Answered step by step

Verified Expert Solution

Question

1 Approved Answer

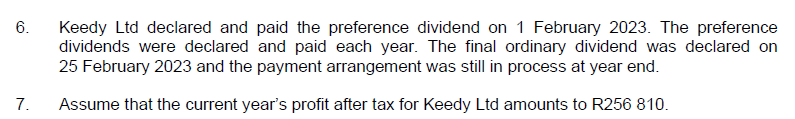

6. Keedy Ltd declared and paid the preference dividend on 1 February 2023. The preference dividends were declared and paid each year. The final ordinary

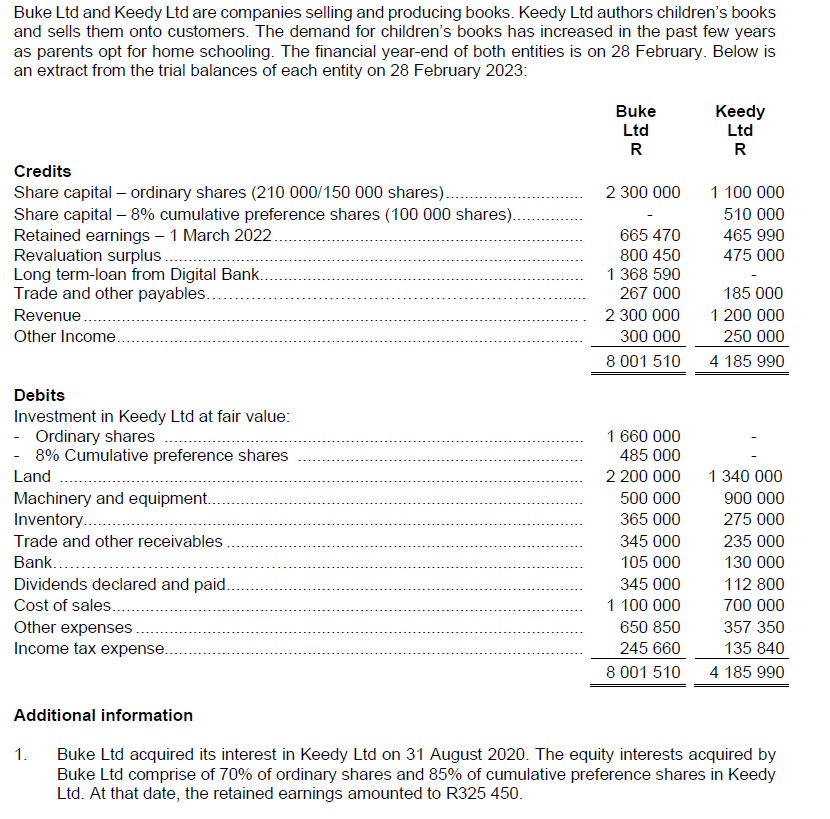

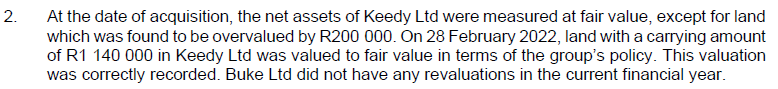

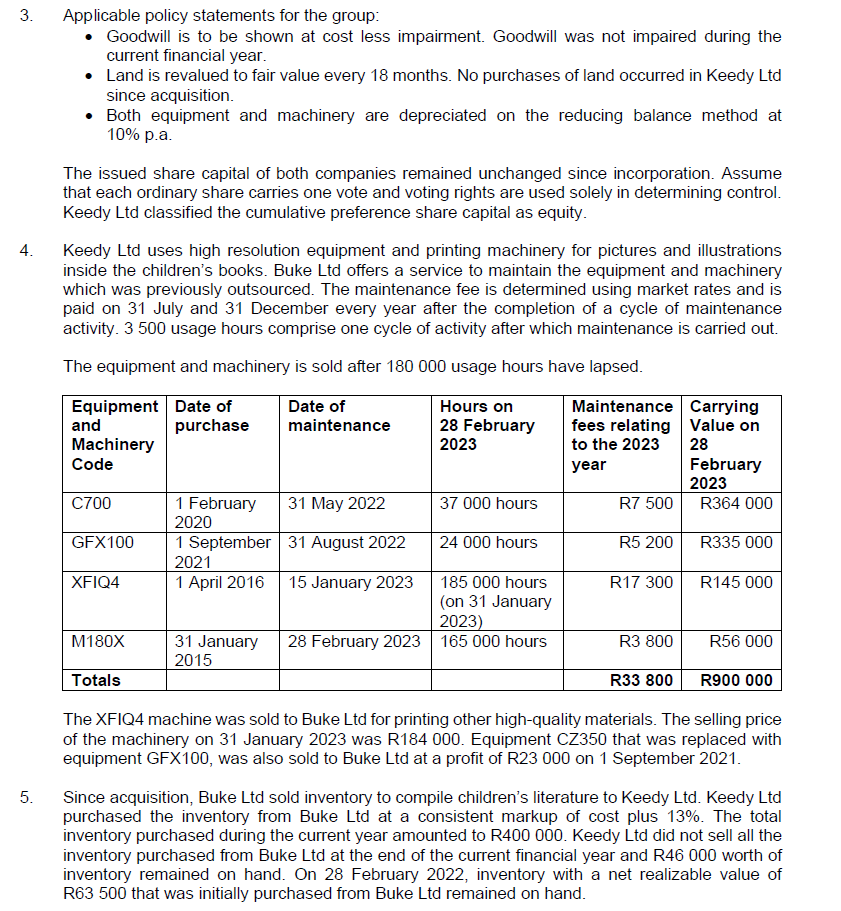

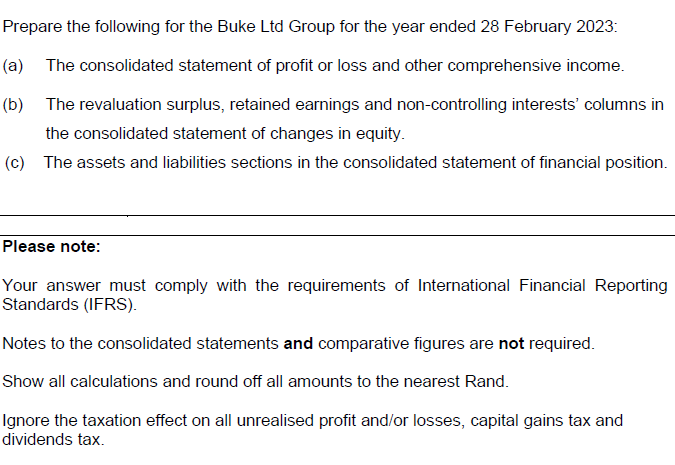

6. Keedy Ltd declared and paid the preference dividend on 1 February 2023. The preference dividends were declared and paid each year. The final ordinary dividend was declared on 25 February 2023 and the payment arrangement was still in process at year end. 3. Applicable policy statements for the group: - Goodwill is to be shown at cost less impairment. Goodwill was not impaired during the current financial year. - Land is revalued to fair value every 18 months. No purchases of land occurred in Keedy Ltd since acquisition. - Both equipment and machinery are depreciated on the reducing balance method at 10% p.a. The issued share capital of both companies remained unchanged since incorporation. Assume that each ordinary share carries one vote and voting rights are used solely in determining control. Keedy Ltd classified the cumulative preference share capital as equity. 4. Keedy Ltd uses high resolution equipment and printing machinery for pictures and illustrations inside the children's books. Buke Ltd offers a service to maintain the equipment and machinery which was previously outsourced. The maintenance fee is determined using market rates and is paid on 31 July and 31 December every year after the completion of a cycle of maintenance activity. 3500 usage hours comprise one cycle of activity after which maintenance is carried out. The equipment and machinery is sold after 180000 usage hours have lapsed. The XFIQ4 machine was sold to Buke Ltd for printing other high-quality materials. The selling price of the machinery on 31 January 2023 was R184 000. Equipment CZ350 that was replaced with equipment GFX100, was also sold to Buke Ltd at a profit of R23 000 on 1 September 2021. 5. Since acquisition, Buke Ltd sold inventory to compile children's literature to Keedy Ltd. Keedy Ltd purchased the inventory from Buke Ltd at a consistent markup of cost plus 13%. The total inventory purchased during the current year amounted to R400 000 . Keedy Ltd did not sell all the inventory purchased from Buke Ltd at the end of the current financial year and R46 000 worth of inventory remained on hand. On 28 February 2022, inventory with a net realizable value of R63 500 that was initially purchased from Buke Ltd remained on hand. At the date of acquisition, the net assets of Keedy Ltd were measured at fair value, except for land which was found to be overvalued by R200 000. On 28 February 2022, land with a carrying amount of R1 140000 in Keedy Ltd was valued to fair value in terms of the group's policy. This valuation was correctly recorded. Buke Ltd did not have any revaluations in the current financial year. Prepare the following for the Buke Ltd Group for the year ended 28 February 2023: (a) The consolidated statement of profit or loss and other comprehensive income. (b) The revaluation surplus, retained earnings and non-controlling interests' columns in the consolidated statement of changes in equity. (c) The assets and liabilities sections in the consolidated statement of financial position. Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). Notes to the consolidated statements and comparative figures are not required. Show all calculations and round off all amounts to the nearest Rand. Ignore the taxation effect on all unrealised profit and/or losses, capital gains tax and dividends tax. Buke Ltd and Keedy Ltd are companies selling and producing books. Keedy Ltd authors children's books 1. Buke Ltd acquired its interest in Keedy Ltd on 31 August 2020 . The equity interests acquired by Buke Ltd comprise of 70% of ordinary shares and 85% of cumulative preference shares in Keedy Ltd. At that date, the retained earnings amounted to R325 450

6. Keedy Ltd declared and paid the preference dividend on 1 February 2023. The preference dividends were declared and paid each year. The final ordinary dividend was declared on 25 February 2023 and the payment arrangement was still in process at year end. 3. Applicable policy statements for the group: - Goodwill is to be shown at cost less impairment. Goodwill was not impaired during the current financial year. - Land is revalued to fair value every 18 months. No purchases of land occurred in Keedy Ltd since acquisition. - Both equipment and machinery are depreciated on the reducing balance method at 10% p.a. The issued share capital of both companies remained unchanged since incorporation. Assume that each ordinary share carries one vote and voting rights are used solely in determining control. Keedy Ltd classified the cumulative preference share capital as equity. 4. Keedy Ltd uses high resolution equipment and printing machinery for pictures and illustrations inside the children's books. Buke Ltd offers a service to maintain the equipment and machinery which was previously outsourced. The maintenance fee is determined using market rates and is paid on 31 July and 31 December every year after the completion of a cycle of maintenance activity. 3500 usage hours comprise one cycle of activity after which maintenance is carried out. The equipment and machinery is sold after 180000 usage hours have lapsed. The XFIQ4 machine was sold to Buke Ltd for printing other high-quality materials. The selling price of the machinery on 31 January 2023 was R184 000. Equipment CZ350 that was replaced with equipment GFX100, was also sold to Buke Ltd at a profit of R23 000 on 1 September 2021. 5. Since acquisition, Buke Ltd sold inventory to compile children's literature to Keedy Ltd. Keedy Ltd purchased the inventory from Buke Ltd at a consistent markup of cost plus 13%. The total inventory purchased during the current year amounted to R400 000 . Keedy Ltd did not sell all the inventory purchased from Buke Ltd at the end of the current financial year and R46 000 worth of inventory remained on hand. On 28 February 2022, inventory with a net realizable value of R63 500 that was initially purchased from Buke Ltd remained on hand. At the date of acquisition, the net assets of Keedy Ltd were measured at fair value, except for land which was found to be overvalued by R200 000. On 28 February 2022, land with a carrying amount of R1 140000 in Keedy Ltd was valued to fair value in terms of the group's policy. This valuation was correctly recorded. Buke Ltd did not have any revaluations in the current financial year. Prepare the following for the Buke Ltd Group for the year ended 28 February 2023: (a) The consolidated statement of profit or loss and other comprehensive income. (b) The revaluation surplus, retained earnings and non-controlling interests' columns in the consolidated statement of changes in equity. (c) The assets and liabilities sections in the consolidated statement of financial position. Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). Notes to the consolidated statements and comparative figures are not required. Show all calculations and round off all amounts to the nearest Rand. Ignore the taxation effect on all unrealised profit and/or losses, capital gains tax and dividends tax. Buke Ltd and Keedy Ltd are companies selling and producing books. Keedy Ltd authors children's books 1. Buke Ltd acquired its interest in Keedy Ltd on 31 August 2020 . The equity interests acquired by Buke Ltd comprise of 70% of ordinary shares and 85% of cumulative preference shares in Keedy Ltd. At that date, the retained earnings amounted to R325 450 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started