Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Berjaya Berhad hold a portfolio of 40 percent of stock A and 60 percent of stock B. The expected return over the next four

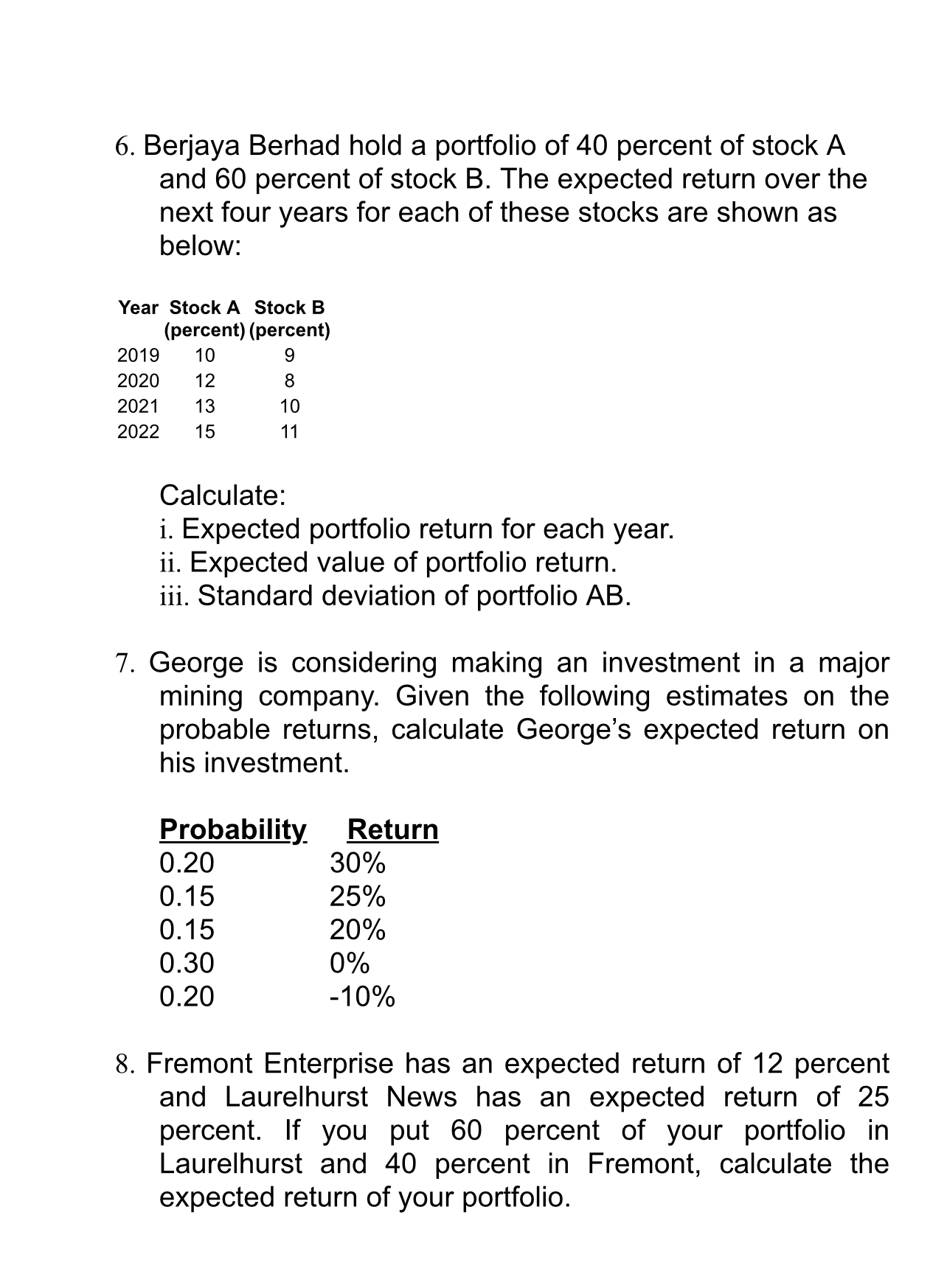

6. Berjaya Berhad hold a portfolio of 40 percent of stock A and 60 percent of stock B. The expected return over the next four years for each of these stocks are shown as below: Calculate: i. Expected portfolio return for each year. ii. Expected value of portfolio return. iii. Standard deviation of portfolio AB. 7. George is considering making an investment in a major mining company. Given the following estimates on the probable returns, calculate George's expected return on his investment. 8. Fremont Enterprise has an expected return of 12 percent and Laurelhurst News has an expected return of 25 percent. If you put 60 percent of your portfolio in Laurelhurst and 40 percent in Fremont, calculate the expected return of your portfolio

6. Berjaya Berhad hold a portfolio of 40 percent of stock A and 60 percent of stock B. The expected return over the next four years for each of these stocks are shown as below: Calculate: i. Expected portfolio return for each year. ii. Expected value of portfolio return. iii. Standard deviation of portfolio AB. 7. George is considering making an investment in a major mining company. Given the following estimates on the probable returns, calculate George's expected return on his investment. 8. Fremont Enterprise has an expected return of 12 percent and Laurelhurst News has an expected return of 25 percent. If you put 60 percent of your portfolio in Laurelhurst and 40 percent in Fremont, calculate the expected return of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started