Question

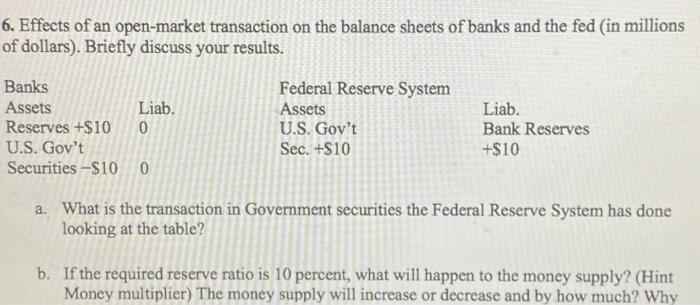

6. Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars). Briefly discuss your results. Banks

6. Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars). Briefly discuss your results. Banks Assets Reserves +$10 U.S. Gov't Securities -$10 0 Liab. 0 Federal Reserve System Assets U.S. Gov't Sec. +$10 Liab. Bank Reserves +$10 a. What is the transaction in Government securities the Federal Reserve System has done looking at the table? b. If the required reserve ratio is 10 percent, what will happen to the money supply? (Hint Money multiplier) The money supply will increase or decrease and by how much? Why

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

aThe transaction is an open market purchase of 10 million in government securities This increases th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Money Banking and Financial Markets

Authors: Stephen Cecchetti, Kermit Schoenholtz

4th edition

007802174X, 978-0078021749

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App