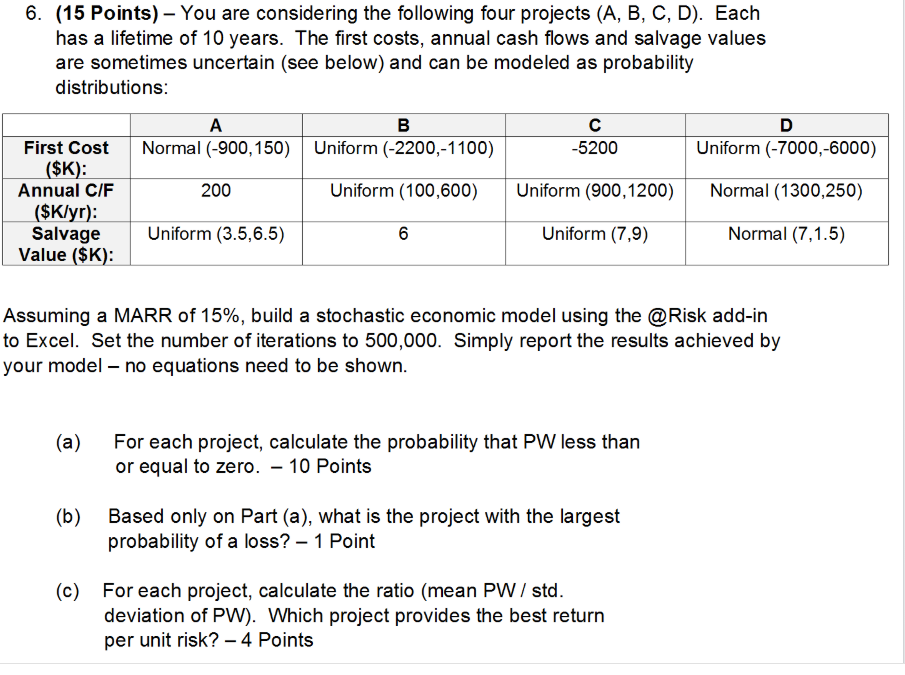

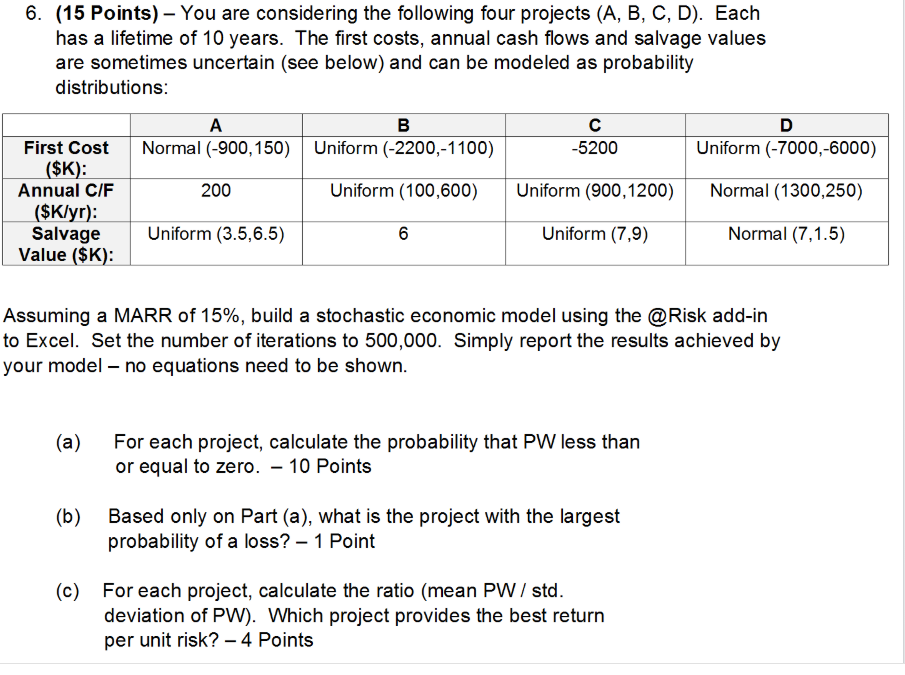

6. (15 Points) - You are considering the following four projects (A, B, C, D). Each has a lifetime of 10 years. The first costs, annual cash flows and salvage values are sometimes uncertain (see below) and can be modeled as probability distributions: A Normal (-900,150) Uniform (-2200,-1100) -5200 Uniform (-7000,-6000) 200 First Cost ($K): Annual C/F ($K/yr): Salvage Value ($K): Uniform (100,600) Uniform (900,1200) Normal (1300,250) Uniform (3.5,6.5) Uniform (7,9) Normal (7,1.5) Assuming a MARR of 15%, build a stochastic economic model using the @Risk add-in to Excel. Set the number of iterations to 500,000. Simply report the results achieved by your model - no equations need to be shown. (a) For each project, calculate the probability that PW less than or equal to zero. 10 Points (b) Based only on Part (a), what is the project with the largest probability of a loss? - 1 Point (c) For each project, calculate the ratio (mean PW/ std. deviation of PW). Which project provides the best return per unit risk? - 4 Points 6. (15 Points) - You are considering the following four projects (A, B, C, D). Each has a lifetime of 10 years. The first costs, annual cash flows and salvage values are sometimes uncertain (see below) and can be modeled as probability distributions: A Normal (-900,150) Uniform (-2200,-1100) -5200 Uniform (-7000,-6000) 200 First Cost ($K): Annual C/F ($K/yr): Salvage Value ($K): Uniform (100,600) Uniform (900,1200) Normal (1300,250) Uniform (3.5,6.5) Uniform (7,9) Normal (7,1.5) Assuming a MARR of 15%, build a stochastic economic model using the @Risk add-in to Excel. Set the number of iterations to 500,000. Simply report the results achieved by your model - no equations need to be shown. (a) For each project, calculate the probability that PW less than or equal to zero. 10 Points (b) Based only on Part (a), what is the project with the largest probability of a loss? - 1 Point (c) For each project, calculate the ratio (mean PW/ std. deviation of PW). Which project provides the best return per unit risk? - 4 Points