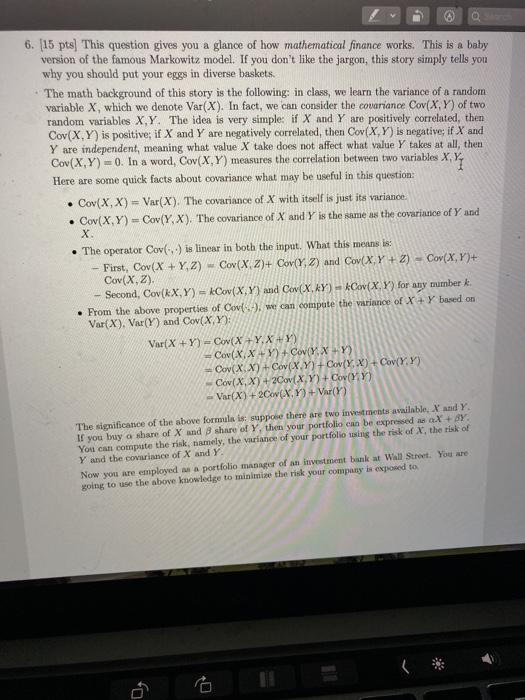

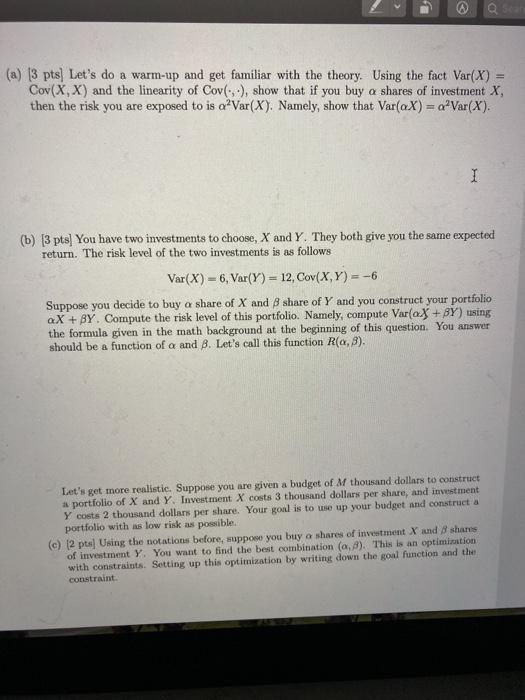

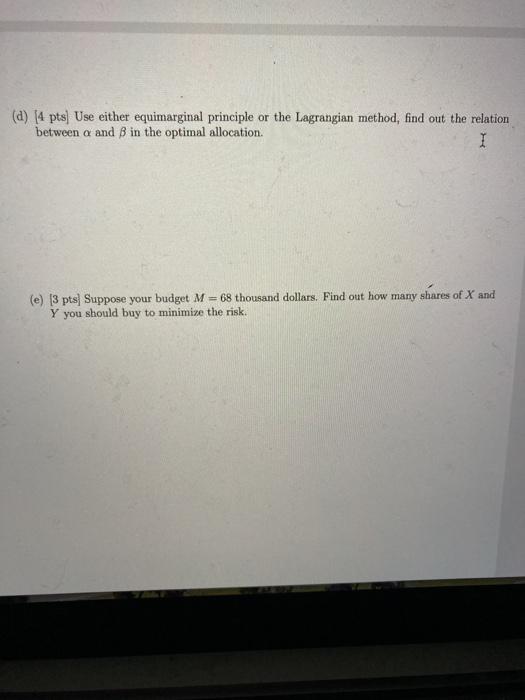

6. [15 pts) This question gives you a glance of how mathematical finance works. This is a baby version of the famous Markowitz model. If you don't like the jargon, this story simply tells you why you should put your eggs in diverse baskets. The math background of this story is the following: in class, we learn the variance A random variable X, which we denote Var(X). In fact, we can consider the covariance Cov(X,Y) of two random variables XY. The idea is very simple: if X and Y are positively correlated, then Cov(X,Y) is positive, if X and Y are negatively correlated, then Cov(X,Y) is negative; if X and Y are independent, meaning what value X take does not affect what value Y takes at all, then Cov(X,Y)=0. In a word, Cov(X,Y) measures the correlation between two variables X,Y, Here are some quick facts about covariance what may be useful in this question: Cov(x,x) - Var(X). The covariance of X with itself is just its variance Cov(X,Y) - Cov(Y, X). The covariance of X and Y is the same as the covariatice of Y and X The operator Cov() is linear in both the input. What this means is: - First, Cov(X+Y. Z) Cov( x 2)+ Cov(Y,Z) and Cov(X,Y + 2) - Cov(X,Y)+ Cov(X.2) Second, Cov(KX,Y)=kCov(X,Y) and Cov(X,Y) - Cov(XY) for any number k. From the above properties of Co-), we can compute the variance of X + y based on Var(X). Var(Y) and Cow(X,Y): Var(X+Y) CovX+Y.X+Y) --Cov(X,X+Y) + Cov(YX+Y) Cov(XX) + Cov(XY)+CovY, X) +Cov(YY) Cov(X, X) + 2Cov(X,Y) + Cov(YY) Var(X) + 2Cov(.X.Y) + Var(Y) . The significance of the above formula is suppose there are two investments available, X and Y. If you buy a share of X and share of y, then your portfolio can be expressed as X+BY You can compute the risk, namely, the variance of your portfolio susing the risk of X, the risk of Y and the coverince of X and Y Now you are employed a portfolio Manager of an investment bank at Wall Street. You are going to use the above knowledge to minimize the risk your company is exposed to (a) (3 pts) Let's do a warm-up and get familiar with the theory. Using the fact Var(X) = Cov(X,X) and the linearity of Cov(-), show that if you buy a shares of investment X, then the risk you are exposed to is a?Var(X). Namely, show that Var(aX) = a Var(X). I (b) (3 pts) You have two investments to choose, X and Y. They both give you the same expected return. The risk level of the two investments is as follows Var(X) - 6, Var(Y) = 12, Cov(X,Y)= -6 Suppose you decide to buy a share of X and share of Y and you construct your portfolio aX+BY. Compute the risk level of this portfolio. Namely, compute Var(aX+BY) using the formula given in the math background at the beginning of this question. You answer should be a function of a and 8. Let's call this function Ra, 8). Let's get more realistic. Suppose you are given a budget of thousand dollars to construct a portfolio of X and Y Investment X costs 3 thousand dollars per share, and investment Y costs 2 thousand dollars per share. Your goal is to use up your budget and construct a portfolio with a low risk as possible (c) (2 pts] Using the notations before, suppon you buy a shares of investment X and 8 shares of investment Y. You want to find the best combination (0,8). This is an optimisation with constraints. Setting up this optimization by writing down the goal function and the constraint. (a) (4 pts. Use either equimarginal principle or the Lagrangian method, find out the relation between a and B in the optimal allocation. 1 (e) (3 pts) Suppose your budget M = 68 thousand dollars. Find out how many shares of X and Y you should buy to minimize the risk. 6. [15 pts) This question gives you a glance of how mathematical finance works. This is a baby version of the famous Markowitz model. If you don't like the jargon, this story simply tells you why you should put your eggs in diverse baskets. The math background of this story is the following: in class, we learn the variance A random variable X, which we denote Var(X). In fact, we can consider the covariance Cov(X,Y) of two random variables XY. The idea is very simple: if X and Y are positively correlated, then Cov(X,Y) is positive, if X and Y are negatively correlated, then Cov(X,Y) is negative; if X and Y are independent, meaning what value X take does not affect what value Y takes at all, then Cov(X,Y)=0. In a word, Cov(X,Y) measures the correlation between two variables X,Y, Here are some quick facts about covariance what may be useful in this question: Cov(x,x) - Var(X). The covariance of X with itself is just its variance Cov(X,Y) - Cov(Y, X). The covariance of X and Y is the same as the covariatice of Y and X The operator Cov() is linear in both the input. What this means is: - First, Cov(X+Y. Z) Cov( x 2)+ Cov(Y,Z) and Cov(X,Y + 2) - Cov(X,Y)+ Cov(X.2) Second, Cov(KX,Y)=kCov(X,Y) and Cov(X,Y) - Cov(XY) for any number k. From the above properties of Co-), we can compute the variance of X + y based on Var(X). Var(Y) and Cow(X,Y): Var(X+Y) CovX+Y.X+Y) --Cov(X,X+Y) + Cov(YX+Y) Cov(XX) + Cov(XY)+CovY, X) +Cov(YY) Cov(X, X) + 2Cov(X,Y) + Cov(YY) Var(X) + 2Cov(.X.Y) + Var(Y) . The significance of the above formula is suppose there are two investments available, X and Y. If you buy a share of X and share of y, then your portfolio can be expressed as X+BY You can compute the risk, namely, the variance of your portfolio susing the risk of X, the risk of Y and the coverince of X and Y Now you are employed a portfolio Manager of an investment bank at Wall Street. You are going to use the above knowledge to minimize the risk your company is exposed to (a) (3 pts) Let's do a warm-up and get familiar with the theory. Using the fact Var(X) = Cov(X,X) and the linearity of Cov(-), show that if you buy a shares of investment X, then the risk you are exposed to is a?Var(X). Namely, show that Var(aX) = a Var(X). I (b) (3 pts) You have two investments to choose, X and Y. They both give you the same expected return. The risk level of the two investments is as follows Var(X) - 6, Var(Y) = 12, Cov(X,Y)= -6 Suppose you decide to buy a share of X and share of Y and you construct your portfolio aX+BY. Compute the risk level of this portfolio. Namely, compute Var(aX+BY) using the formula given in the math background at the beginning of this question. You answer should be a function of a and 8. Let's call this function Ra, 8). Let's get more realistic. Suppose you are given a budget of thousand dollars to construct a portfolio of X and Y Investment X costs 3 thousand dollars per share, and investment Y costs 2 thousand dollars per share. Your goal is to use up your budget and construct a portfolio with a low risk as possible (c) (2 pts] Using the notations before, suppon you buy a shares of investment X and 8 shares of investment Y. You want to find the best combination (0,8). This is an optimisation with constraints. Setting up this optimization by writing down the goal function and the constraint. (a) (4 pts. Use either equimarginal principle or the Lagrangian method, find out the relation between a and B in the optimal allocation. 1 (e) (3 pts) Suppose your budget M = 68 thousand dollars. Find out how many shares of X and Y you should buy to minimize the risk