Answered step by step

Verified Expert Solution

Question

1 Approved Answer

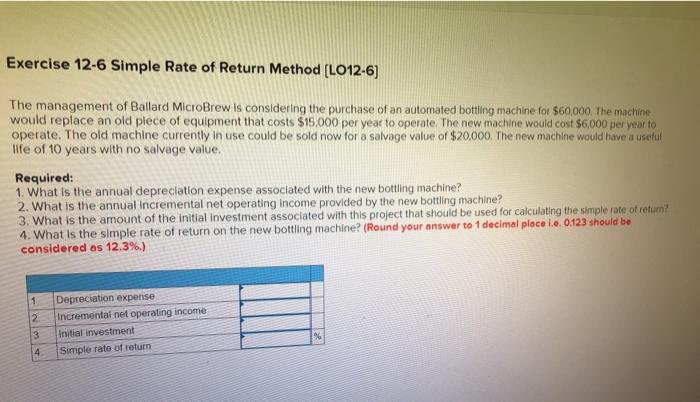

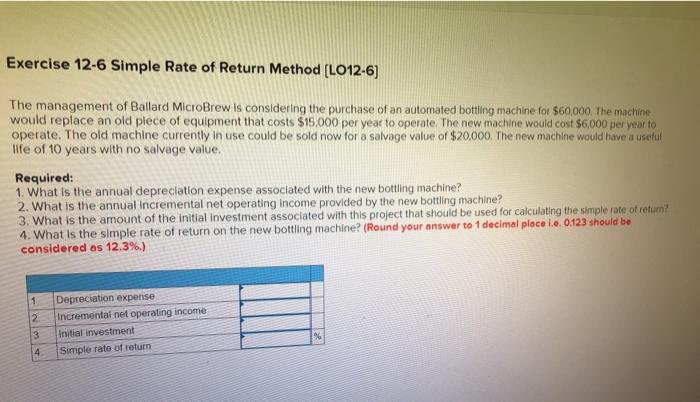

6 Exercise 12-6 Simple Rate of Return Method [LO12-6] The management of Ballard MicroBrew is considering the purchase of an automated botting machine for $60.000

6

Exercise 12-6 Simple Rate of Return Method [LO12-6] The management of Ballard MicroBrew is considering the purchase of an automated botting machine for $60.000 The machine would replace an old piece of equipment that costs $15,000 per year to operate. The new machine would cost $6.000 per year to operate. The old machine currently in use could be sold now for a salvage value of $20,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual Incremental net operating Income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of retum 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place le. 0.123 should be considered as 12.3%) 1 2 3 Depreciation expense Incremental net operating income Initial investment Simple rate of return 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started