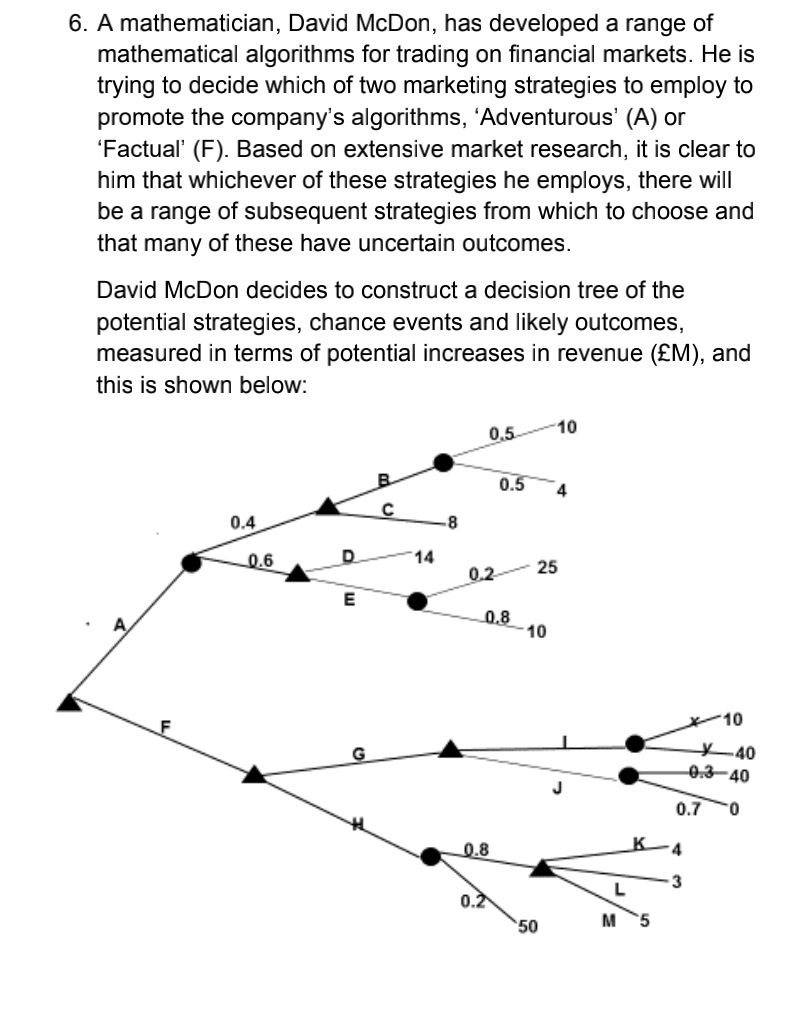

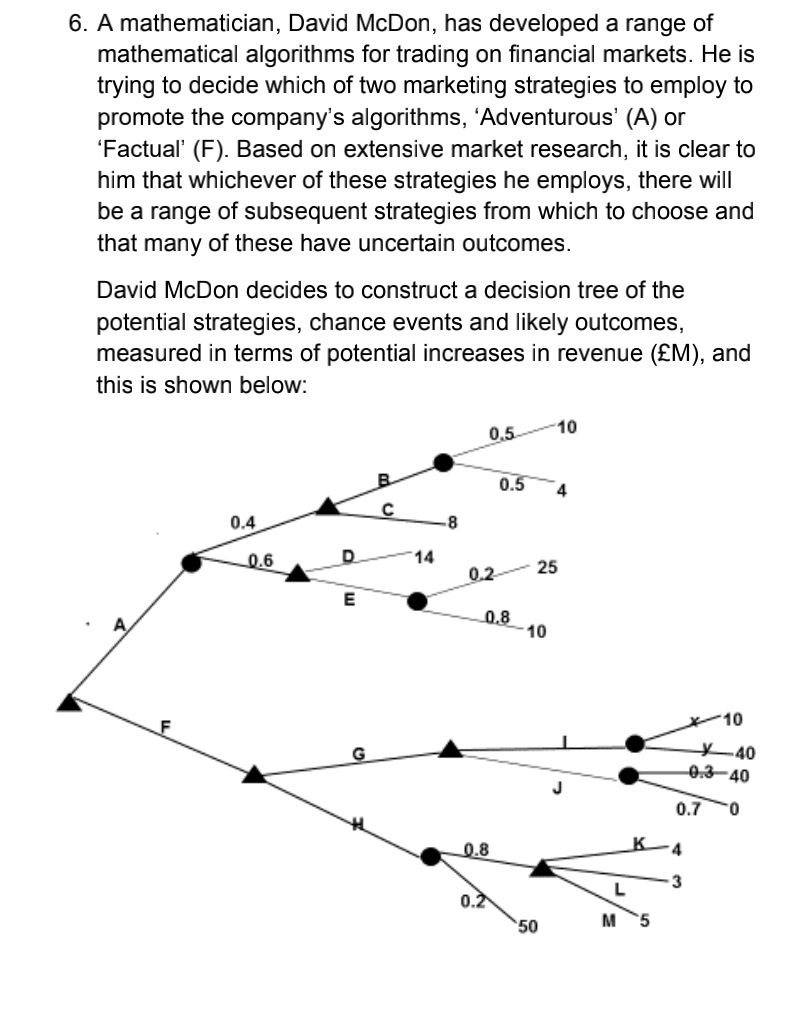

6. A mathematician, David McDon, has developed a range of mathematical algorithms for trading on financial markets. He is trying to decide which of two marketing strategies to employ to promote the company's algorithms, 'Adventurous' (A) or 'Factual' (F). Based on extensive market research, it is clear to him that whichever of these strategies he employs, there will be a range of subsequent strategies from which to choose and that many of these have uncertain outcomes. David McDon decides to construct a decision tree of the potential strategies, chance events and likely outcomes, measured in terms of potential increases in revenue (M), and this is shown below: 10 0,5 4 C 0.4 10 0.6 D E 14 8 0.2 0.5 0.8 0.8 0.2 25 10 50 M 40 -0.3-40 0.7 0 (a) Calculate the expected increase in revenue if David McDon decides to adopt an Adventurous (A) marketing strategy. (20 marks) David McDon has not been able to estimate all the probabilities associated with his decision (i.e., those labelled x and y in the decision tree diagram). (b) Determine the minimum value that probability y must be in order for David McDon to adopt strategy Factual (F) followed by strategy G, and outline any assumptions you make in determining this value. (150 words maximum) (20 marks) (c) Explain to David McDon the benefits of using a decision tree to help inform his choice. (250 words maximum) (20 marks) (d) Describe a risk/return diagram and explain its value when making decisions such as that facing David McDon [No calculation required]. (300 words maximum) (25 marks) (e) Explain to David McDon the value of using utility values rather than monetary amounts for the outcomes which might be achieved from the various strategies associated with his decision [No calculation required]. (200 words maximum) (15 marks) 6. A mathematician, David McDon, has developed a range of mathematical algorithms for trading on financial markets. He is trying to decide which of two marketing strategies to employ to promote the company's algorithms, 'Adventurous' (A) or 'Factual' (F). Based on extensive market research, it is clear to him that whichever of these strategies he employs, there will be a range of subsequent strategies from which to choose and that many of these have uncertain outcomes. David McDon decides to construct a decision tree of the potential strategies, chance events and likely outcomes, measured in terms of potential increases in revenue (M), and this is shown below: 10 0,5 4 C 0.4 10 0.6 D E 14 8 0.2 0.5 0.8 0.8 0.2 25 10 50 M 40 -0.3-40 0.7 0 (a) Calculate the expected increase in revenue if David McDon decides to adopt an Adventurous (A) marketing strategy. (20 marks) David McDon has not been able to estimate all the probabilities associated with his decision (i.e., those labelled x and y in the decision tree diagram). (b) Determine the minimum value that probability y must be in order for David McDon to adopt strategy Factual (F) followed by strategy G, and outline any assumptions you make in determining this value. (150 words maximum) (20 marks) (c) Explain to David McDon the benefits of using a decision tree to help inform his choice. (250 words maximum) (20 marks) (d) Describe a risk/return diagram and explain its value when making decisions such as that facing David McDon [No calculation required]. (300 words maximum) (25 marks) (e) Explain to David McDon the value of using utility values rather than monetary amounts for the outcomes which might be achieved from the various strategies associated with his decision [No calculation required]. (200 words maximum) (15 marks)