Answered step by step

Verified Expert Solution

Question

1 Approved Answer

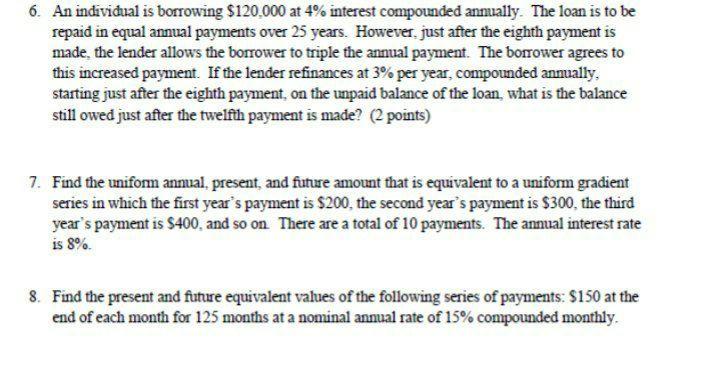

6. An individual is borrowing $120,000 at 4% interest compounded annually. The loan is to be repaid in equal annual payments over 25 years.

6. An individual is borrowing $120,000 at 4% interest compounded annually. The loan is to be repaid in equal annual payments over 25 years. However, just after the eighth payment is made, the lender allows the borrower to triple the annual payment. The borrower agrees to this increased payment. If the lender refinances at 3% per year, compounded annually. starting just after the eighth payment, on the unpaid balance of the loan, what is the balance still owed just after the twelfth payment is made? (2 points) 7. Find the uniform annual, present, and future amount that is equivalent to a uniform gradient series in which the first year's payment is $200, the second year's payment is $300, the third year's payment is $400, and so on. There are a total of 10 payments. The annual interest rate is 8%. 8. Find the present and future equivalent values of the following series of payments: $150 at the end of each month for 125 months at a nominal annual rate of 15% compounded monthly.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Ans 6 Balance amount at start of loan agreement Annual Payments over 25 years Remaining amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started