Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5.Week Handnotes are: Can you solve the above question using the fifth week notes as reference? please help me In the lecture, you have been

5.Week Handnotes are:

Can you solve the above question using the fifth week notes as reference? please help me

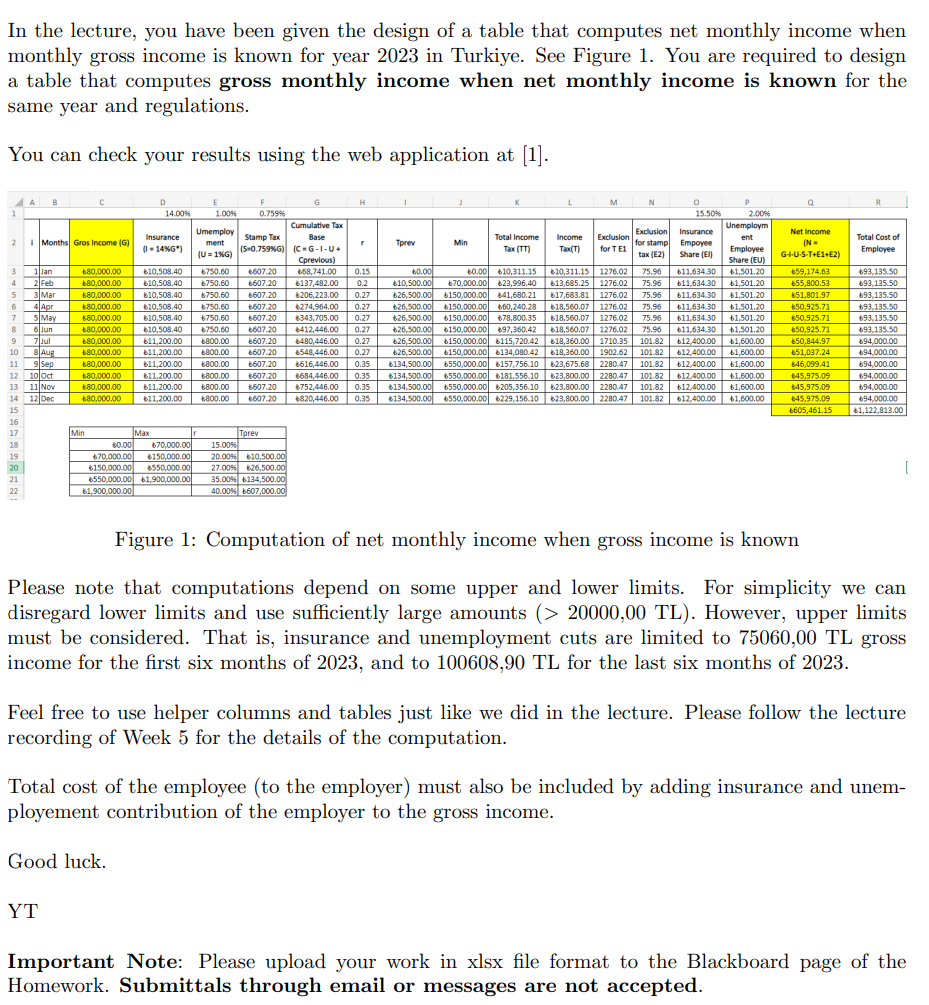

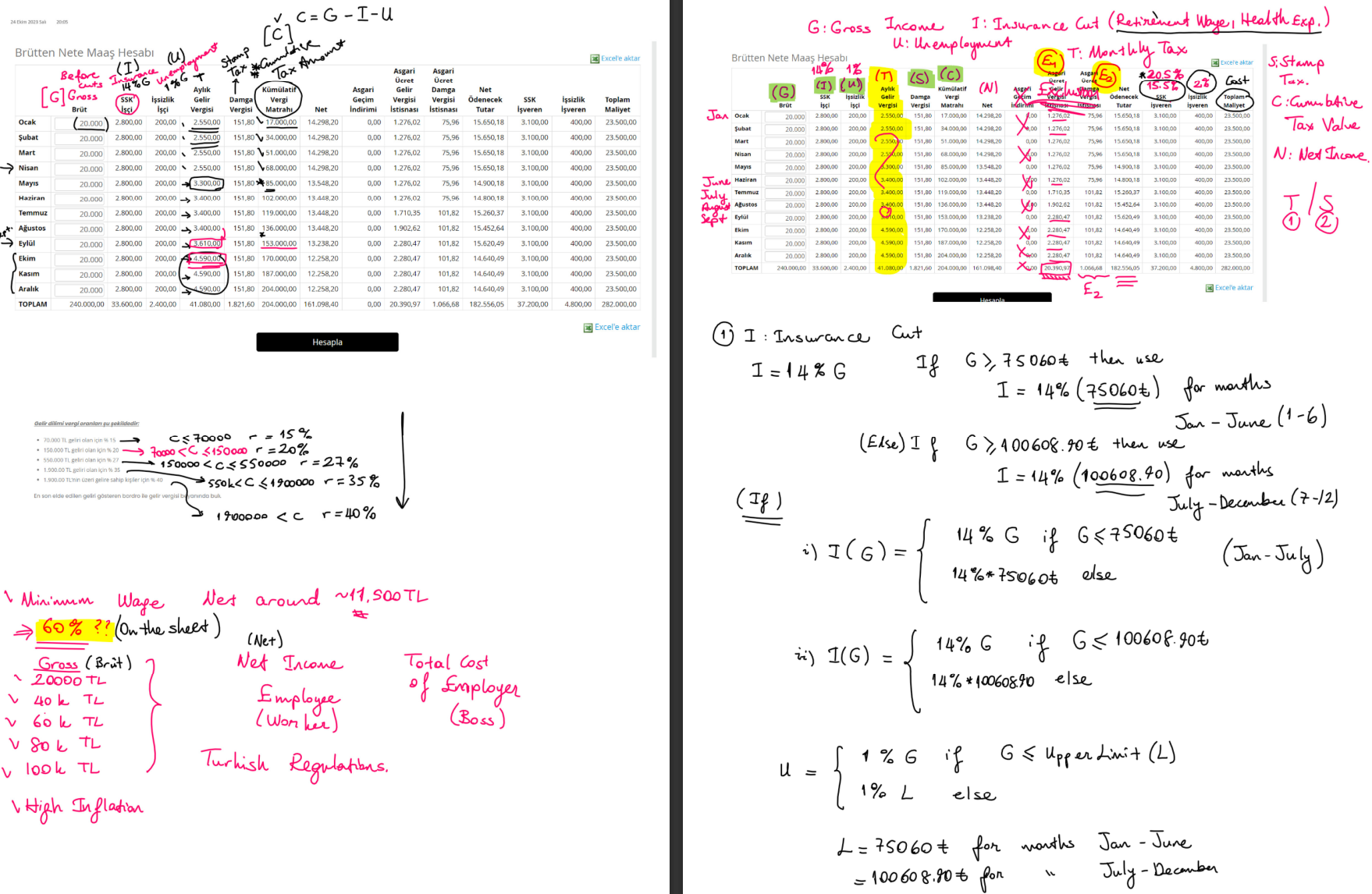

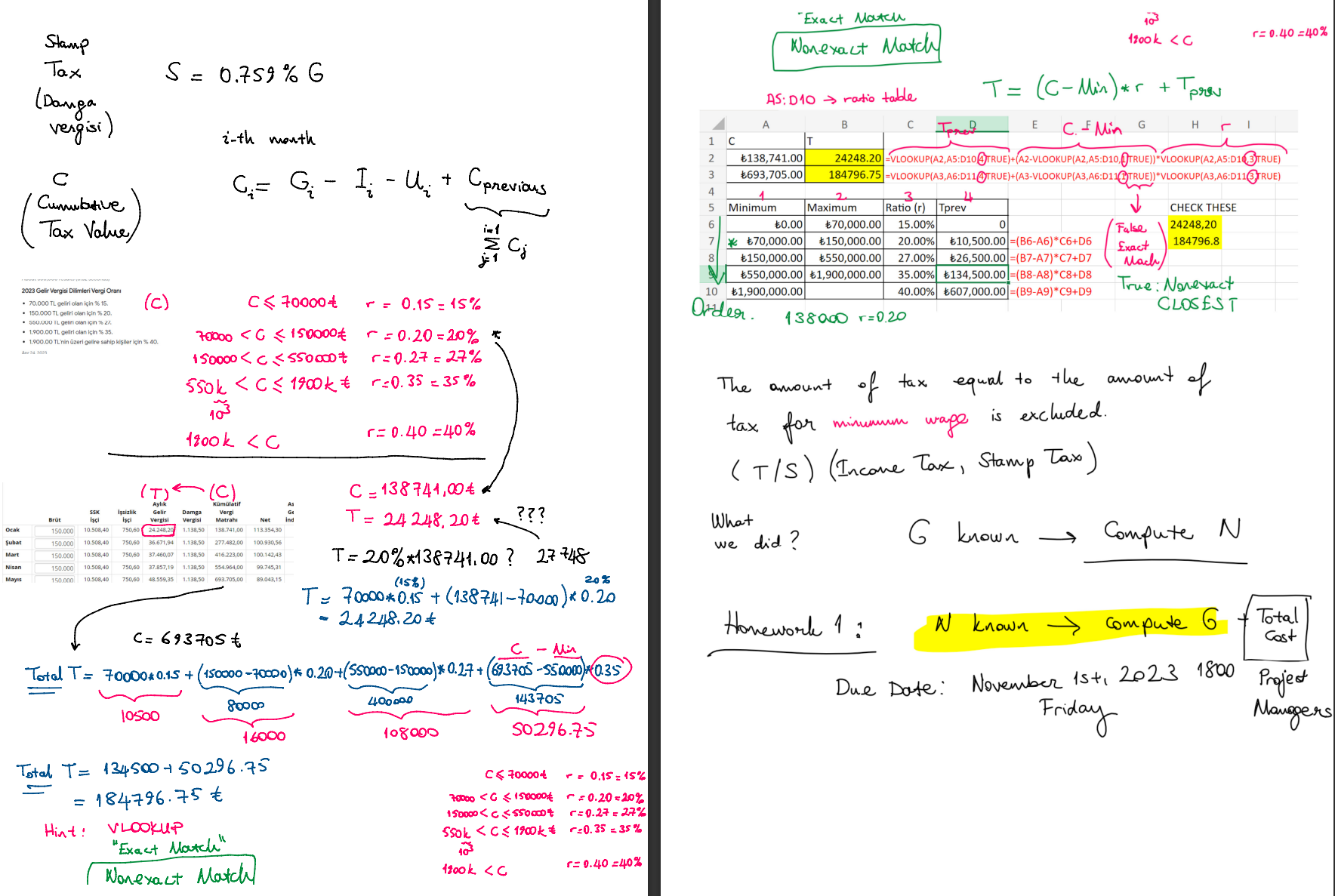

In the lecture, you have been given the design of a table that computes net monthly income when monthly gross income is known for year 2023 in Turkiye. See Figure 1. You are required to design a table that computes gross monthly income when net monthly income is known for the same year and regulations. You can check your results using the web application at [1]. Figure 1: Computation of net monthly income when gross income is known Please note that computations depend on some upper and lower limits. For simplicity we can disregard lower limits and use sufficiently large amounts (>20000,00 TL). However, upper limits must be considered. That is, insurance and unemployment cuts are limited to 75060,00 TL gross income for the first six months of 2023, and to 100608,90 TL for the last six months of 2023. Feel free to use helper columns and tables just like we did in the lecture. Please follow the lecture recording of Week 5 for the details of the computation. Total cost of the employee (to the employer) must also be included by adding insurance and unemployement contribution of the employer to the gross income. Good luck. YT Important Note: Please upload your work in xlsx file format to the Blackboard page of the Homework. Submittals through email or messages are not accepted. ,C=GIU G: Gross Income I: Insurance Cut (Retirnent Waye, Heal th Exp.) Hespla 1 Minimum Wage Nes around 11, S00TL 60% ?? (On the sheet) 60kTL sok TL (Worker) Turhish Regulations. High Inflation Excel'e aktar (1) I : Insurance Cut I=14%G If G75060t then use I=14% (75060t) for months (Else) I f G400608.90 t then use Jan-June (16) I=14%(100608.40) for morths (If) July-December (7-12) i) I(G)={14%GifG75060t14%750607else (Jan-July) ii) I(G)={14%GifG100608.90t14%100608.90else U={1%G1%LifGupperdimit(L)else L=75060= for wanths Jan-Jure =100608.90t for "July-Decomber Stamp Tax S=0.759%G (Danga vergisi) i-th month C (Cummbtive ) Ci=GiIiUi+j=1i=1CjCprevious (c) c70000tr=0.15=15% - 150.000TL geliri clan iin %20. - 1,900.00 TL geliri olan iin %35 - 1.900.00 TL'nin zeri gelire sahip ksiler ipin ss an. 70000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started