Job order costing and is deciding whether to use activity-based costing. The bakery makes many different products, including the one you produced in the job order costing project. In this project, you will calculate the unit product cost under activity-based costing for the same bakery product you produced in the job order costing project Project Data: The bakery has identified the following activity cost pools, cost drivers, and total yearly quantity for the cost drivers, and percentage of total estimated manufacturing overhead cost allocated to each cost pool. The bakery estimates $50,000 in total manufacturing overhead. Activity Cost Pool Data Percent of Total Manufacturing Activity Cost Pool Cost Driver Cost Driver Quantity Overhead Materials Ordering and Number of purchase Inspection orders 1,500 orders 30% Equipment Setup Number of setups 750 setups 30% Quality Control Number of inspections 2,500 inspections 25% Other Number of direct labor hours 10,000 hours 15% 5. Estimate total units produced in the year and calculate manufacturing overhead per unit. 6. Using direct materials per unit and direct labor per unit from the job order costing project, calculate unit product cost. 7. In a few sentences, explain the differences in unit product cost between job order and activity based costing. Direct Labor Task Hours $ Rate $ Manufacturing Overhead Hours Rate $ Amount 3 SS $15.00 Amount Amount $4 2 lbs. $2.00 0.5 $8 Prep Mixer $0.21 per 1 $8 $8 Baker 1 $9 $9 Direct Materials Ingredient Cost per unit of Quantity measurement Needed EXAMPLE: Sugar $1.00 per lb Bananas 100 Butter $1.00 per stick 25 sticks Baking Soda $0.20 per tsp Salt $0.15 per tsp 25 tsp Sugar Eggs $0.20 per egg Vanilla Extract $0.05 per tsp Flour $0.35 per cup 25 tsp Server 0.5 $6 S3 $10.5 $25 $5 $3.75 $12.5 $10 $0.25 per cup 50 cups 50 eggs 50 tsp 50 cups $2.5 $17.5 Direct Materials Direct Labor Manufacturing Overhead Total Job Cost Unit Product Cost Cost Summary $86.75 $24 $15 125.75 125.75/50 units -2.52