Question

6. Construct a graph of the Security Market Line given by the parameters in #5. Point out the SML returns you calculated in #5

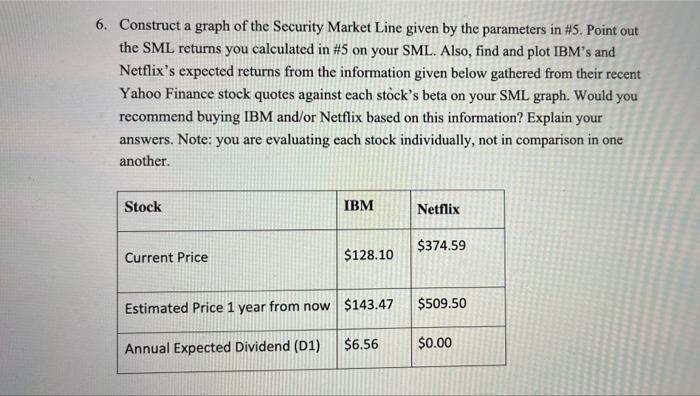

6. Construct a graph of the Security Market Line given by the parameters in #5. Point out the SML returns you calculated in #5 on your SML. Also, find and plot IBM's and Netflix's expected returns from the information given below gathered from their recent Yahoo Finance stock quotes against each stock's beta on your SML graph. Would you recommend buying IBM and/or Netflix based on this information? Explain your answers. Note: you are evaluating each stock individually, not in comparison in one another. Stock IBM Netflix $374.59 Current Price $128.10 Estimated Price 1 year from now $143.47 $509.50 Annual Expected Dividend (D1) $6.56 $0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham

Concise 9th Edition

1305635937, 1305635930, 978-1305635937

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App