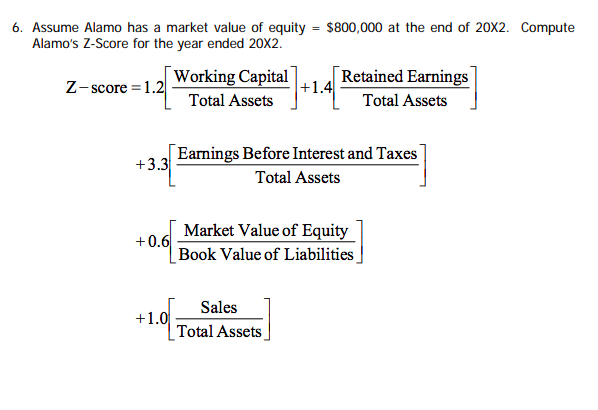

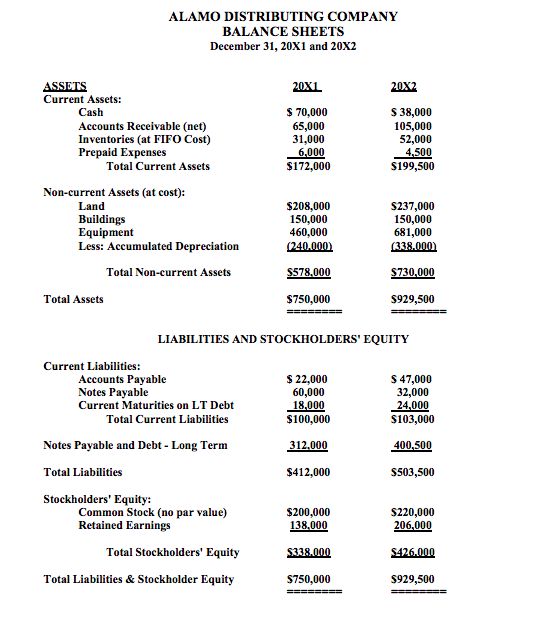

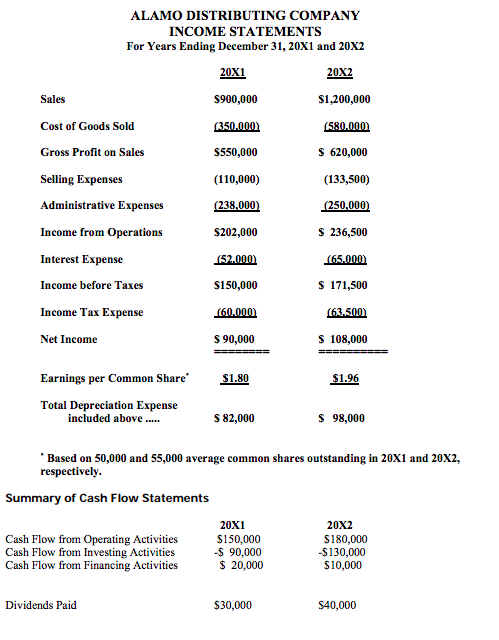

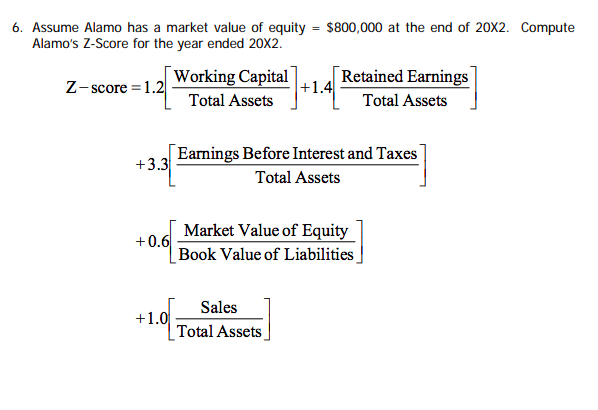

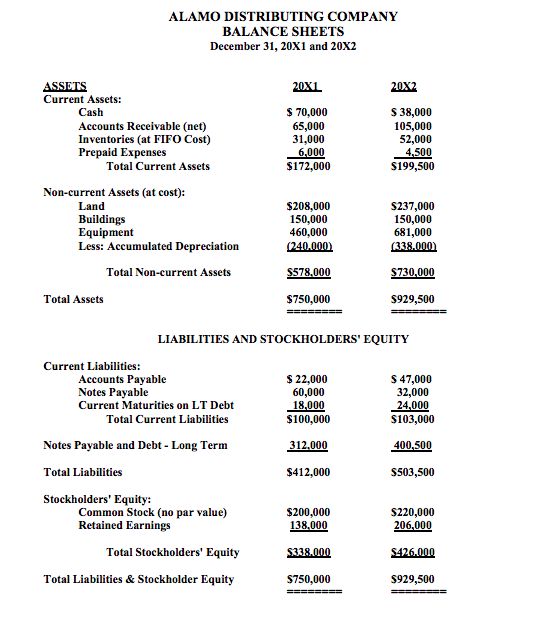

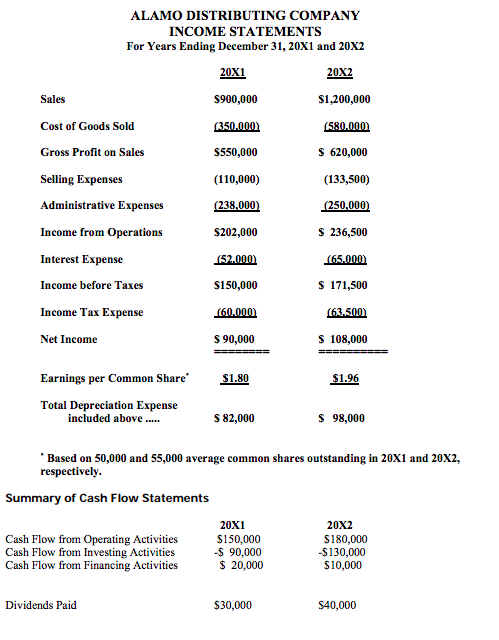

6. Assume Alamo has a market value of equity = $800,000 at the end of 20x2. Compute Alamo's Z-Score for the year ended 20x2. Z-score=1.2 Working Capital Retained Earnings +1.4) Total Assets Total Assets Earnings Before Interest and Taxes +3.3 Total Assets +0.6 Market Value of Equity Book Value of Liabilities Sales +1.0 Total Assets ALAMO DISTRIBUTING COMPANY BALANCE SHEETS December 31, 20X1 and 20X2 20X2 20X1 $ 70,000 65,000 31,000 6,000 $172,000 $ 38,000 105,000 52,000 4.500 $199,500 ASSETS Current Assets: Cash Accounts Receivable (net) Inventories (at FIFO Cost) Prepaid Expenses Total Current Assets Non-current Assets (at cost): Land Buildings Equipment Less: Accumulated Depreciation Total Non-current Assets Total Assets $208,000 150,000 460,000 (240.000) S237,000 150,000 681,000 (338.000 $578.000 $ 730,000 $929,500 $750,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts Payable $ 22,000 $ 47,000 Notes Payable 60,000 32,000 Current Maturities on LT Debt 18,000 24,000 Total Current Liabilities $100,000 $103,000 Notes Payable and Debt - Long Term 312.000 400.500 Total Liabilities $412,000 $503,500 Stockholders' Equity: Common Stock (no par value) $200,000 S220,000 Retained Earnings 138.000 206,000 Total Stockholders' Equity 5338.000 S426.000 Total Liabilities & Stockholder Equity $750,000 $929,500 ALAMO DISTRIBUTING COMPANY INCOME STATEMENTS For Years Ending December 31, 20X1 and 20X2 20X1 20X2 Sales $900,000 $1,200,000 Cost of Goods Sold (350.000) (580.000) Gross Profit on Sales $550,000 $ 620,000 Selling Expenses (110,000) (133,500) Administrative Expenses (238,000) (250,000) Income from Operations $202,000 $ 236,500 (52.000) (65.000) Interest Expense Income before Taxes Income Tax Expense Net Income $150,000 (60.000) $ 171,500 (63.500) $ 90,000 $ 108,000 $1.80 $1.96 Earnings per Common Share Total Depreciation Expense included above.... $ 82,000 $ 98,000 Based on 50,000 and 55,000 average common shares outstanding in 20X1 and 20x2, respectively. Summary of Cash Flow Statements 20x1 20X2 Cash Flow from Operating Activities $150,000 $180,000 Cash Flow from Investing Activities $ 90,000 -$130,000 Cash Flow from Financing Activities $ 20,000 $10,000 Dividends Paid $30,000 $40,000