Question

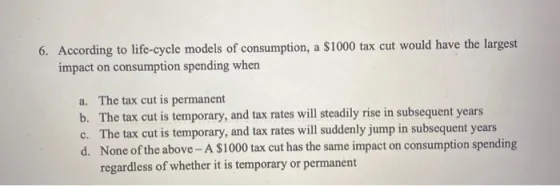

6. According to life-cycle models of consumption, a $1000 tax cut would have the largest impact on consumption spending when a. The tax cut

6. According to life-cycle models of consumption, a $1000 tax cut would have the largest impact on consumption spending when a. The tax cut is permanent b. The tax cut is temporary, and tax rates will steadily rise in subsequent years c. The tax cut is temporary, and tax rates will suddenly jump in subsequent years d. None of the above-A $1000 tax cut has the same impact on consumption spending regardless of whether it is temporary or permanent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is a The tax cut is permanent Explanation Lifecycle models of consumpt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: Paul A. Samuelson, William Nordhaus

19th edition

978-0073511290, 73511293, 978-0073344232, 73344230, 978-007351129

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App