Answered step by step

Verified Expert Solution

Question

1 Approved Answer

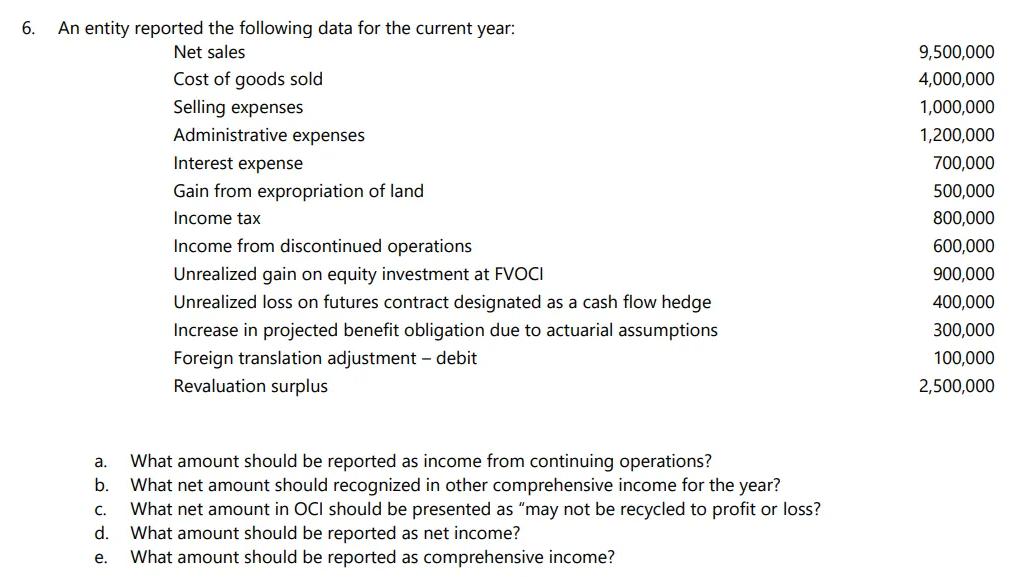

6. An entity reported the following data for the current year: Net sales b. C. d. e. Cost of goods sold Selling expenses Administrative

6. An entity reported the following data for the current year: Net sales b. C. d. e. Cost of goods sold Selling expenses Administrative expenses Interest expense Gain from expropriation of land Income tax Income from discontinued operations Unrealized gain on equity investment at FVOCI Unrealized loss on futures contract designated as a cash flow hedge Increase in projected benefit obligation due to actuarial assumptions Foreign translation adjustment - debit Revaluation surplus What amount should be report as income from continuing operations? What net amount should recognized in other comprehensive income for the year? What net amount in OCI should be presented as "may not be recycled to profit or loss? What amount should be reported as net income? What amount should be reported as comprehensive income? 9,500,000 4,000,000 1,000,000 1,200,000 700,000 500,000 800,000 600,000 900,000 400,000 300,000 100,000 2,500,000

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Income from continuing operations can be calculated as Net sales Cost of goods sold Selling expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started