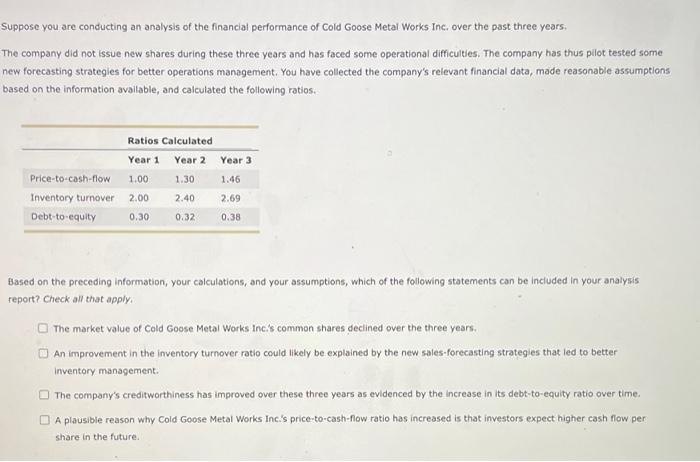

6. Analyzing ratios One of the most important applications of ratio analysis is to compare a company's performance with that of other players in the industry or to compare its own performance over a period of time. Such analyses are referred to as a comparative analysis and trend analysis, respectively. A common size analysis requires the representation of financial statement data in terms of a single financial statement item (or base account or value). What is the most commonly used base item for a common size income statement? Total liabilities Stockholders' equity Total assets Net sales Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 Year 3 Price-to-cash-flow 1.00 1.30 1.46 Inventory turnover 2.00 2.40 2.69 Debt-to-equity 0.30 0.32 0.38 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. The market value of Cold Goose Metal Works Inc.'s common shares declined over the three years. An improvement in the inventory turnover ratio could likely be explained by the new sales-forecasting strategies that led to better inventory management. The company's creditworthiness has improved over these three years as evidenced by the increase in its debt-to-equity ratio over time. A plausible reason why Cold Goose Metal Works Inc.'s price-to-cash-flow ratio has increased is that investors expect higher cash flow per share in the future