Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. a. a. b. A cocoa merchant holds current inventory of cocoa grade No.2 worth $10 million at present price of $1,250 per metric

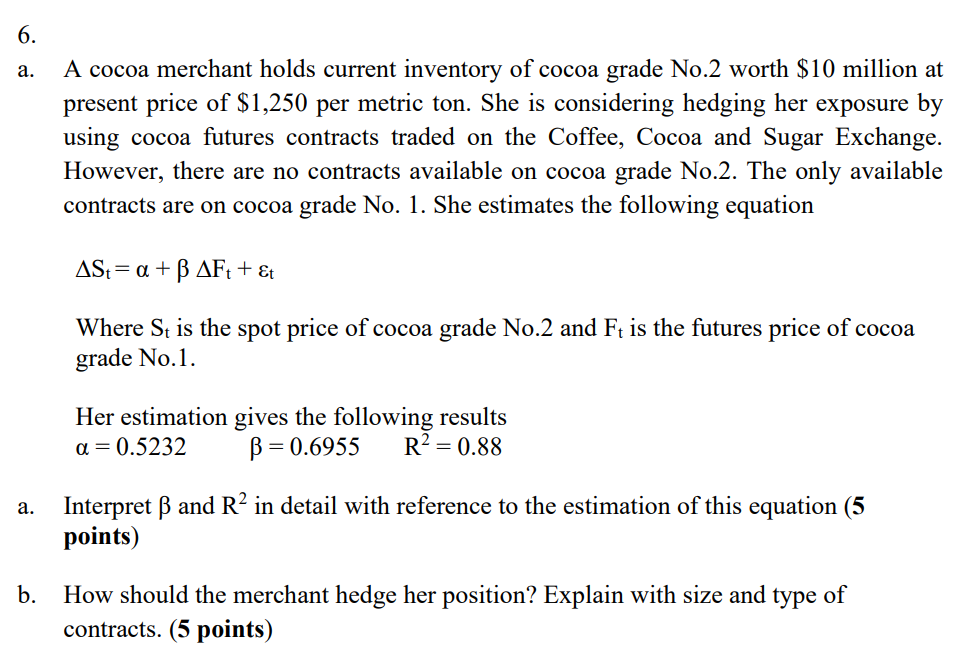

6. a. a. b. A cocoa merchant holds current inventory of cocoa grade No.2 worth $10 million at present price of $1,250 per metric ton. She is considering hedging her exposure by using cocoa futures contracts traded on the Coffee, Cocoa and Sugar Exchange. However, there are no contracts available on cocoa grade No.2. The only available contracts are on cocoa grade No. 1. She estimates the following equation ASt = a + AFt + &t Where St is the spot price of cocoa grade No.2 and Ft is the futures price of cocoa grade No.1. Her estimation gives the following results = 0.5232 B=0.6955 R = 0.88 Interpret and R in detail with reference to the estimation of this equation (5 points) How should the merchant hedge her position? Explain with size and type of contracts. (5 points)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Cocoa Merchant Hedge Analysis a Interpretation of Coefficients 06955 This coefficient represents the change in the spot price of cocoa grade No2 S for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started