Answered step by step

Verified Expert Solution

Question

1 Approved Answer

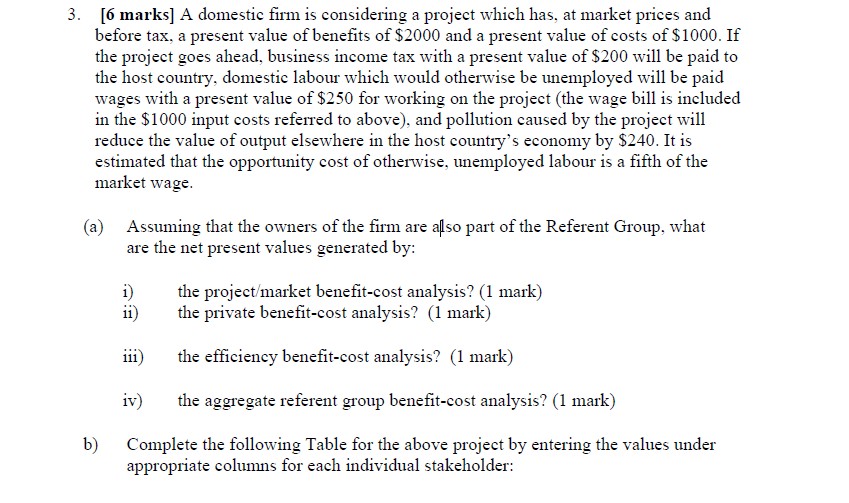

[6 marks] A domestic firm is considering a project which has, at market prices and before tax, a present value of benefits of $2000 and

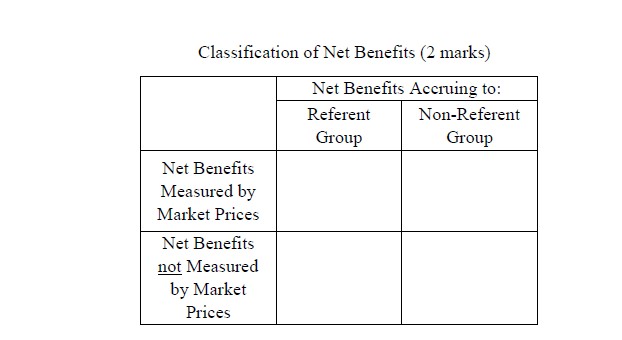

[6 marks] A domestic firm is considering a project which has, at market prices and before tax, a present value of benefits of $2000 and a present value of costs of $1000. If the project goes ahead, business income tax with a present value of S200 will be paid to the host country, domestic labour which would otherwise be unemployed will be paid wages with a present value of $250 for working on the project (the wage bill is included in the $1000 input costs referred to above), and pollution caused by the project will reduce the value of output elsewhere in the host country's economy by $240. It is estimated that the opportunity cost of otherwise, unemployed labour is a fifth of the market wage 3. (a) Assuming that the owners of the firm are also part of the Referent Group, what are the net present values generated by: i) the project market benefit-cost analysis? (1 mark) ii he private benefit-cost analysis? (1 mark) iii) the efficiency benefit-cost analysis? (1 mark) iv) the aggregate referent group benefit-cost analysis? (1 mark) Complete the following Table for the above project by entering the values under b) appropriate columns for each individual stakeholder

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started