6. Discuss how the term structure of interest rates would impact Teslas financing decisions in the future. Recommend changes to short-term/long-term financing model and how these changes could affect interest costs and Net Income. (Note: Calculate the cost based on short-term and long-term financings for both current and capital assets using the estimated 1-year and 10-year rates indicated by the yield curve). If interest rates rise in future, how will this impact the companys costs and decision to use debt financing?

Hint: Find the Weighted Average of Tesla's financing

10 Year Interest Rate for yield Curve.

1 Year Yield Curve

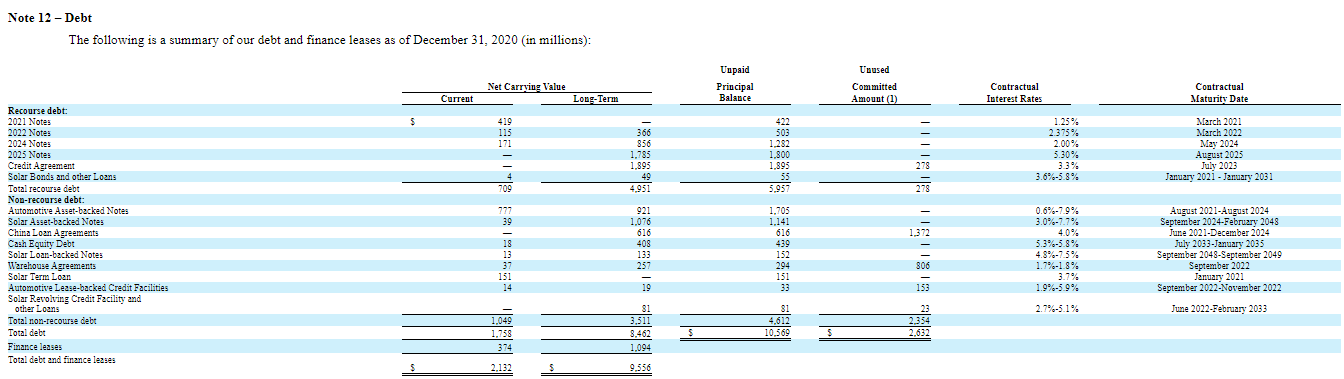

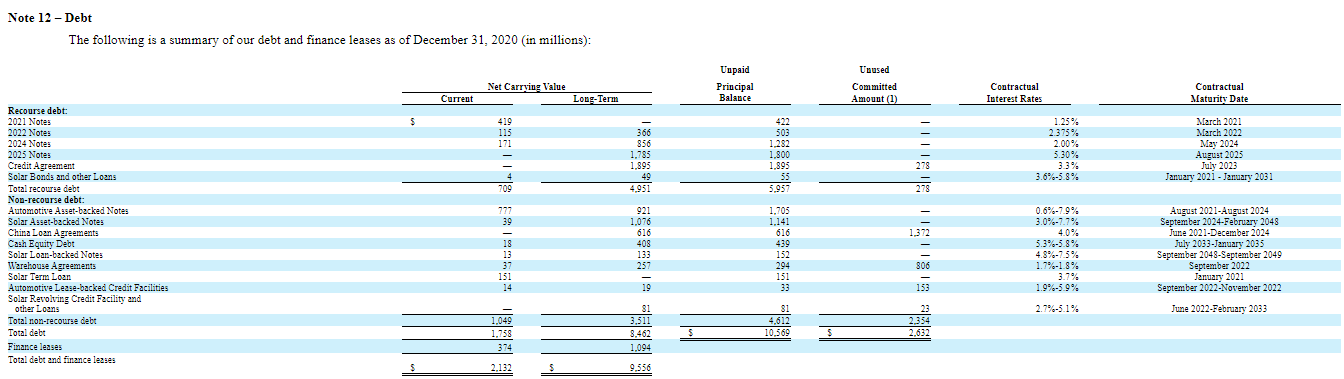

U.S. 10 Year Treasury Note 1.676% 0.00 Last Updated: Apr 1,20218:13p.m.EDT U.S. 1 Year Treasury Bill 0.065% -0.003 Last Updated: Apr 1, 2021 8:13p.m.EDT PREVIOUS CLOSE Note 12 - Debt The following is a summary of our debt and finance leases as of December 31, 2020 (in millions): Net Carryiug Value Long-Term Unpaid Principal Balance Unused Committed Amount (1) Contractual Interest Rates Contractual Maturity Date Current S 419 115 171 366 856 1,783 422 503 1.282 1.800 1.995 55 5.957 1.25% 2.375% 2.00% 5.30% 3.3% 3.6%-3.8% March 2021 March 2022 May 2024 August 2025 July 2023 January 2021 - January 2031 1.995 278 49 4.951 709 777 39 Recourse debt 2021 Notes 2022 Notes 2024 Notes 2025 Notes Credit Agreement Solar Bonds and other Loans Total recourse debt Non-recourse debt: Automotive Asset-backed Notes Solar Asset-backed Notes China Loan Agreements Cash Equity Debt Solar Loan-backed Notes Warehouse Agreements Solar Term Loan Automotive Lease-backed Credit Facilities Solar Revolving Credit Facility and other Loans Total non-recourse debt Total debt Finance leases Total debt and finance leases 1,372 921 1,076 616 408 133 257 18 13 1.705 1,141 616 439 152 294 151 0.6%-7.9% 3.0%-7.7% 4.0% 5.3%-3.8% 4.3%-7.5% 1.7%-1.8% 3.7% 19%-5.9% 2.7%-5.1% August 2021-August 2024 September 2024-February 2048 June 2021-December 2024 July 2033-January 2033 September 2049-September 2049 September 2022 January 2021 September 2022-November 2022 806 151 14 19 153 June 2022-February 2033 1.049 1.758 374 81 3,511 8.462 1.094 81 4,612 10,569 23 2.354 2.632 S $ 2.132 9.556 U.S. 10 Year Treasury Note 1.676% 0.00 Last Updated: Apr 1,20218:13p.m.EDT U.S. 1 Year Treasury Bill 0.065% -0.003 Last Updated: Apr 1, 2021 8:13p.m.EDT PREVIOUS CLOSE Note 12 - Debt The following is a summary of our debt and finance leases as of December 31, 2020 (in millions): Net Carryiug Value Long-Term Unpaid Principal Balance Unused Committed Amount (1) Contractual Interest Rates Contractual Maturity Date Current S 419 115 171 366 856 1,783 422 503 1.282 1.800 1.995 55 5.957 1.25% 2.375% 2.00% 5.30% 3.3% 3.6%-3.8% March 2021 March 2022 May 2024 August 2025 July 2023 January 2021 - January 2031 1.995 278 49 4.951 709 777 39 Recourse debt 2021 Notes 2022 Notes 2024 Notes 2025 Notes Credit Agreement Solar Bonds and other Loans Total recourse debt Non-recourse debt: Automotive Asset-backed Notes Solar Asset-backed Notes China Loan Agreements Cash Equity Debt Solar Loan-backed Notes Warehouse Agreements Solar Term Loan Automotive Lease-backed Credit Facilities Solar Revolving Credit Facility and other Loans Total non-recourse debt Total debt Finance leases Total debt and finance leases 1,372 921 1,076 616 408 133 257 18 13 1.705 1,141 616 439 152 294 151 0.6%-7.9% 3.0%-7.7% 4.0% 5.3%-3.8% 4.3%-7.5% 1.7%-1.8% 3.7% 19%-5.9% 2.7%-5.1% August 2021-August 2024 September 2024-February 2048 June 2021-December 2024 July 2033-January 2033 September 2049-September 2049 September 2022 January 2021 September 2022-November 2022 806 151 14 19 153 June 2022-February 2033 1.049 1.758 374 81 3,511 8.462 1.094 81 4,612 10,569 23 2.354 2.632 S $ 2.132 9.556