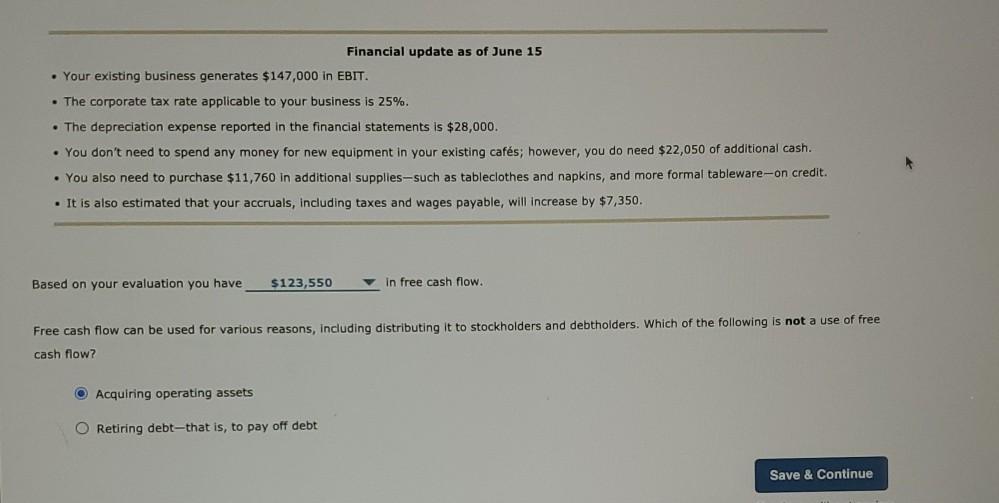

6. Free cash flow Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash position. Which of the following statements best describes free cash flow? O Residual cash flow after taking into account operating cash flows, including fixed-asset acquisitions, asset sales, and working-capital expenditures Cash flows generated by operating the business Suppose you are the only owner of a chain of coffee shops near universities. Your current cafes are doing well, but you are interested in starting a fine-dining restaurant. You decide to use the cash generated from your existing business to enter into a new business. Your accountant provides you with the following data on your current financial performance: Financial update as of June 15 Your existing business generates $147,000 in EBIT. The corporate tax rate applicable your business is 25%. The depreciation expense reported in the financial statements is $28,000. . You don't need to spend any money for new equipment in your existing cafs; however, you do need $22,050 of additional cash. . You also need to purchase $11,760 in additional supplies such as tableclothes and napkins, and more formal tableware-on credit. . It is also estimated that your accruals, including taxes and wages payable, will increase by $7,350. Financial update as of June 15 Your existing business generates $147,000 in EBIT. The corporate tax rate applicable to your business is 25%. The depreciation expense reported in the financial statements is $28,000. . You don't need to spend any money for new equipment in your existing cafs; however, you do need $22,050 of additional cash. You also need to purchase $11,760 in additional supplies--such as tableclothes and napkins, and more formal tableware-on credit. . It is also estimated that your accruals, including taxes and wages payable, will increase by $7,350. Based on your evaluation you have $123,550 in free cash flow. Free cash flow can be used for various reasons, including distributing it to stockholders and debtholders. Which of the following is not a use of free cash flow? Acquiring operating assets O Retiring debt-that is, to pay off debt Save & Continue 6. Free cash flow Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash position. Which of the following statements best describes free cash flow? O Residual cash flow after taking into account operating cash flows, including fixed-asset acquisitions, asset sales, and working-capital expenditures Cash flows generated by operating the business Suppose you are the only owner of a chain of coffee shops near universities. Your current cafes are doing well, but you are interested in starting a fine-dining restaurant. You decide to use the cash generated from your existing business to enter into a new business. Your accountant provides you with the following data on your current financial performance: Financial update as of June 15 Your existing business generates $147,000 in EBIT. The corporate tax rate applicable your business is 25%. The depreciation expense reported in the financial statements is $28,000. . You don't need to spend any money for new equipment in your existing cafs; however, you do need $22,050 of additional cash. . You also need to purchase $11,760 in additional supplies such as tableclothes and napkins, and more formal tableware-on credit. . It is also estimated that your accruals, including taxes and wages payable, will increase by $7,350. Financial update as of June 15 Your existing business generates $147,000 in EBIT. The corporate tax rate applicable to your business is 25%. The depreciation expense reported in the financial statements is $28,000. . You don't need to spend any money for new equipment in your existing cafs; however, you do need $22,050 of additional cash. You also need to purchase $11,760 in additional supplies--such as tableclothes and napkins, and more formal tableware-on credit. . It is also estimated that your accruals, including taxes and wages payable, will increase by $7,350. Based on your evaluation you have $123,550 in free cash flow. Free cash flow can be used for various reasons, including distributing it to stockholders and debtholders. Which of the following is not a use of free cash flow? Acquiring operating assets O Retiring debt-that is, to pay off debt Save & Continue