Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. (10 points) Northern Lights Corp. stock trades at $55 per share and there are 72 million shares outstanding. The management would like to

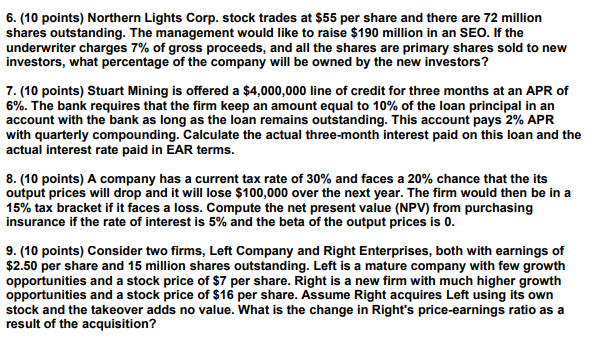

6. (10 points) Northern Lights Corp. stock trades at $55 per share and there are 72 million shares outstanding. The management would like to raise $190 million in an SEO. If the underwriter charges 7% of gross proceeds, and all the shares are primary shares sold to new investors, what percentage of the company will be owned by the new investors? 7. (10 points) Stuart Mining is offered a $4,000,000 line of credit for three months at an APR of 6%. The bank requires that the firm keep an amount equal to 10% of the loan principal in an account with the bank as long as the loan remains outstanding. This account pays 2% APR with quarterly compounding. Calculate the actual three-month interest paid on this loan and the actual interest rate paid in EAR terms. 8. (10 points) A company has a current tax rate of 30% and faces a 20% chance that the its output prices will drop and it will lose $100,000 over the next year. The firm would then be in a 15% tax bracket if it faces a loss. Compute the net present value (NPV) from purchasing insurance if the rate of interest is 5% and the beta of the output prices is 0. 9. (10 points) Consider two firms, Left Company and Right Enterprises, both with earnings of $2.50 per share and 15 million shares outstanding. Left is a mature company with few growth opportunities and a stock price of $7 per share. Right is a new firm with much higher growth opportunities and a stock price of $16 per share. Assume Right acquires Left using its own stock and the takeover adds no value. What is the change in Right's price-earnings ratio as a result of the acquisition?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 6 Northern Lights wants to raise 190 million and the underwrit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started