Answered step by step

Verified Expert Solution

Question

1 Approved Answer

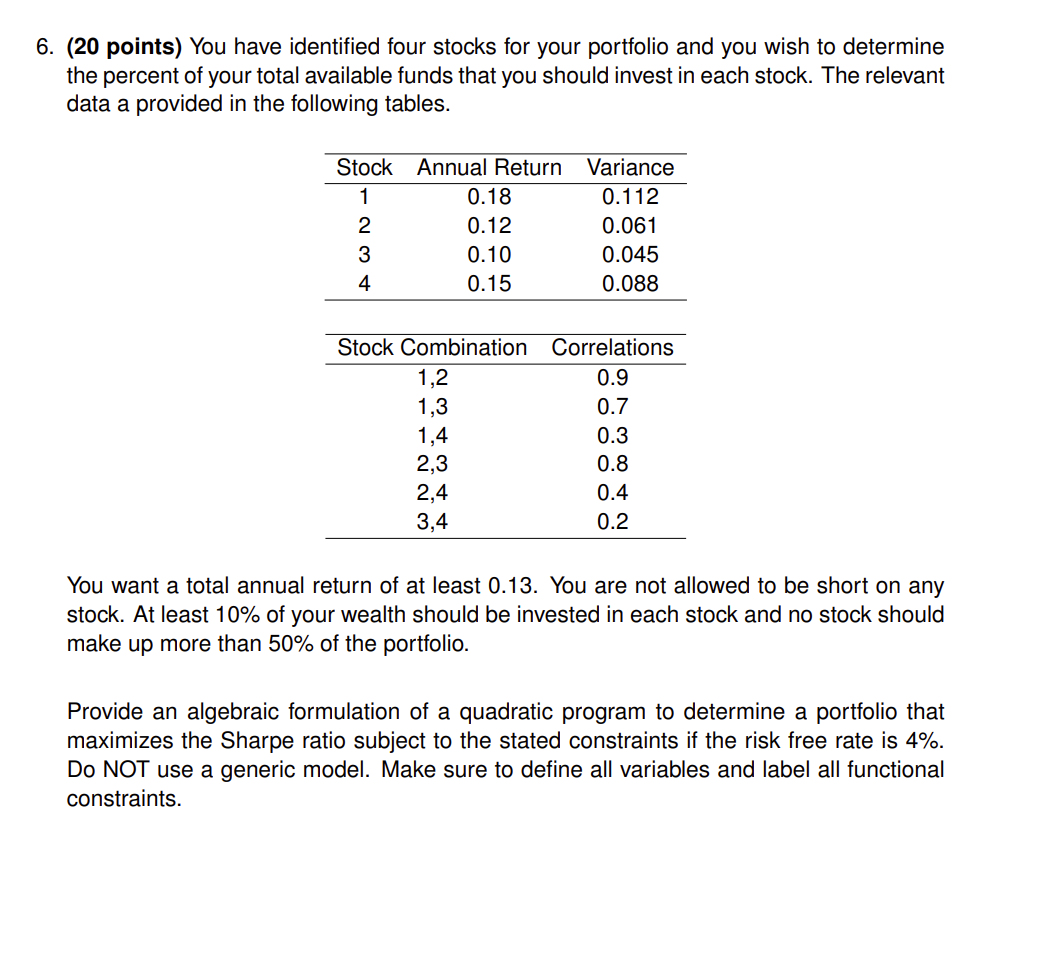

6. (20 points) You have identified four stocks for your portfolio and you wish to determine the percent of your total available funds that

6. (20 points) You have identified four stocks for your portfolio and you wish to determine the percent of your total available funds that you should invest in each stock. The relevant data a provided in the following tables. Stock Annual Return Variance 1 0.18 0.112 23 0.12 0.061 0.10 0.045 4 0.15 0.088 Stock Combination Correlations 1,2 0.9 1,3 0.7 1,4 0.3 2,3 0.8 2,4 0.4 3,4 0.2 You want a total annual return of at least 0.13. You are not allowed to be short on any stock. At least 10% of your wealth should be invested in each stock and no stock should make up more than 50% of the portfolio. Provide an algebraic formulation of a quadratic program to determine a portfolio that maximizes the Sharpe ratio subject to the stated constraints if the risk free rate is 4%. Do NOT use a generic model. Make sure to define all variables and label all functional constraints.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started