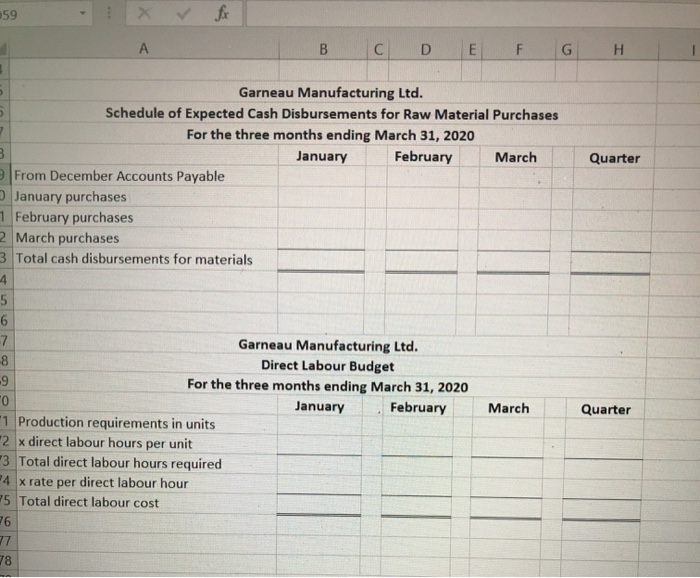

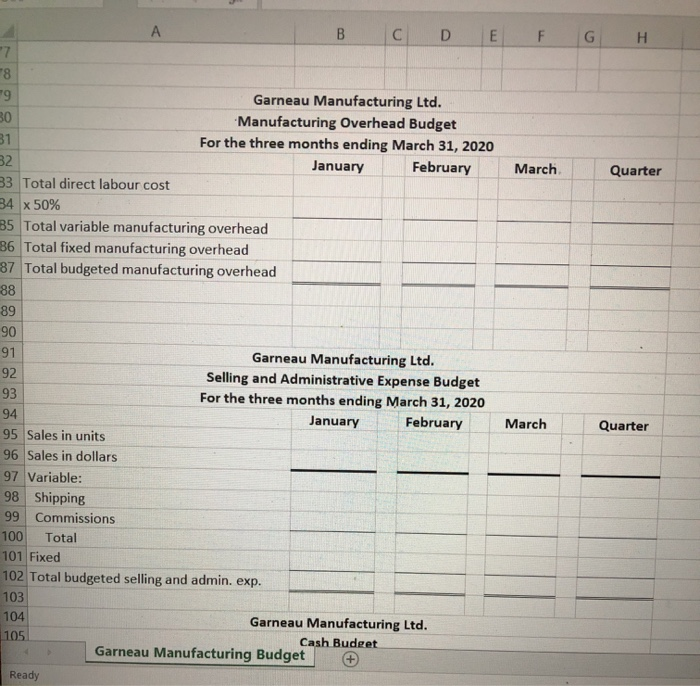

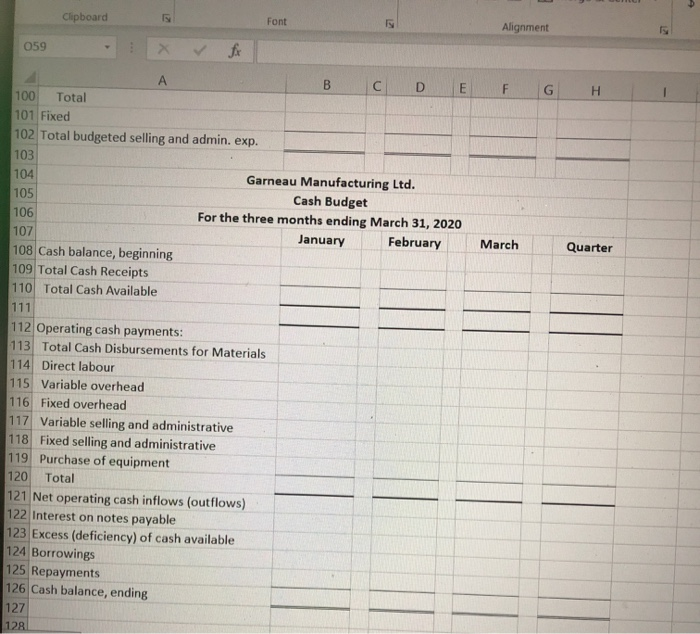

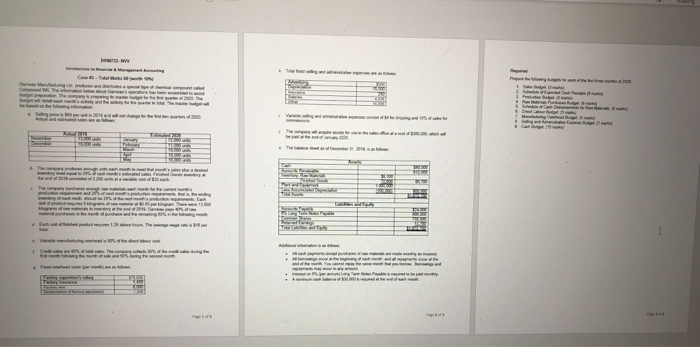

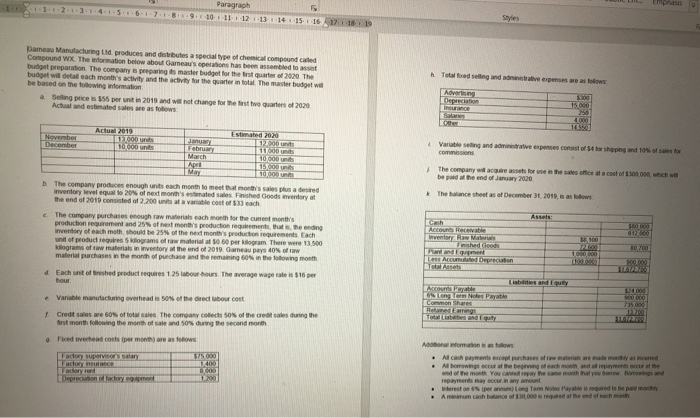

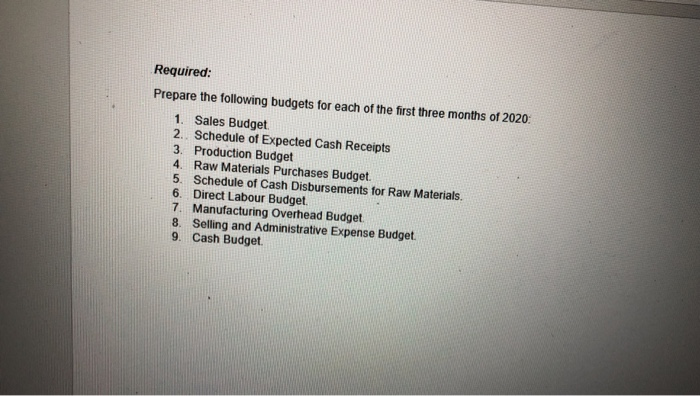

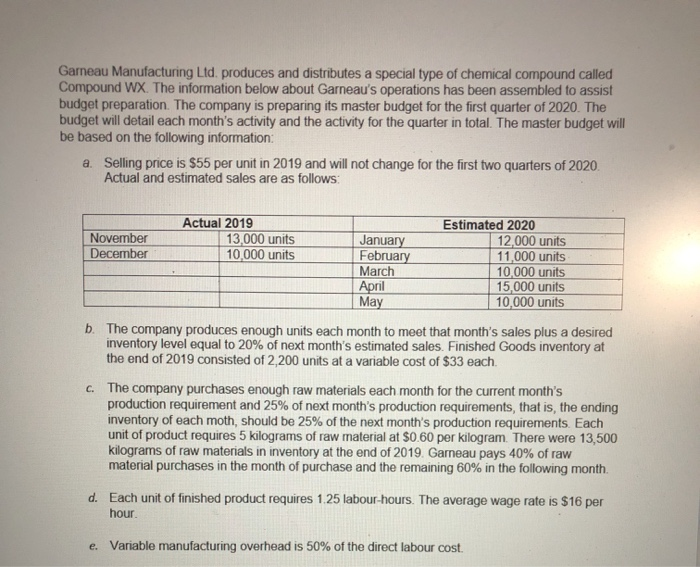

59 B C D E F G H 5 m Quarter Garneau Manufacturing Ltd. Schedule of Expected Cash Disbursements for Raw Material Purchases For the three months ending March 31, 2020 January February March From December Accounts Payable January purchases 1 February purchases 2 March purchases 3 Total cash disbursements for materials 4 5 6 7 Garneau Manufacturing Ltd. 8 Direct Labour Budget -9 For the three months ending March 31, 2020 "0 January February March "1 Production requirements in units 2 x direct labour hours per unit 3 Total direct labour hours required 4 x rate per direct labour hour 25 Total direct labour cost 76 Quarter 78 F G H March Quarter A B C D E 7 18 79 Garneau Manufacturing Ltd. 30 Manufacturing Overhead Budget 31 For the three months ending March 31, 2020 82 January February 33 Total direct labour cost 34 x 50% B5 Total variable manufacturing overhead 86 Total fixed manufacturing overhead 87 Total budgeted manufacturing overhead 88 89 90 91 Garneau Manufacturing Ltd. 92 Selling and Administrative Expense Budget 93 For the three months ending March 31, 2020 94 January February 95 Sales in units 96 Sales in dollars 97 Variable: 98 Shipping 99 Commissions 100 Total 101 Fixed 102 Total budgeted selling and admin. exp. 103 104 Garneau Manufacturing Ltd. 105 Cash Budget Garneau Manufacturing Budget Ready March Quarter Clipboard Font 21 Alignment 059 fx C F G H March Quarter A B D E 100 Total 101 Fixed 102 Total budgeted selling and admin. exp. 103 104 Garneau Manufacturing Ltd. 105 Cash Budget 106 For the three months ending March 31, 2020 107 January February 108 Cash balance, beginning 109 Total Cash Receipts 110 Total Cash Available 111 112 Operating cash payments: 113 Total Cash Disbursements for Materials 114 Direct labour 115 Variable overhead 116 Fixed overhead 117 Variable selling and administrative 118 Fixed selling and administrative 119 Purchase of equipment 120 Total 121 Net operating cash inflows (outflows) 122 Interest on notes payable 123 Excess (deficiency) of cash available 124 Borrowings 125 Repayments 126 Cash balance, ending 127 128 AN Male TH The FC Could you please provide the excel formula so as to better understand the answers? Much thanks and appreciated. I Paragraph 11.1.2-1.3 1.41-5-6-7.1.3.1.9.-10-11 12 13 14 15 16 17 18 19 Empasts Styles Damen Manufacturing uld produces and distributes a special type of chemical compound card Compound WX. The information below about Game's operation has been assembled to budget preparation. The company is preparing to master budget for the best of 2020 The budget wil detall each month's activity and the activity for the quarter in total the master budget be based on the following information Selling price is 555 per unitin 2015 and will not change for the states of 2020 Actual and estimated sales are as follows Total feeling and expenses areas 300 Advertising Depreciation Insurance 250 Variable selling and administrative expenses consist of 54 for shoping and 10% of sales for Commons The company will come for use in the sale office at a cost of $100 000, which we be paid the end of January 2020 The balance sheet as of December 31, 2010, as follows Assets 6137 Actual 2019 Estimated 2010 November E127000 December 10 000 units February 11000 March 10 000 units April 150 10000 un The company produces enough units each month to meet that month's sales plus a desired inventory level equal to 20% of next month's estimated sales Finished Goods entory at the end of 2019 consisted of 2.200 units at a cost of $3 each The company purchases enough raw materials each month for the current month's production requirement and 25% of the month's production requirements that the ending Inventory of each moth should be 25% of the next month's production requirements. Each unit of produires ograms of raw material at 50 60 per kilogram There were 13.500 Kograms of uw materials in Inventory at the end of 2019. Gameau pus 40% of raw material purchases in the month of purchase and the remaining 60% in the following month Each unit of the product requires 125 bor hours. The average wage rate is 16 hour Variable manufacturing overhead is 50% of the direct bour cost Credit alles are 60% of total sales The company collect 50% of the credit sales during the Srst month following the month of don dug the second month 9. Fred overhead costs per month are as follows Factory up or salary 575.000 1/400 000 Depreciation open Cash Account Recewable Inventory Raw Materiais The Good Landed Les Acued Depreciation 10.700 1000000 Accounts Ingo Noles Payable Commons Berg 2000 O 000 735000 Antonio All cash payments except purchases of water are made only as med Al borrowings occur at the beginning of each month and repayments occur at the and of the month You can pay the same month that you w Borowings and repayments may occur in any amount Wersones per annum Long Term Notes Payables required to be pad many A minimum cash balance 30.000 at the end of each month Required: Prepare the following budgets for each of the first three months of 2020 1. Sales Budget 2. Schedule of Expected Cash Receipts 3. Production Budget 4. Raw Materials Purchases Budget 5. Schedule of Cash Disbursements for Raw Materials. 6. Direct Labour Budget 7. Manufacturing Overhead Budget 8. Selling and Administrative Expense Budget 9 Cash Budget Garneau Manufacturing Ltd. produces and distributes a special type of chemical compound called Compound WX. The information below about Garneau's operations has been assembled to assist budget preparation. The company is preparing its master budget for the first quarter of 2020. The budget will detail each month's activity and the activity for the quarter in total. The master budget will be based on the following information: a. Selling price is $55 per unit in 2019 and will not change for the first two quarters of 2020. Actual and estimated sales are as follows: November December Actual 2019 13,000 units 10,000 units January February March April May Estimated 2020 12,000 units 11,000 units 10,000 units 15,000 units 10,000 units b. The company produces enough units each month to meet that month's sales plus a desired inventory level equal to 20% of next month's estimated sales. Finished Goods inventory at the end of 2019 consisted of 2,200 units at a variable cost of $33 each. C. The company purchases enough raw materials each month for the current month's production requirement and 25% of next month's production requirements, that is, the ending inventory of each moth, should be 25% of the next month's production requirements. Each unit of product requires 5 kilograms of raw material at $0.60 per kilogram. There were 13,500 kilograms of raw materials in inventory at the end of 2019. Garneau pays 40% of raw material purchases in the month of purchase and the remaining 60% in the following month. d. Each unit of finished product requires 1.25 labour-hours. The average wage rate is $16 per hour e. Variable manufacturing overhead is 50% of the direct labour cost. E 21 AaBbCcDd AaBbccdd AaBbc AaBbccc AaB 1 No Spac... Heading 1 Heading 2 1 Normal Title Paragraph 2.1.3.1.4 4.1.5 16 Styles 14. 1.15.1.16 1 1.7 10. 1. 11. 12. 13. ! f. Credit sales are 60% of total sales. The company collects 50% of the credit sales during the first month following the month of sale and 50% during the second month. g. Fixed overhead costs (per month) are as follows: Factory supervisor's salary Factory insurance Factory rent Depreciation of factory equipment $75,000 1.400 8,000 1.200 Page 1 of 3 h. Total fixed selling and administrative expenses are as follows: Advertising Depreciation Insurance Salaries Other $300 15 000 250 4,000 14 550 v Title 1 Normal 1 No Spac... Heading 1 Heading 2 Paragraph LIN.2.1.3 Styles 1.11. 112: 13. 14. 1.15.1.16.17 5 1.6 1.7.1.8 1.9 1.10 i. Variable selling and administrative expenses consist of $4 for shipping and 10% of sales for commissions j. The company will acquire assets for use in the sales office at a cost of $300,000, which will be paid at the end of January 2020. k. The balance sheet as of December 31, 2019, is as follows: Assets: $80,000 612,000 Cash Accounts Receivable Inventory. Raw Materials Finished Goods Plant and Equipment Less Accumulated Depreciation Total Assets 80,700 $8,100 72.600 1,000,000 (100,000) 900.000 $1,672,700 Liabilities and Equity Accounts Payable 6% Long Term Notes Payable Common Shares Retained Earnings Total Liabilities and Equity $24,000 900,000 735,000 13.700 $1.672.700 . Additional information is as follows: All cash payments except purchases of raw materials are made monthly as incurred. All borrowings occur at the beginning of each month, and all repayments occur at the end of the month. You cannot repay the same month that you borrow. Borrowings and repayments may occur in any amount. Interest on 6% (per annum) Long Term Notes Payable is required to be paid monthly A minimum cash balance of $30,000 is required at the end of each month . Required: Prepare the following budgets for each of the first three months of 2020: 1. Sales Budget 2. Schedule of Expected Cash Receipts 3. Production Budget 4. Raw Materials Purchases Budget. 5. Schedule of Cash Disbursements for Raw Materials. 6. Direct Labour Budget. 7. Manufacturing Overhead Budget. 8. Selling and Administrative Expense Budget. 9. Cash Budget