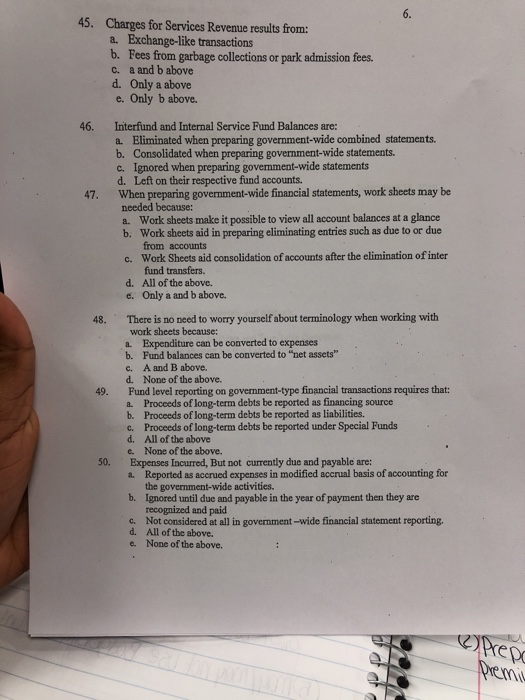

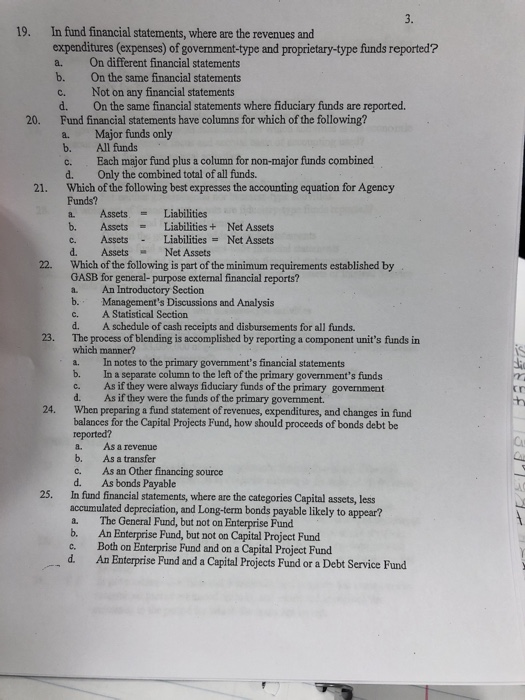

6. 45. Charges for Services Revenue results from: a. Exchange-like transactions b. Fees from garbage collections or park admission fees. c. a and b above d. Only a above e. Only b above. 46. Interfund and Internal Service Fund Balances are: a. Eliminated when preparing government-wide combined statements. b. Consolidated when preparing government-wide statements. c. Ignored when preparing government-wide statements d. Left on their respective fund accounts. 47. When preparing government-wide financial statements, work sheets may be needed because: a. Work sheets make it possible to view all account balances at a glance b. Work sheets aid in preparing eliminating entries such as due to or due from accounts c. Work Sheets aid consolidation of accounts after the elimination of inter fund transfers. All of the above. e. d. Only a and b above. There is no need to worry yourself about terminology when working with work sheets because: 48. a. Expenditure can be converted to expenses b. Fund balances can be converted to "net assets" c. A and B above. d. None of the above. Fund level reporting on government-type financial transactions requires that: a. Proceeds of long-term debts be reported as financing source b. Proceeds of long-term debts be reported as liabilities. c. Proceeds of long-term debts be reported under Special Funds d. All of the above e. None of the above. Expenses Incurred, But not currently due and payable are: a. 49. 50. Reported as accrued expenses in modified accrual basis of accounting for the government-wide activities. Ignored until due and payable in the year of payment then they are recognized and paid b. c. Not considered at all in government-wide financial statement reporting d. All of the above. e. None of the above. ni 3. In fund financial statements, where are the revenues and 19. expenditures (expenses) of government-type and proprietary-type funds reported? a. On different financial statements b. On the same financial statements c. Not on any financial statements d. On the same financial statements where fiduciary funds are reported. Fund financial statements have columns for which of the following? a. b. c. 20. Major funds only All funds Each major fund plus a column for non-major funds combined Only the combined total of all funds. d. Which of the following best expresses the accounting equation for Agency Funds? a Assets.Liabilities b. AssetsLiabilities+ Net Assets c. Assets Liabilities Net Assets d. AssetsNet Assets Which of the following is part of the minimum requirements established by GASB for general- purpose external financial reports? a. An Introductory Section b.Management's Discussions and Analysis c. A Statistical Section d. A schedule of cash receipts and disbursements for all funds. 21. 22. 23. The process of blending is accomplished by reporting a component unit's funds in which manner? a. In notes to the primary government's financial statements b. In a separate column to the left of the primary government's funds c. As if they were always fiduciary funds of the primary government d. As if they were the funds of the primary govemment. When preparing a fund statement of revenues, expenditures, and changes in fund balances for the Capital Projects Fund, how should proceeds of bonds debt be reported? a. As a revenue b. As a transfer c. As an Other financing source d. As bonds Payable In fund financial statements, where are the categories Capital assets, less accumulated depreciation, and Long-term bonds payable likely to appear? a. The General Fund, but not on Enterprise Fund b. An Enterprise Fund, but not on Capital Project Fund c. Both on Enterprise Fund and on a Capital Project Fund d. An Enterprise Fund and a Capital Projects Fund or a Debt Service Fund 24. Ca 25