Answered step by step

Verified Expert Solution

Question

1 Approved Answer

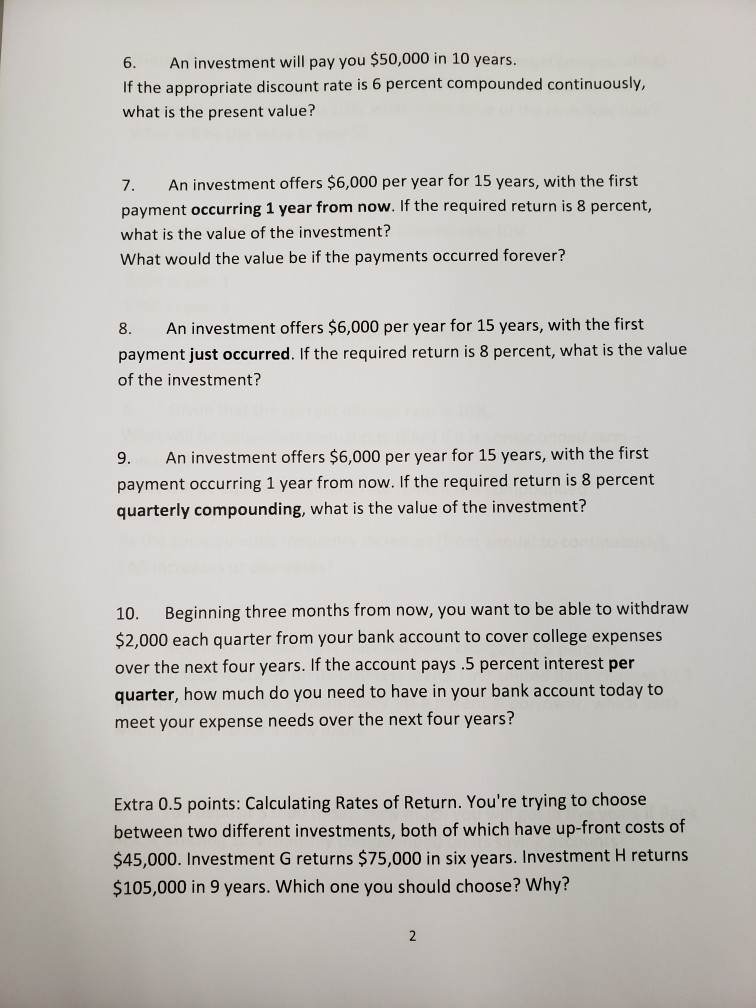

6. An investment will pay you $50,000 in 10 years. If the appropriate discount rate is 6 percent compounded continuously, what is the present value?

6. An investment will pay you $50,000 in 10 years. If the appropriate discount rate is 6 percent compounded continuously, what is the present value? 7. An investment offers $6,000 per year for 15 years, with the first payment occurring 1 year from now. If the required return is 8 percent, what is the value of the investment? What would the value be if the payments occurred forever? 8. An investment offers $6,000 per year for 15 years, with the first payment just occurred. If the required return is 8 percent, what is the value of the investment? 9. An investment offers $6,000 per year for 15 years, with the first payment occurring 1 year from now. If the required return is 8 percent quarterly compounding, what is the value of the investment? 10. Beginning three months from now, you want to be able to withdraw $2,000 each quarter from your bank account to cover college expenses over the next four years. If the account pays.5 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years? Extra 0.5 points: Calculating Rates of Return. You're trying to choose between two different investments, both of which have up-front costs of $45,000. Investment G returns $75,000 in six years. Investment H returns $105,000 in 9 years. Which one you should choose? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started