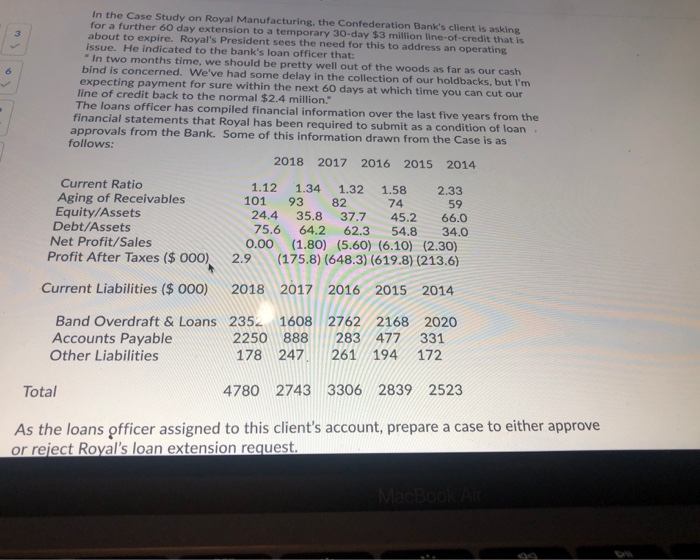

6 In the Case Study on Royal Manufacturing the Confederation Bank's client is asking for a further 60 day extension to a temporary 30-day $3 million line-of-credit that is about to expire. Royal's President sees the need for this to address an operating issue. He indicated to the bank's loan officer that: "In two months time, we should be pretty well out of the woods as far as our cash bind is concerned. We've had some delay in the collection of our holdbacks, but I'm expecting payment for sure within the next 60 days at which time you can cut our line of credit back to the normal $2.4 million." The loans officer has compiled financial information over the last five years from the financial statements that Royal has been required to submit as a condition of loan approvals from the Bank. Some of this information drawn from the Case is as follows: 2018 2017 2016 2015 2014 59 Current Ratio Aging of Receivables Equity/Assets Debt/Assets Net Profit/Sales Profit After Taxes ($ 000) Current Liabilities ($ 000) 1.12 1.34 1.32 1.58 2.33 101 93 82 74 24.4 35.8 37.7 45.2 66.0 75.6 64.2 62.3 54.8 34.0 0.00 (1.80) (5.60) (6.10) (2.30) 2.9 (175.8) (648.3) (619.8) (213.6) 2018 2017 2016 2015 2014 Band Overdraft & Loans 2352 1608 2762 2168 2020 Accounts Payable 2250 888 283 477 331 Other Liabilities 178 247 261 194 172 Total 4780 2743 3306 2839 2523 As the loans officer assigned to this client's account, prepare a case to either approve or reject Royal's loan extension request. MacBook 6 In the Case Study on Royal Manufacturing the Confederation Bank's client is asking for a further 60 day extension to a temporary 30-day $3 million line-of-credit that is about to expire. Royal's President sees the need for this to address an operating issue. He indicated to the bank's loan officer that: "In two months time, we should be pretty well out of the woods as far as our cash bind is concerned. We've had some delay in the collection of our holdbacks, but I'm expecting payment for sure within the next 60 days at which time you can cut our line of credit back to the normal $2.4 million." The loans officer has compiled financial information over the last five years from the financial statements that Royal has been required to submit as a condition of loan approvals from the Bank. Some of this information drawn from the Case is as follows: 2018 2017 2016 2015 2014 59 Current Ratio Aging of Receivables Equity/Assets Debt/Assets Net Profit/Sales Profit After Taxes ($ 000) Current Liabilities ($ 000) 1.12 1.34 1.32 1.58 2.33 101 93 82 74 24.4 35.8 37.7 45.2 66.0 75.6 64.2 62.3 54.8 34.0 0.00 (1.80) (5.60) (6.10) (2.30) 2.9 (175.8) (648.3) (619.8) (213.6) 2018 2017 2016 2015 2014 Band Overdraft & Loans 2352 1608 2762 2168 2020 Accounts Payable 2250 888 283 477 331 Other Liabilities 178 247 261 194 172 Total 4780 2743 3306 2839 2523 As the loans officer assigned to this client's account, prepare a case to either approve or reject Royal's loan extension request. MacBook