6. David Smith, a purchasing manager for the regional homebuilder, Hasty Homes, projects that the company will need to purchase 300,000 board feet of

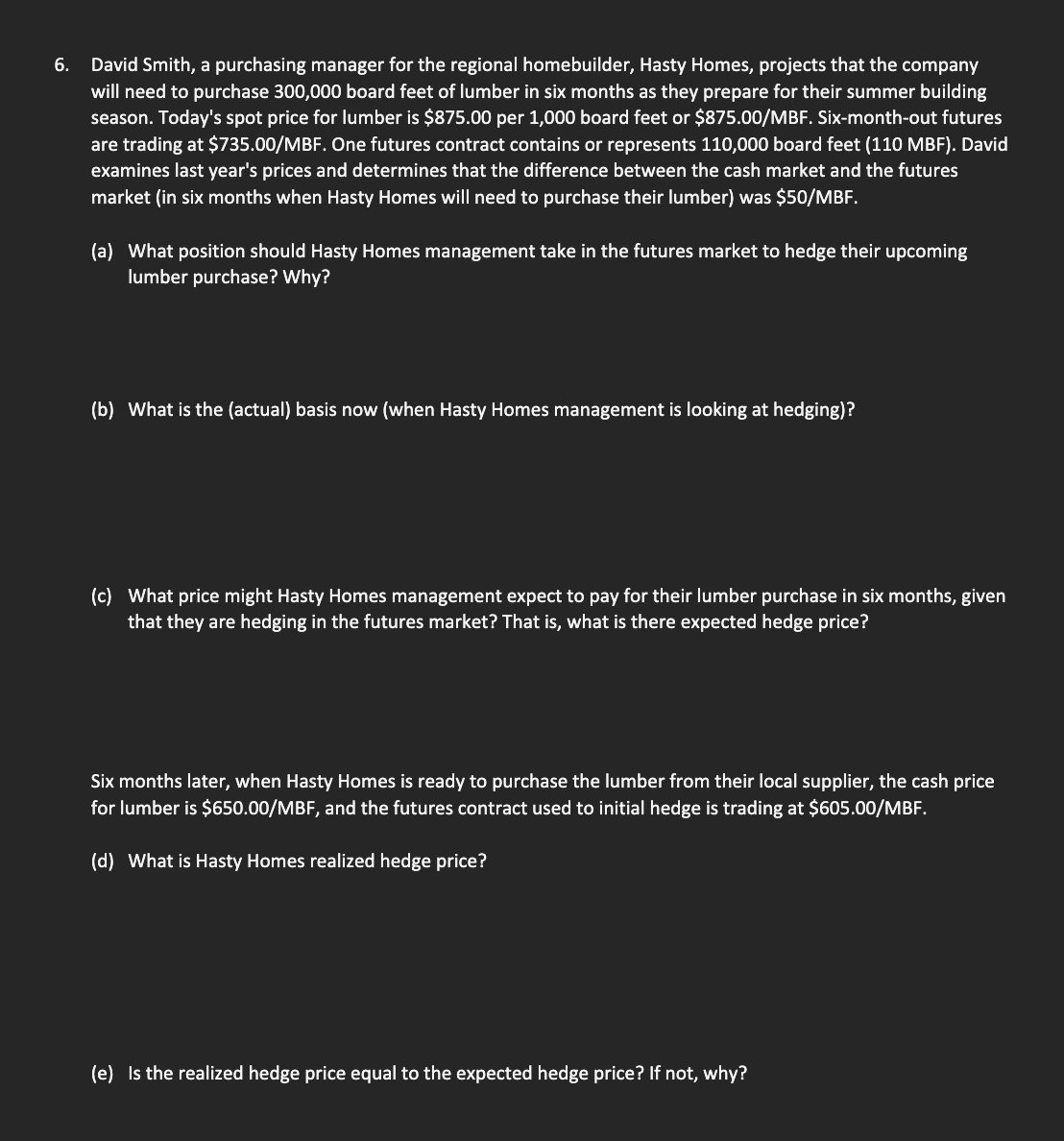

6. David Smith, a purchasing manager for the regional homebuilder, Hasty Homes, projects that the company will need to purchase 300,000 board feet of lumber in six months as they prepare for their summer building season. Today's spot price for lumber is $875.00 per 1,000 board feet or $875.00/MBF. Six-month-out futures are trading at $735.00/MBF. One futures contract contains or represents 110,000 board feet (110 MBF). David examines last year's prices and determines that the difference between the cash market and the futures market (in six months when Hasty Homes will need to purchase their lumber) was $50/MBF. (a) What position should Hasty Homes management take in the futures market to hedge their upcoming lumber purchase? Why? (b) What is the (actual) basis now (when Hasty Homes management is looking at hedging)? (c) What price might Hasty Homes management expect to pay for their lumber purchase in six months, given that they are hedging in the futures market? That is, what is there expected hedge price? Six months later, when Hasty Homes is ready to purchase the lumber from their local supplier, the cash price for lumber is $650.00/MBF, and the futures contract used to initial hedge is trading at $605.00/MBF. (d) What is Hasty Homes realized hedge price? (e) Is the realized hedge price equal to the expected hedge price? If not, why?

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Hasty Homes should take a long position in the futures market to hedge their upcoming lumber purch...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started