Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#6 #9 The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates Based

#6

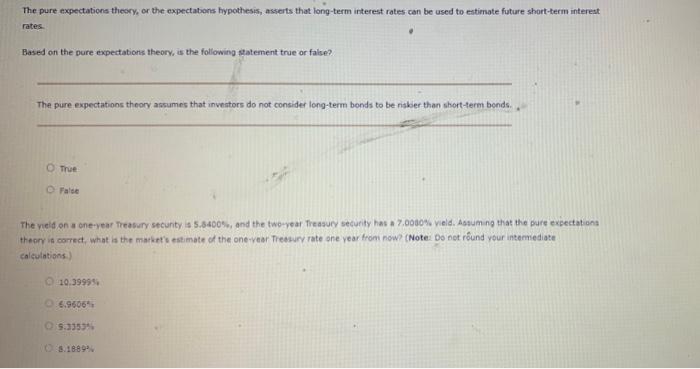

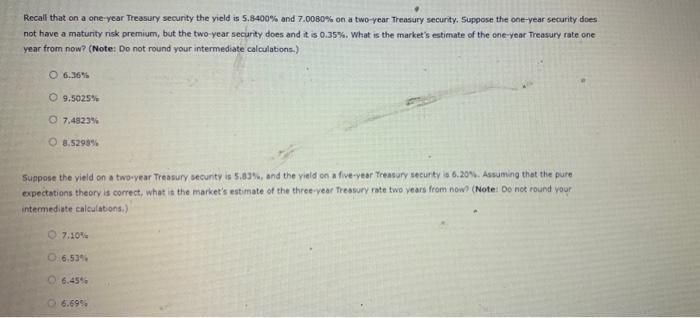

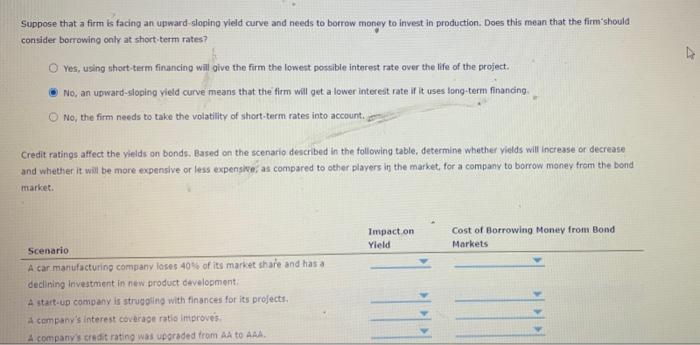

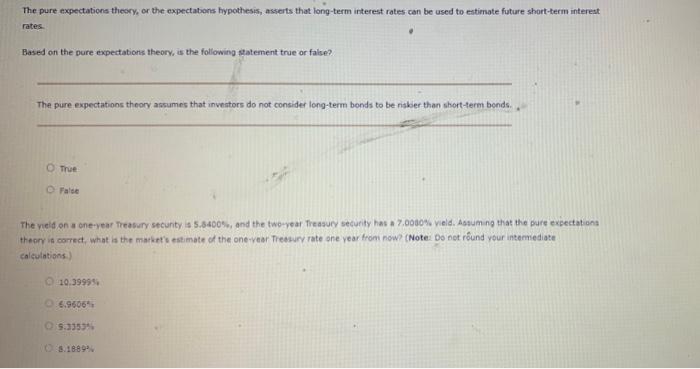

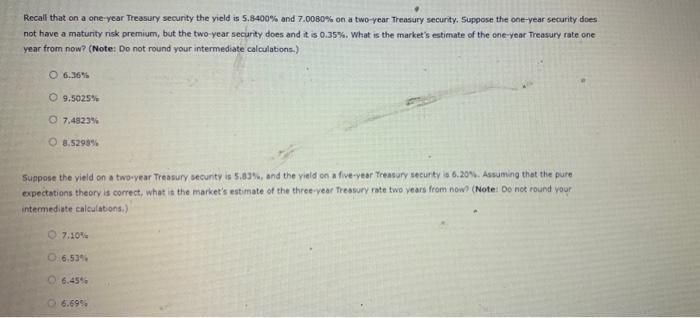

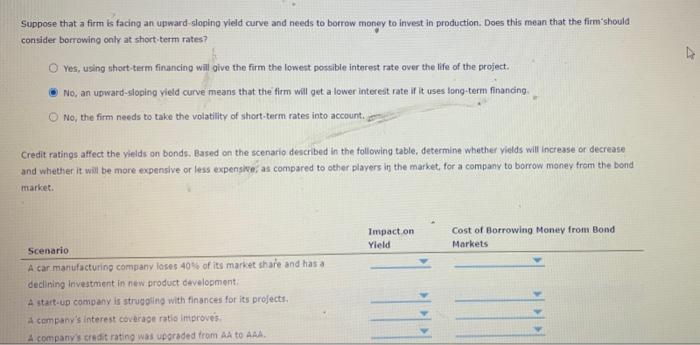

The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that investors do not consider long-term bonds to be niskier than short-term bonds True False The veld on a one-year Treasury secunity is 5.8400%, and the two-year Treasury security has a 7.0000% Vield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-ver Treasury rate one year from now? (Note: Do not rund your intermediate Calculations 10.39995 6.9606" 9.3359 8.1889 Recall that on a one-year Treasury security the yield is 5.8400% and 7.0080% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.35%. What is the market's estimate of the one year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 6.36 O 9.5025% 7.4823% O 8.52939 Suppose the yield on a two-year Treasury securty is 5.694, and the vield on a five-year Treasury securty is 6. 20%. Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Tresory rate two years from now (Note: Do not round your intermediate calculations 7.104 6.53% 06.454 6.695. Suppose that a firm is facing an upward sloping yield curve and needs to borrow mongy to invest in production. Does this mean that the firm'should consider borrowing only at short term rates? Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. No, an upward-sloping yield curve means that the firm will get a lower interest rate if it uses long-term financing O No, the firm needs to take the volatility of short-term rates into account a Credit ratings affect the yields on bonds. Based on the scenario described in the following table, determine whether yields will increase or decrease and whether it will be more expensive or less expensive, as compared to other players in the market, for a company to borrow money from the bond market. Impact on Yield Cost of Borrowing Money from Bond Markets Scenario A car manufacturing company loses 40% of its market share and has a declining Investment in new product development A start-up company is struggling with finances for its projects, A company's Interest coverage ratio Improves a company's credit rating was upgraded from AA to AAA

#9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started