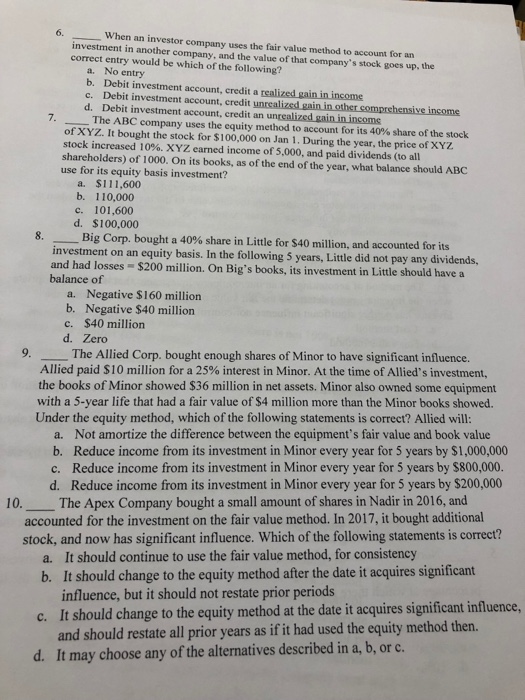

6. investment in another company, and the value of that company's stock goes up, the correct entry would be which of the following? When an investor company uses the fair value method to account for an a. No entry b. Debit investment account, credit a realized gain in income c. Debit investment account, credit unrcalizsd gain in other comprehensive income d. Debit investment account, credit an unrealized gain in incoms The ABC company uses the equity method to account for its 40% share of the stock of XYZ. It bought the stock for $100,000 on Jan 1. During the year, the price of XYZ stock increased 10% XYZ earned income of 5,000, and paid dividends (to all shareholders) of 1000. On its books, as of the end of the year, what balance should ABC use for its equity basis investment? a. $111,600 b. 110,000 c. 101,600 d. $100,000 Big Corp. bought a 40% share in Little for S40 million, and accounted for its investment on an equity basis. In the following 5 years, Little did not pay any dividends, and had losses $200 million. On Big's books, its investment in Little should have a balance of a. Negative $160 million b. Negative $40 million c. $40 million d. Zero 9. The Allied Corp. bought enough shares of Minor to have significant influence. Allied paid $10 million for a 25% interest in Minor. At the time of Allied's investment, the books of Minor showed $36 million in net assets. Minor also owned some equipment with a 5-year life that had a fair value of $4 million more than the Minor books showed. Under the equity method, which of the following statements is correct? Allied will a. Not amortize the difference between the equipment's fair value and book value b. Reduce income from its investment in Minor every year for 5 years by $1,000,000 c. Reduce income from its investment in Minor every year for 5 years by $800,000. d. Reduce income from its investment in Minor every year for 5 years by $200,000 10. The Apex Company bought a small amount of shares in Nadir in 2016, and accounted for the investment on the fair value method. In 2017, it bought additional stock, and now has significant influence. Which of the following statements is correct? a. It should continue to use the fair value method, for consistency b. It should change to the equity method after the date it acquires significant influence, but it should not restate prior periods It should change to the equity method at the date it acquires significant influence, and should restate all prior years as if it had used the equity method then. c. d. It may choose any of the alternatives described in a, b, or c