Question

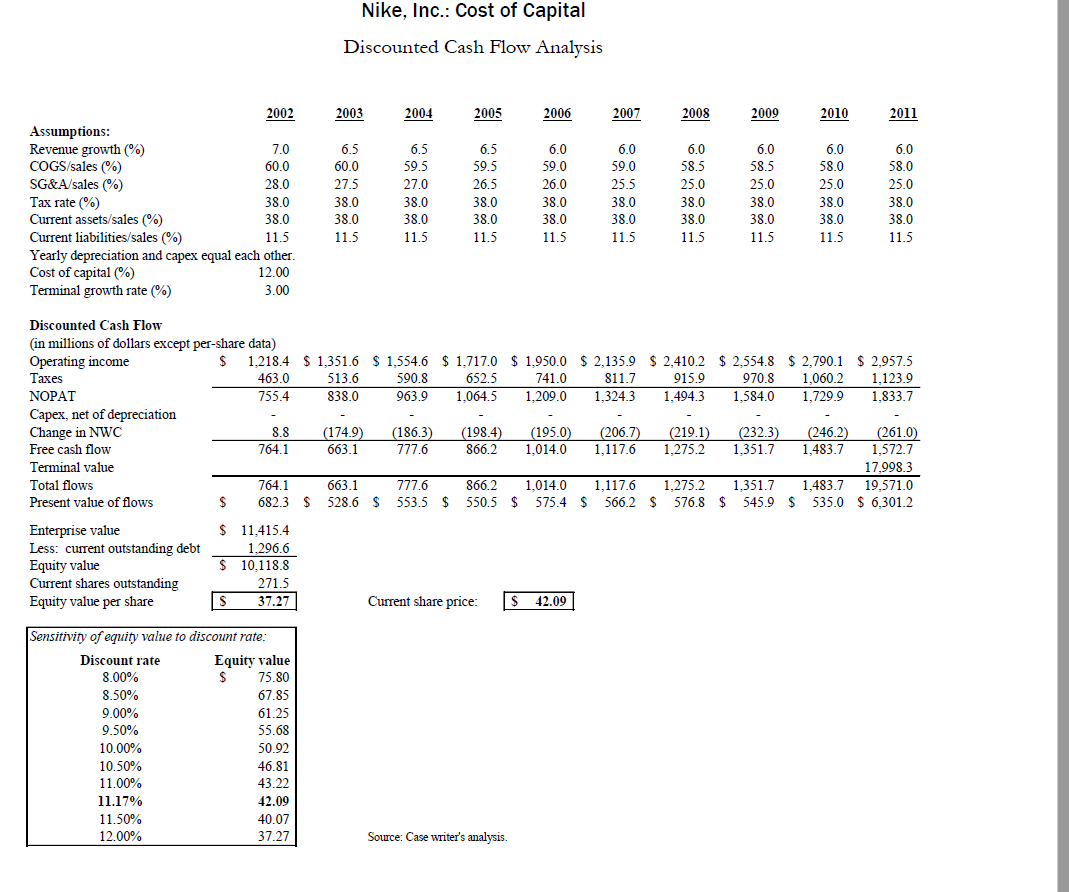

6. Based on the WACC that you arrive at, should Kimi Ford buy Nike, and why or why not. My group uses a 38 %

6. Based on the WACC that you arrive at, should Kimi Ford buy Nike, and why or why not.

My group uses a 38 % discounted Rate and came up with 9.27 % WACC. I)Replicate the table shown in Exhibit 2 with the discounted cash flow up till and including the total cash flow lines. Notice that the terminal value is already calculated, and you do not have to calculate it.

II) Next, use the discount rate your group calculated in the Nike CoC case to find the NPVs of the cash flows.

III) What is the Enterprise Value for Nike?

IV) What is the share price for Nike? How does it compare with the current market price?

Nike, Inc.: Cost of Capital Nike, Inc.: Cost of CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started