Answered step by step

Verified Expert Solution

Question

1 Approved Answer

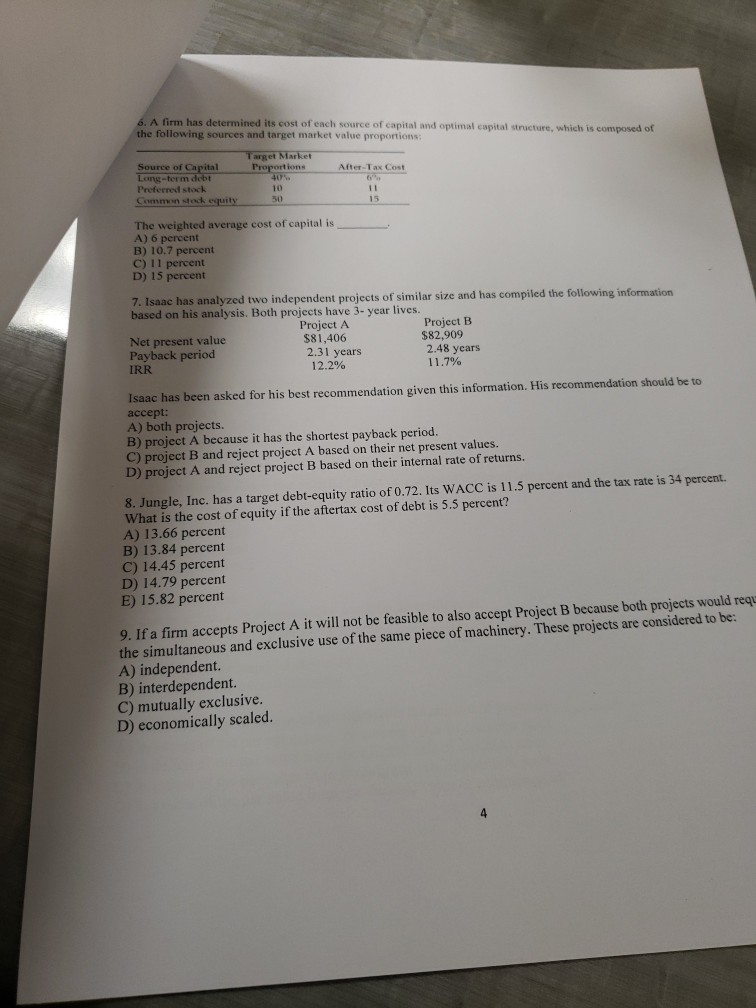

6. A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target

6. A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions: Target Market Source of Capital Proportions After Tax Cost Long-term debt Preferred stock 10 Common och equity The weighted average cost of capital is A) 6 percent B) 10.7 percent C) 11 percent D) 15 percent 7. Isaac has analyzed two independent projects of similar size and has compiled the following information based on his analysis. Both projects have 3-year lives. Project A Project B $81,406 Net present value $82,909 Payback period 2.31 years 2.48 years 11.7% 12.2% IRR Isaac has been asked for his best recommendation given this information. His recommendation should be to accept: A) both projects. B) project A because it has the shortest payback period. C) project B and reject project A based on their net present values. D) project A and reject project B based on their internal rate of returns. 8. Jungle, Inc. has a target debt-equity ratio of 0.72. Its WACC is 11.5 percent and the tax rate is 34 percent. What is the cost of equity if the aftertax cost of debt is 5.5 percent? A) 13.66 percent B) 13.84 percent C) 14.45 percent D) 14.79 percent E) 15.82 percent 9. If a firm accepts Project A it will not be feasible to also accept Project B because both projects would requ the simultaneous and exclusive use of the same piece of machinery. These projects are considered to be: A) independent. B) interdependent. C) mutually exclusive. D) economically scaled

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started