Question

6. During the recession in mid-2009, homebuilder KB Home had outstanding 7-year bonds with a yield to maturity of 8.8% and a BB rating. If

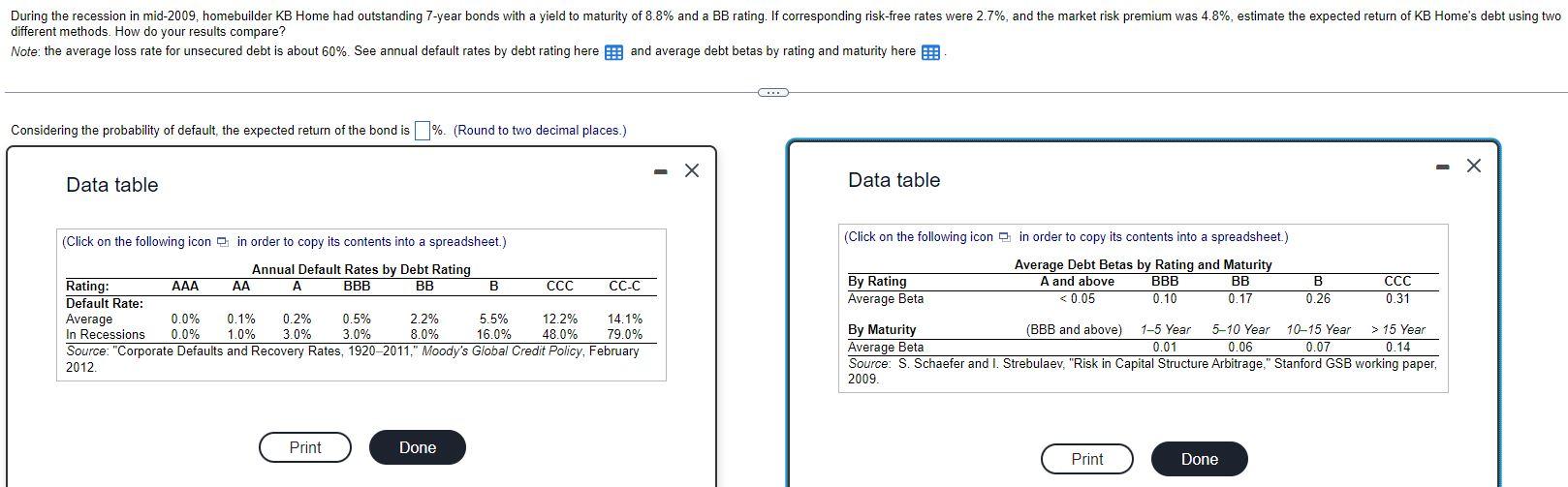

6. During the recession in mid-2009, homebuilder KB Home had outstanding 7-year bonds with a yield to maturity of 8.8% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 4.8%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating here (table 1 on left) and average debt betas by rating and maturity here (table 2 on right).

a. Considering the probability of default, the expected return of the bond is: _____%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started