Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. I have already done part a, just need the THREE journal entries for part b. see pictures for the JEs needed. Thanks! Stage Company

6.

I have already done part a, just need the THREE journal entries for part b. see pictures for the JEs needed. Thanks!

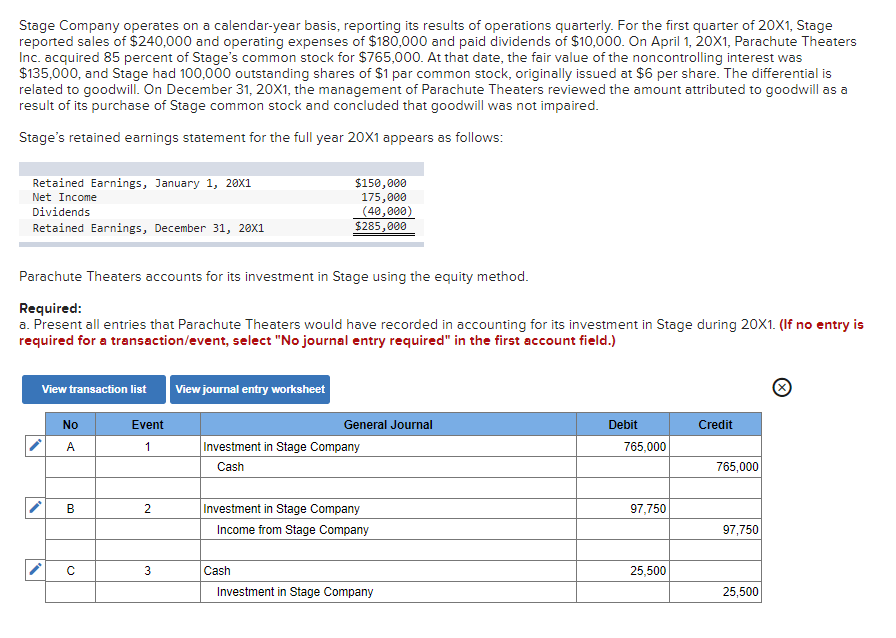

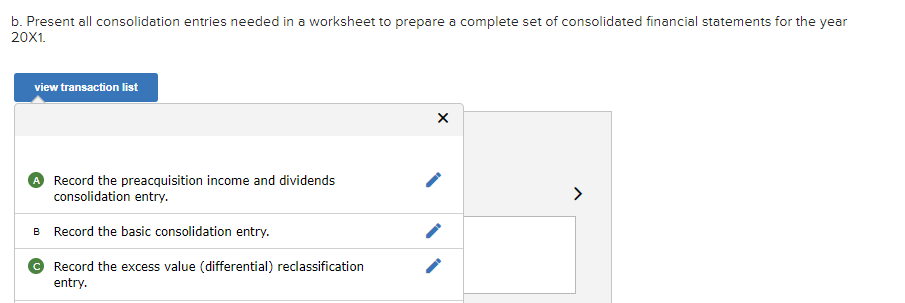

Stage Company operates on a calendar-year basis, reporting its results of operations quarterly. For the first quarter of 201, Stage reported sales of $240,000 and operating expenses of $180,000 and paid dividends of $10,000. On April 1, 20X1, Parachute Theaters Inc. acquired 85 percent of Stage's common stock for $765,000. At that date, the fair value of the noncontrolling interest was $135,000, and Stage had 100,000 outstanding shares of $1 par common stock, originally issued at $6 per share. The differential is related to goodwill. On December 31,201, the management of Parachute Theaters reviewed the amount attributed to goodwill as a result of its purchase of Stage common stock and concluded that goodwill was not impaired. Stage's retained earnings statement for the full year 201 appears as follows: Parachute Theaters accounts for its investment in Stage using the equity method. Required: a. Present all entries that Parachute Theaters would have recorded in accounting for its investment in Stage during 20X1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Present all consolidation entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 201. Record the preacquisition income and dividends consolidation entry. Record the basic consolidation entry. Record the excess value (differential) reclassification entry

Stage Company operates on a calendar-year basis, reporting its results of operations quarterly. For the first quarter of 201, Stage reported sales of $240,000 and operating expenses of $180,000 and paid dividends of $10,000. On April 1, 20X1, Parachute Theaters Inc. acquired 85 percent of Stage's common stock for $765,000. At that date, the fair value of the noncontrolling interest was $135,000, and Stage had 100,000 outstanding shares of $1 par common stock, originally issued at $6 per share. The differential is related to goodwill. On December 31,201, the management of Parachute Theaters reviewed the amount attributed to goodwill as a result of its purchase of Stage common stock and concluded that goodwill was not impaired. Stage's retained earnings statement for the full year 201 appears as follows: Parachute Theaters accounts for its investment in Stage using the equity method. Required: a. Present all entries that Parachute Theaters would have recorded in accounting for its investment in Stage during 20X1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Present all consolidation entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 201. Record the preacquisition income and dividends consolidation entry. Record the basic consolidation entry. Record the excess value (differential) reclassification entry Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started