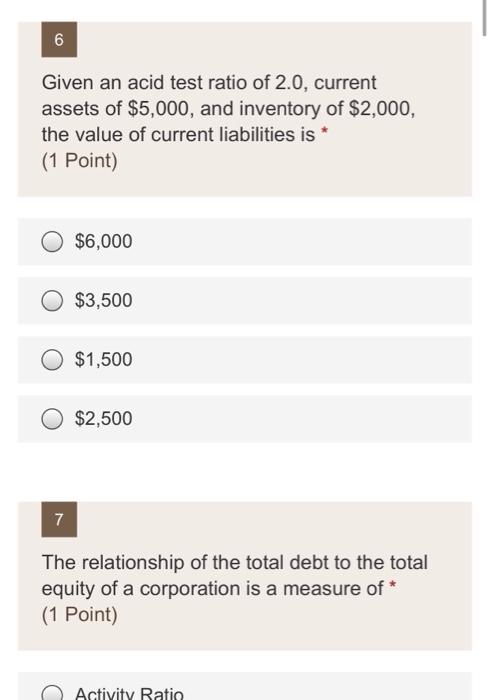

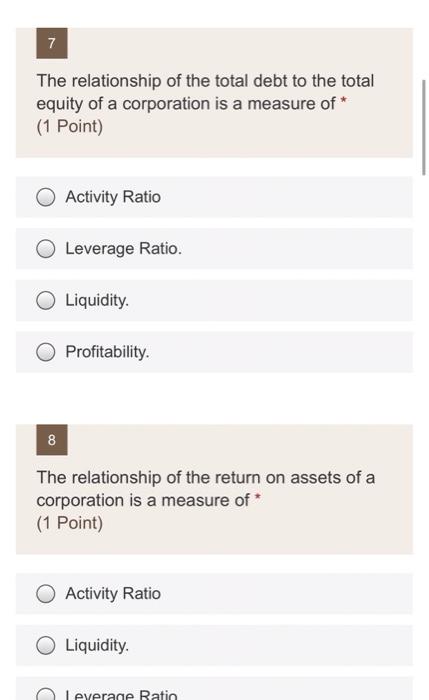

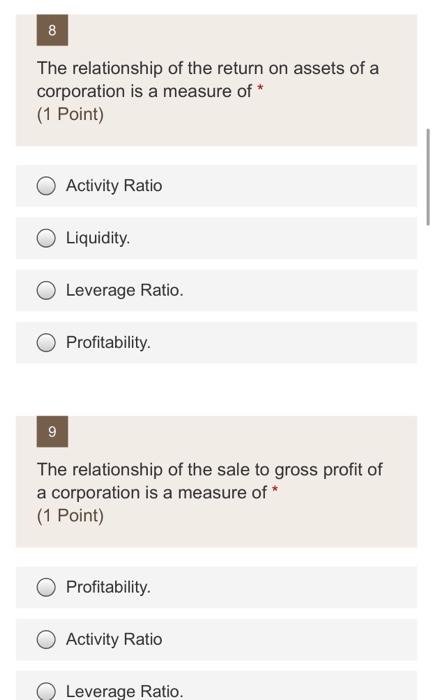

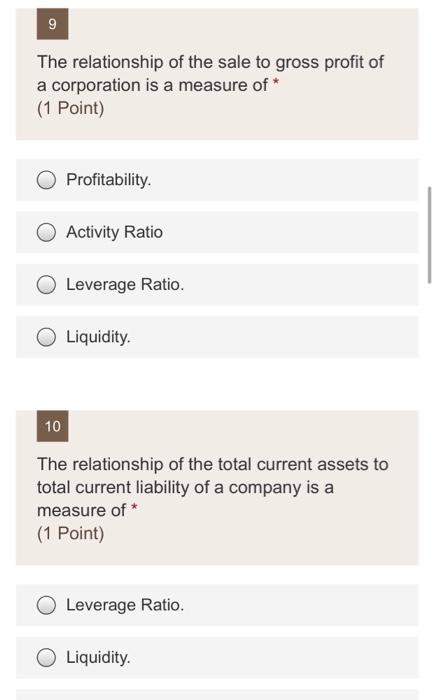

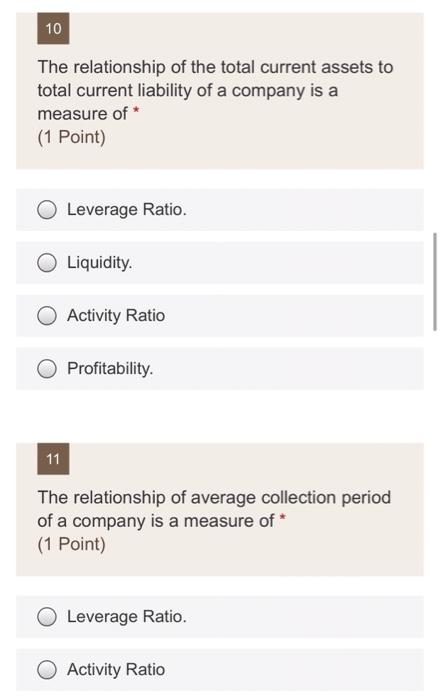

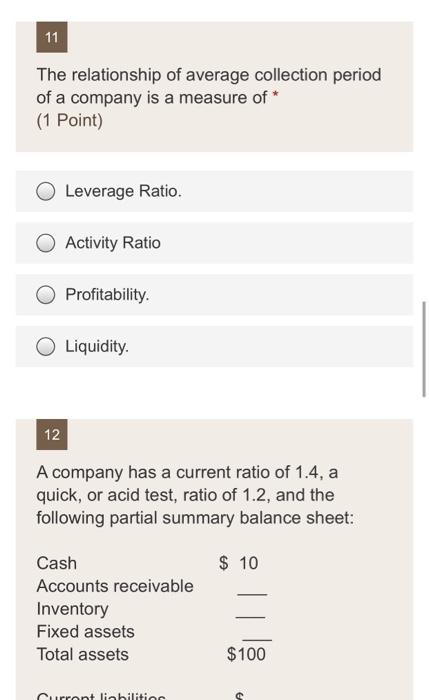

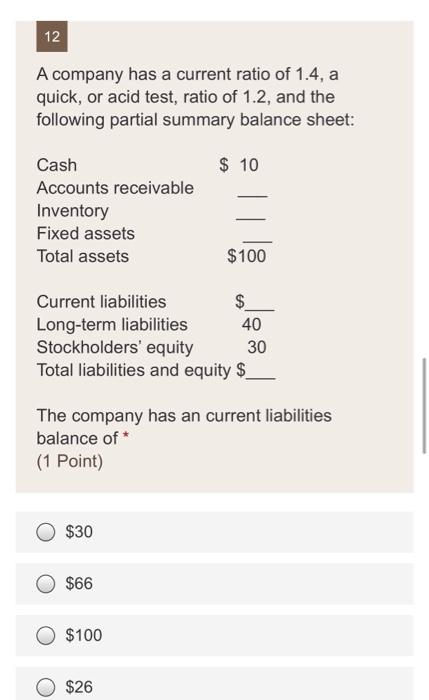

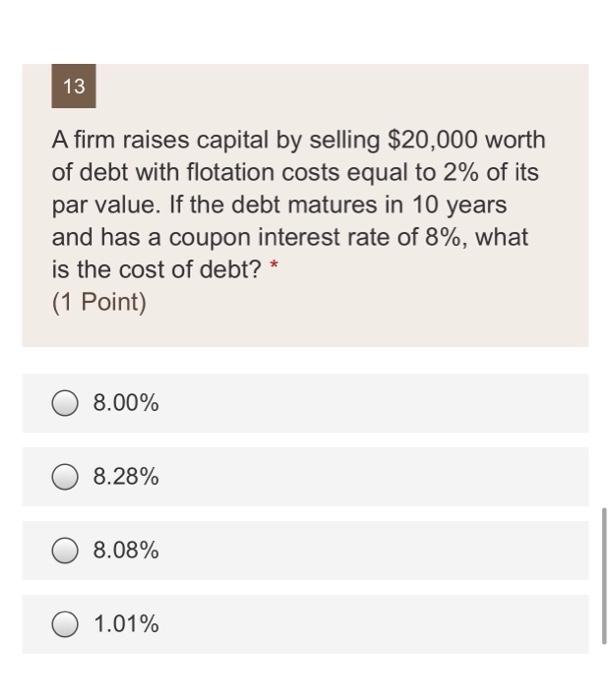

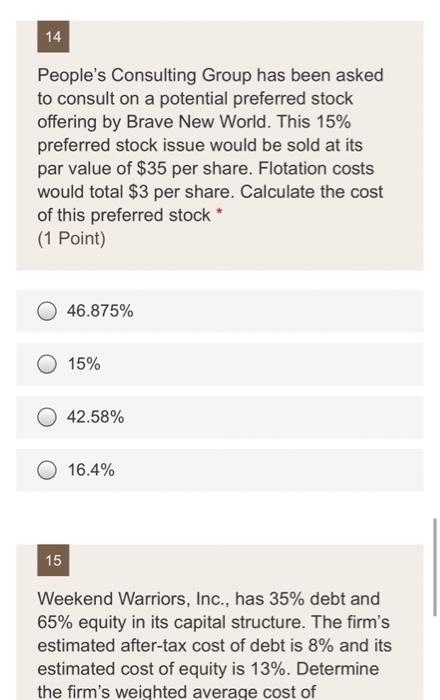

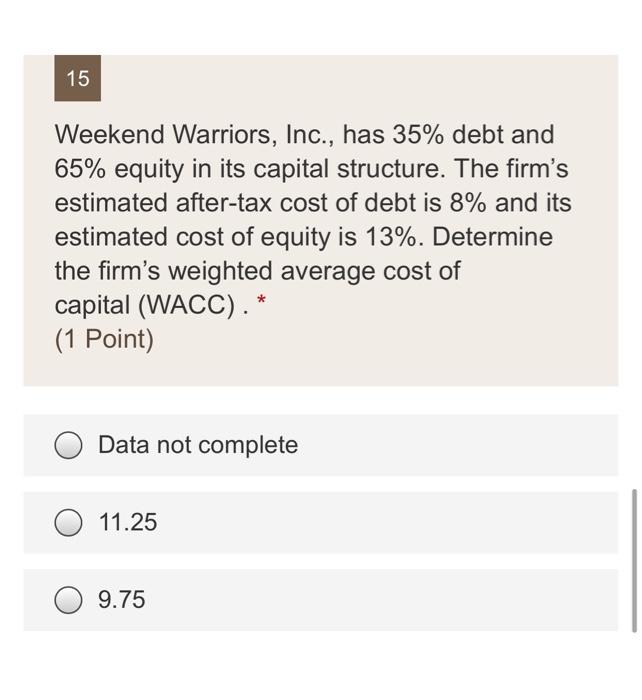

6 Given an acid test ratio of 2.0, current assets of $5,000, and inventory of $2,000, the value of current liabilities is * (1 Point) $6,000 $3,500 $1,500 $2,500 7 The relationship of the total debt to the total equity of a corporation is a measure of * (1 Point) Activity Ratio 8 The relationship of the return on assets of a corporation is a measure of * (1 Point) Activity Ratio Liquidity. Leverage Ratio. Profitability 9 The relationship of the sale to gross profit of a corporation is a measure of * (1 Point) Profitability. Activity Ratio Leverage Ratio. 9 The relationship of the sale to gross profit of a corporation is a measure of * (1 Point) O Profitability. Activity Ratio Leverage Ratio. Liquidity. 10 The relationship of the total current assets to total current liability of a company is a measure of (1 Point) Leverage Ratio O Liquidity. 10 The relationship of the total current assets to total current liability of a company is a measure of (1 Point) Leverage Ratio. O Liquidity. Activity Ratio Profitability. 11 The relationship of average collection period of a company is a measure of * (1 Point) Leverage Ratio. Activity Ratio 11 The relationship of average collection period of a company is a measure of (1 Point) Leverage Ratio. Activity Ratio Profitability. O Liquidity. 12 A company has a current ratio of 1.4, a quick, or acid test, ratio of 1.2, and the following partial summary balance sheet: $ 10 Cash Accounts receivable Inventory Fixed assets Total assets $100 Curront liabilities 12 A company has a current ratio of 1.4, a quick, or acid test, ratio of 1.2, and the following partial summary balance sheet: $ 10 Cash Accounts receivable Inventory Fixed assets Total assets $100 Current liabilities $ Long-term liabilities 40 Stockholders' equity Total liabilities and equity $ 30 The company has an current liabilities balance of * (1 Point) $30 $66 $100 $26 13 A firm raises capital by selling $20,000 worth of debt with flotation costs equal to 2% of its par value. If the debt matures in 10 years and has a coupon interest rate of 8%, what is the cost of debt? * (1 Point) 8.00% 8.28% 8.08% 1.01% 14 People's Consulting Group has been asked to consult on a potential preferred stock offering by Brave New World. This 15% preferred stock issue would be sold at its par value of $35 per share. Flotation costs would total $3 per share. Calculate the cost of this preferred stock * (1 Point) 46.875% 15% 42.58% 16.4% 15 5 Weekend Warriors, Inc., has 35% debt and 65% equity in its capital structure. The firm's estimated after-tax cost of debt is 8% and its estimated cost of equity is 13%. Determine the firm's weighted average cost of 15 Weekend Warriors, Inc., has 35% debt and 65% equity in its capital structure. The firm's estimated after-tax cost of debt is 8% and its estimated cost of equity is 13%. Determine the firm's weighted average cost of capital (WACC). * (1 Point) Data not complete 11.25 9.75