Question

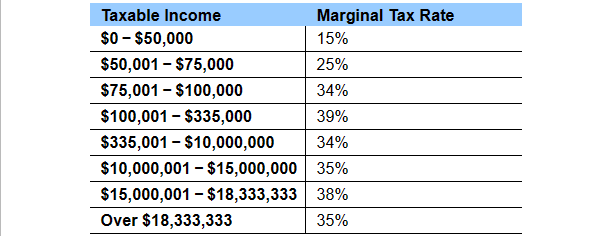

6. a. Boisjoly Productions had taxable income of $19.6 million. Calculate Boisjoly's federal income taxes using the tax table shown in the popup window: Now

6.

a. Boisjoly Productions had taxable income of $19.6 million. Calculate Boisjoly's federal income taxes using the tax table shown in the popup window:

Now calculate Boisjoly's average and marginal tax rates.

The firm's tax liability for the year is $???. (Round to the nearest dollar.)

The firm's average tax rate is ???%. (Round to two decimal places.)

The firm's marginal tax rate is ???%. (Round to the nearest integer.)

b. Kabutell, Inc. had net income of $850,000, cash flow from financing activities of $50,000, depreciation expenses of $80,000, and cash flow from operating activities of $650,000.

Calculate the quality of earnings ratio. What does this ratio tell you?

Kabutell, Inc. reported the following in its annual reports for 20112013:

| ($ million) | 2011 | 2012 | 2013 |

|---|---|---|---|

| Cash Flow from Operations | $480 | $404 | $468 |

| Capital Expenditures (CAPEX) | $458 | $448 | $456 |

Calculate the average capital acquisitions ratio over the three-year period. How would you interpret these results?

What is Kabutell's quality of earnings ratio?: ???% (Round to one decimal place.)

What does this ratio tell you?(Select the best choice below.)

A. Kabutell's cash flow from operations was 76.5 percent of the firm's reported net income. The firm depends mainly on non-operating source of cash to generate its net income.

B. Kabutell's cash flow from operations was 76.5 percent of the firm's reported net income. The firm depends mainly on operating source of cash to generate its net income.

C. Kabutell's reported net income was 76.5 percent of the firm's cash flow from operations. The firm depends mainly on non-operating source of cash to generate its net income.

D. Kabutell's reported net income was 76.5 percent of the firm's cash flow from operations. The firm depends mainly on operating source of cash to generate its net income.

What is Kabutell's average capital acquisitions ratio over the three-year period?: ???% (Round to one decimal place.)

\begin{tabular}{l|l} Taxable Income & Marginal Tax Rate \\ $0$50,000 & 15% \\ \hline$50,001$75,000 & 25% \\ \hline$75,001$100,000 & 34% \\ \hline$100,001$335,000 & 39% \\ \hline$335,001$10,000,000 & 34% \\ \hline$10,000,001$15,000,000 & 35% \\ \hline$15,000,001$18,333,333 & 38% \\ \hline Over $18,333,333 & 35% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started