Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5-a. Refer to the original data. Assume that the company sold 28,000 units last year. The sales manager is convinced that a 10% reduction in

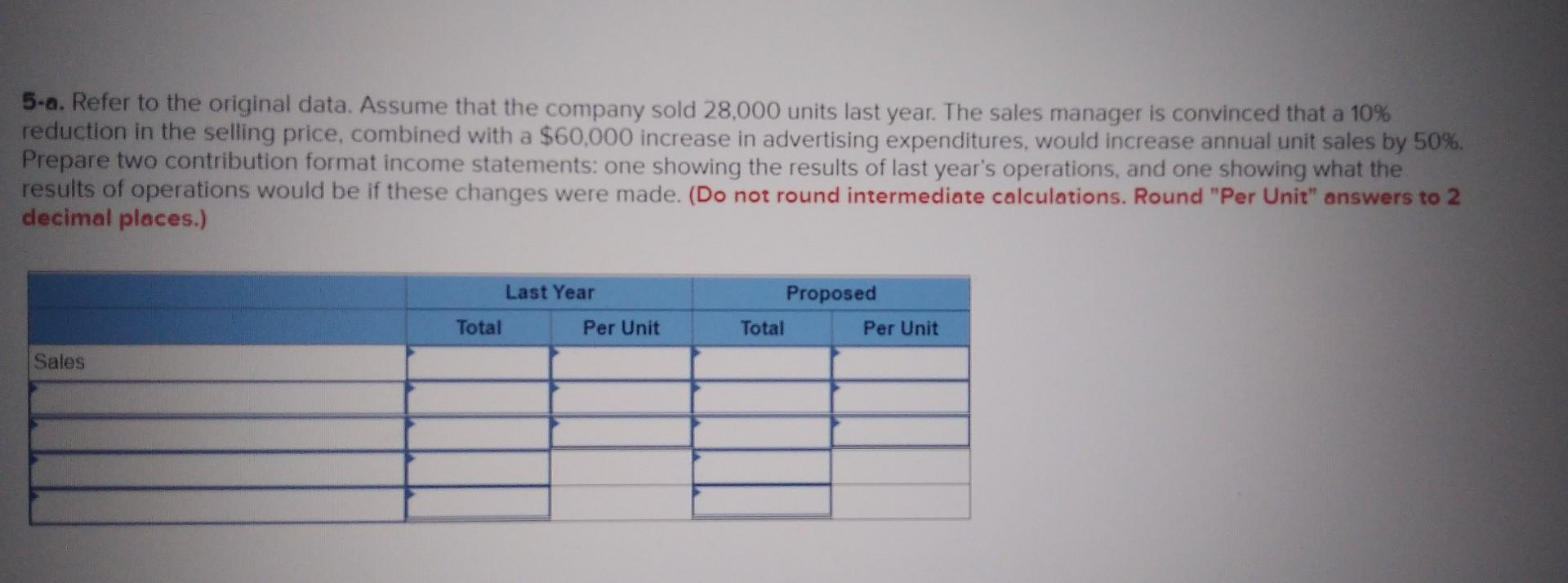

5-a. Refer to the original data. Assume that the company sold 28,000 units last year. The sales manager is convinced that a 10% reduction in the selling price, combined with a $60,000 increase in advertising expenditures, would increase annual unit sales by 50%. Prepare two contribution format income statements: one showing the results of last year's operations, and one showing what the results of operations would be if these changes were made. (Do not round intermediate calculations. Round "Per Unit" answers to 2 decimal places.) 5-a. Refer to the original data. Assume that the company sold 28,000 units last year. The sales manager is convinced that a 10% reduction in the selling price, combined with a $60,000 increase in advertising expenditures, would increase annual unit sales by 50%. Prepare two contribution format income statements: one showing the results of last year's operations, and one showing what the results of operations would be if these changes were made. (Do not round intermediate calculations. Round "Per Unit" answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started