Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Carlos O'Malley's, a popular Mexican restaurant, is outgrowing its current setting and needs to expand. Two mutually exclusive expansion projects are being considered:

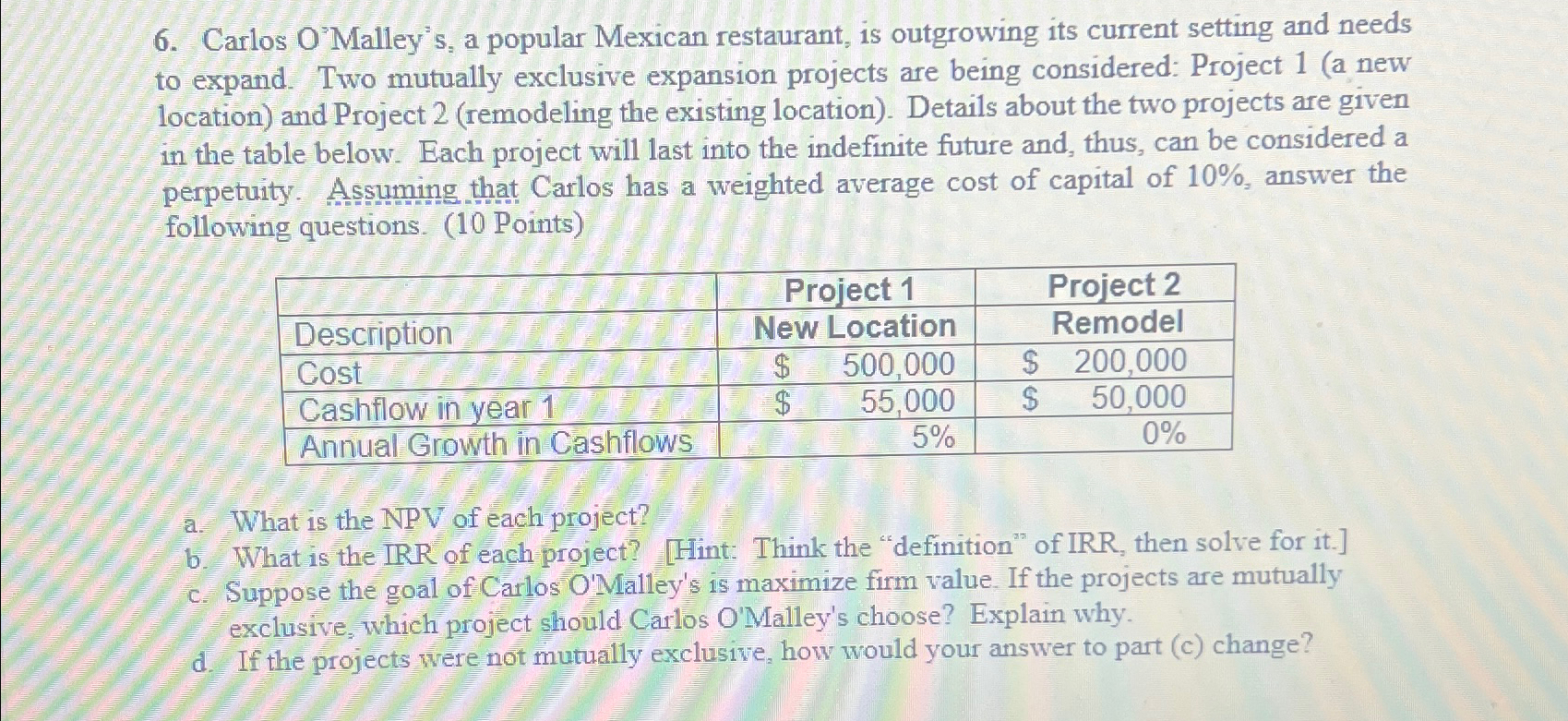

6. Carlos O'Malley's, a popular Mexican restaurant, is outgrowing its current setting and needs to expand. Two mutually exclusive expansion projects are being considered: Project 1 (a new location) and Project 2 (remodeling the existing location). Details about the two projects are given in the table below. Each project will last into the indefinite future and, thus, can be considered a perpetuity. Assuming that Carlos has a weighted average cost of capital of 10%, answer the following questions. (10 Points) Project 2 Project 1 Description New Location Remodel Cost $ 500,000 $ 200,000 Cashflow in year 1 $ 55,000 $ 50,000 Annual Growth in Cashflows 5% 0% a. What is the NPV of each project? b What is the IRR of each project? [Hint: Think the "definition" of IRR, then solve for it.] c. Suppose the goal of Carlos O'Malley's is maximize firm value. If the projects are mutually exclusive, which project should Carlos O'Malley's choose? Explain why. d. If the projects were not mutually exclusive, how would your answer to part (c) change?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started