Answered step by step

Verified Expert Solution

Question

1 Approved Answer

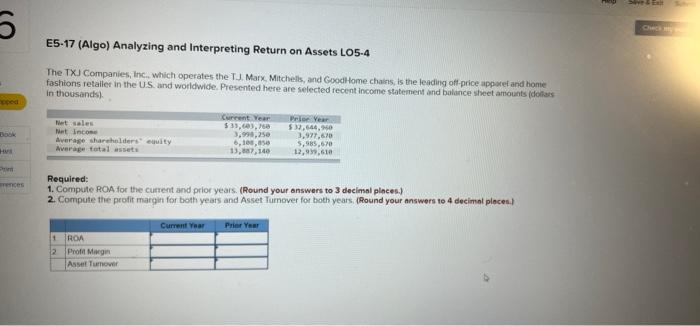

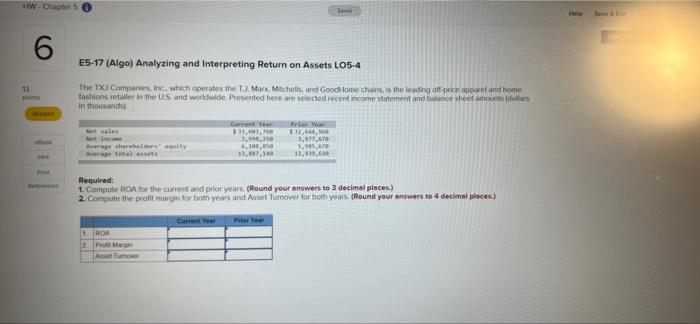

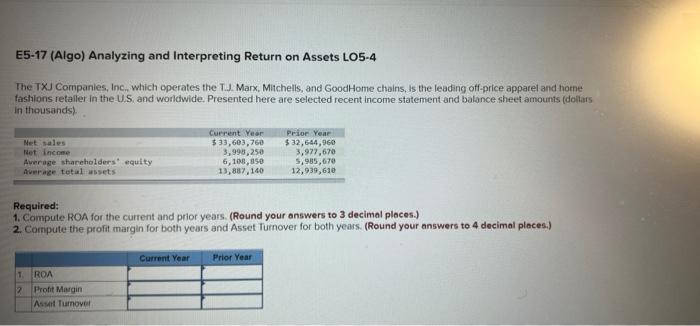

6 apped E5-17 (Algo) Analyzing and Interpreting Return on Assets LO5-4 The TXJ Companies, Inc., which operates the TJ. Marx, Mitchells, and GoodHome chains,

6 apped E5-17 (Algo) Analyzing and Interpreting Return on Assets LO5-4 The TXJ Companies, Inc., which operates the TJ. Marx, Mitchells, and GoodHome chains, is the leading off-price apparel and home fashions retailer in the US. and worldwide. Presented here are selected recent income statement and balance sheet amounts (dollars in thousands). Net sales Book Net Income H Average shareholders equity Average total assets Current Year $33,603,760 3,998,250 6,108,858 13,887,140 Prior Year $32,644,960 3,977,670 5,985,670 12,939,610 P ences Required: 1. Compute ROA for the current and prior years. (Round your answers to 3 decimal places.) 2. Compute the profit margin for both years and Asset Turnover for both years. (Round your answers to 4 decimal places.) 1 ROA 2 Profit Margin Asset Turnover Current Year Prior Year Save & Ext Chuck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started