6. A welding machine (Model A) which is bought two (2) years ago by Endah Berhad Company had unexpectedly higher maintenance cost. There are

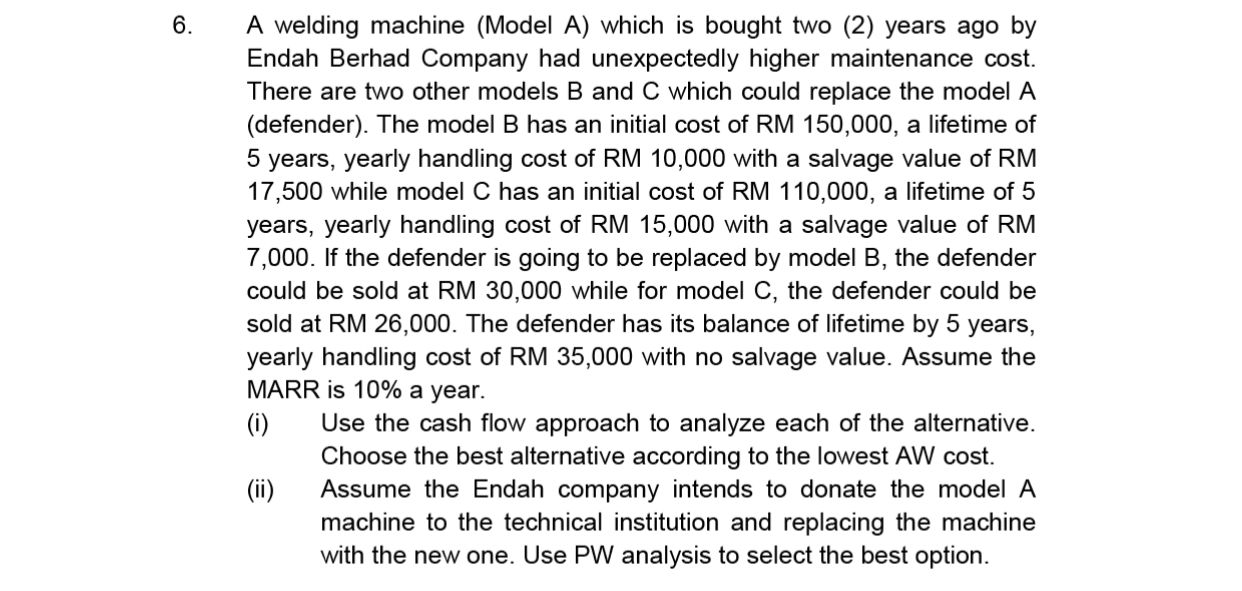

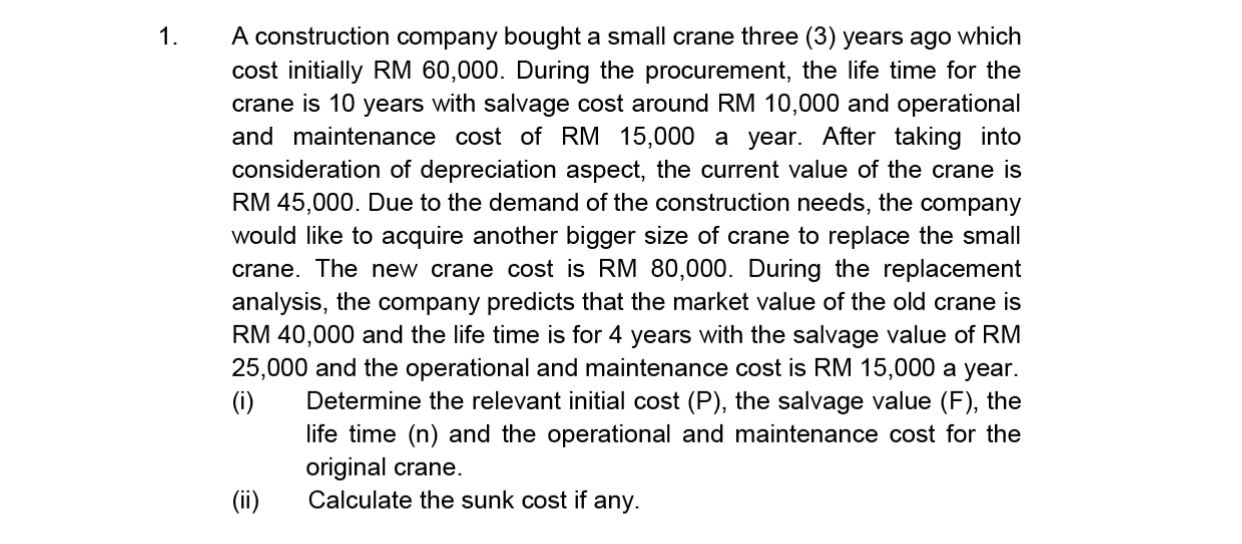

6. A welding machine (Model A) which is bought two (2) years ago by Endah Berhad Company had unexpectedly higher maintenance cost. There are two other models B and C which could replace the model A (defender). The model B has an initial cost of RM 150,000, a lifetime of 5 years, yearly handling cost of RM 10,000 with a salvage value of RM 17,500 while model C has an initial cost of RM 110,000, a lifetime of 5 years, yearly handling cost of RM 15,000 with a salvage value of RM 7,000. If the defender is going to be replaced by model B, the defender could be sold at RM 30,000 while for model C, the defender could be sold at RM 26,000. The defender has its balance of lifetime by 5 years, yearly handling cost of RM 35,000 with no salvage value. Assume the MARR is 10% a year. (i) (ii) Use the cash flow approach to analyze each of the alternative. Choose the best alternative according to the lowest AW cost. Assume the Endah company intends to donate the model A machine to the technical institution and replacing the machine with the new one. Use PW analysis to select the best option. 1. A construction company bought a small crane three (3) years ago which cost initially RM 60,000. During the procurement, the life time for the crane is 10 years with salvage cost around RM 10,000 and operational and maintenance cost of RM 15,000 a year. After taking into consideration of depreciation aspect, the current value of the crane is RM 45,000. Due to the demand of the construction needs, the company would like to acquire another bigger size of crane to replace the small crane. The new crane cost is RM 80,000. During the replacement analysis, the company predicts that the market value of the old crane is RM 40,000 and the life time is for 4 years with the salvage value of RM 25,000 and the operational and maintenance cost is RM 15,000 a year. Determine the relevant initial cost (P), the salvage value (F), the life time (n) and the operational and maintenance cost for the original crane. (i) Calculate the sunk cost if any. (ii)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started